Weekly Insight March 20

United States

United States

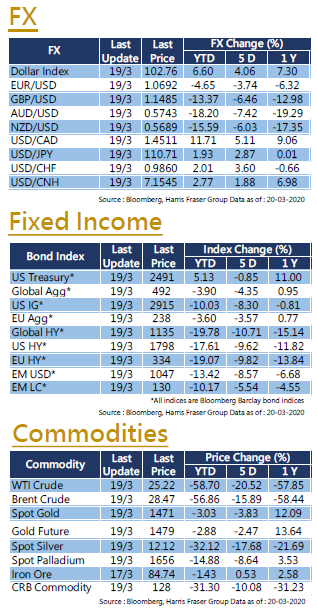

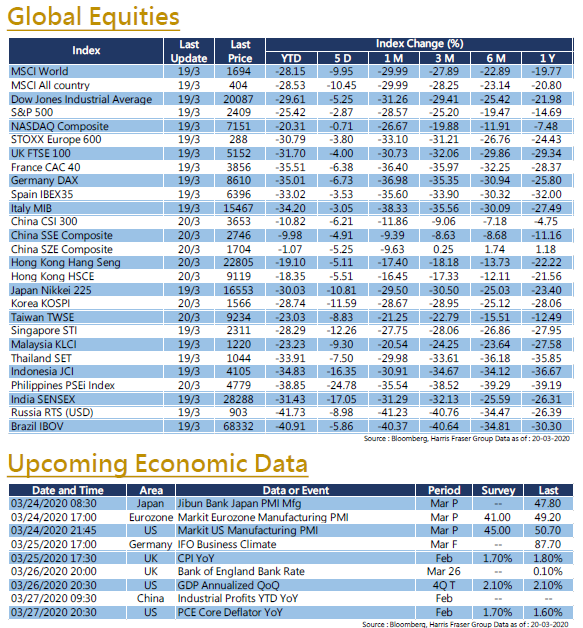

The global spread of the COVID-19 epidemic has not subsided, the number of cases globally has risen sharply and exceeded 230,000, and the number of deaths globally has also broken the 10,000 mark. Europe became an epicentre of the COVID-19 epidemic, virus deaths in Italy alone surpassed Chinese figures. However, the selloff in US stocks has shown signs of easing. Over the past 5 days ending Thursday, the Dow fell 5.25%; the S&P 500 lost 2.87%; while the NASDAQ has the smallest drop of only 0.71%. US equity markets recorded the worst one-day percentage drop since 1987 on Monday, and triggered the ‘Circuit Breaker’ several times in recent weeks. Apart from stock markets falling, it was surprising that other assets classes also experienced significant selloffs, this includes traditional safe haven assets such as investment grade bonds and gold. The common consensus on the cause of the prolonged market fall was mainly driven by large-scale deleveraging factors, resulting in virtually all financial assets being sold in the market for cash. Therefore, the US dollar index which reflects the strength of the Dollar has also risen sharply. In terms of international oil prices, after Saudi Arabia insisted on increasing crude oil production, WTI Crude briefly touched the level of US$ 20.06 per barrel, before rebounding to around $26.6/barrel at the time of writing. At the moment, the fed funds rate is down to 0.00 - 0.25 %, and President Trump has signed the second epidemic relief bill of US$ 1.2 trillion, the market is still evaluating the effectiveness of the latest rescue measures.

Europe

Europe

The number of new cases of COVID-19 in the world has increased sharply, and Italy has become the epicentre of the ongoing epidemic, Prime Minister Conte will announce the extension of the national lockdown and school suspension. Britain however has rejected plans to lockdown London, and Prime Minister Johnson claimed that the government can get the situation under control within 12 weeks. In order to combat the impact of the virus epidemic on people’s livelihood and the economy, the European Central Bank announced an asset purchase plan of 750 billion euros; the Bank of England also cut interest rates by 0.15% to 0.1%, and extended the scale of the bond purchase program by 200 billion Pounds. Over the past 5 days ending Thursday, the UK, French and German indexes fell 1.64% to 6.01%.

China

China

The COVID-19 epidemic brought challenges to the Chinese economy, and the country’s industrial production, retail sales, and fixed investment growth figures have all seen sharp falls in February. However, the epidemic seems to be fading out in China. This week, the country reported zero locally transmitted cases, the first time since the outbreak. Over the week, the CSI 300 and the Hang Seng Index fell 6.21% and 5.11% respectively. China announced today that its one-year and five-year LPRs will not be adjusted, while the market had originally expected them to be reduced by 5 basis points each. At the moment, market expects that The two sessions will be postponed until late April or early May. Industrial profits data will be published next week.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”, “iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)