Weekly Insight March 27

United States

United States

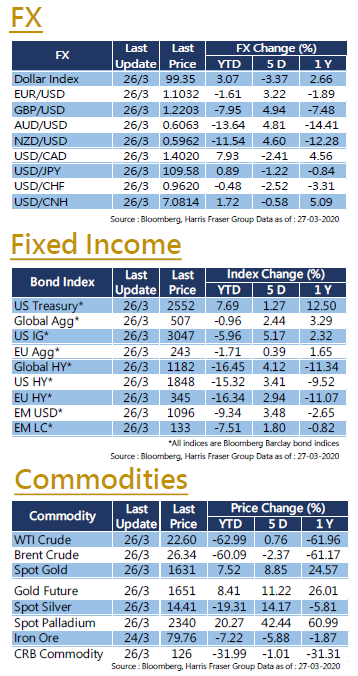

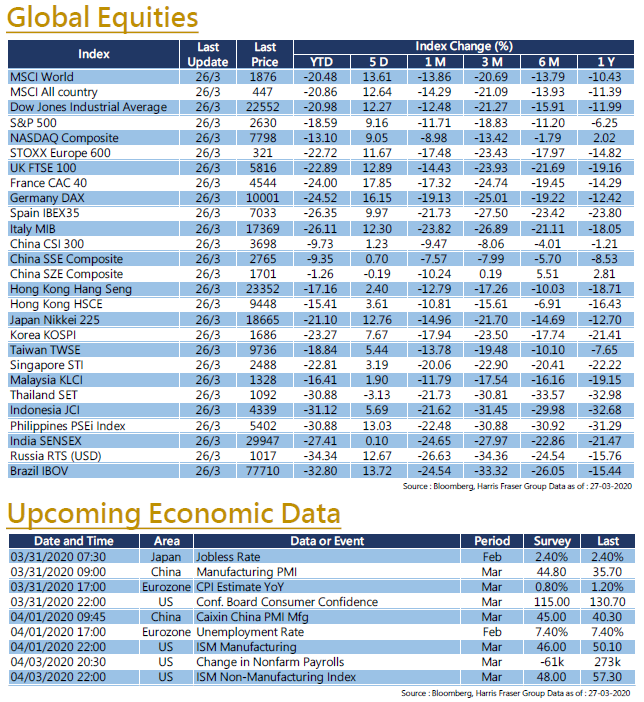

Global stock markets rebounded this week, US equities had a great week. Over the past 5 days ending Thursday, the Dow, S&P 500, and NASDAQ gained 12.27%, 9.16%, and 9.05% respectively. As for virus relief measures, the two parties in Congress are close to reaching a deal on the largest stimulus package in US history, driving the global stock market up. In particular, the Dow has recorded the largest daily gain since 1933 in the week. Market expects the House of Representatives to swiftly approve the US$ 2 trillion stimulus bill on Friday. In addition, members of both parties in Congress also wrote to Trump requesting all tariffs to be postponed for 90 days, the Federal Reserve is also expected to inject trillions of dollars to the US economy for further support. As for the COVID-19 epidemic, the United States has surpassed China and became the country with the most number of confirmed COVID-19 cases in the world. More officials have also contracted the disease globally, including Prince Charles of the UK and the Deputy Prime Minister of Spain. Outside the US, the G20 also pledged to use every means to fight the outbreak. As for the latest economic data, initial jobless claims figures in the US last week has soared to a record high of 3.28 million, which is more than four times higher than the previous record set in 1982. US and global PMI data will be released next week, which should shed more light on the global economic outlook.

Europe

Europe

European stock markets also rebounded significantly. German and French markets rose by more than 16% over the past 5 days ending Thursday, while UK equities also rose more than 12%. After multiple countries increased economy stimulus, the Bank of England also kept the benchmark interest rate at a record low on Thursday, the central bank noted that it could further increase asset purchases if necessary. As for the epidemic situation, Italy’s new COVID-19 cases on Thursday saw the largest daily increase up to date, and the situation remains severe. The UK has entered a national lockdown and demanded citizens to stay at home. Regarding economic data, the Eurozone consumer confidence index in March fell to negative 11.6 from negative 6.6 in February. European Central Bank Vice President Guindos said that the COVID-19 epidemic will send Europe into recession, but it should be short-lived and expects a rebound in the second quarter. Eurozone will release data on inflation and unemployment next week.

China

China

China and Hong Kong stock markets had a weaker rebound this week compared to global markets. The Hang Seng Index rose 2.99% over the week, and the CSI 300 Index rose 1.56%. It was reported that according to Chinese Ministry of Foreign Affairs officials, China is implementing a US$ 344 billion package to combat the COVID-19 epidemic, with fiscal measures as the mainstay and tax reliefs of about RMB 1 trillion. The market expects the 7-day reverse repo and a one-year MLF interest rate to further reduce by 10 bps. Next week, China will announce the official March manufacturing and non-manufacturing PMIs, as well as the Caixin Manufacturing and Services PMI Indexes for March.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, AttendedBloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”,“iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”,“OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)