As the epidemic outbreak further spread over the region, the economic outlook of Europe grows bleak by the day. With recession likely on the horizon, STOXX 600 went down by 14.80% (15.03% in US$ terms) in March. As cases overwhelmed medical facilities, fatalities skyrocketed, Italy even topped the world in covid-19 death numbers, the WHO claimed that Europe is now the epicentre of outbreak. Although new cases seemed to have slowed down towards the end of the month, we do not expect the situation to improve significantly in the short term.

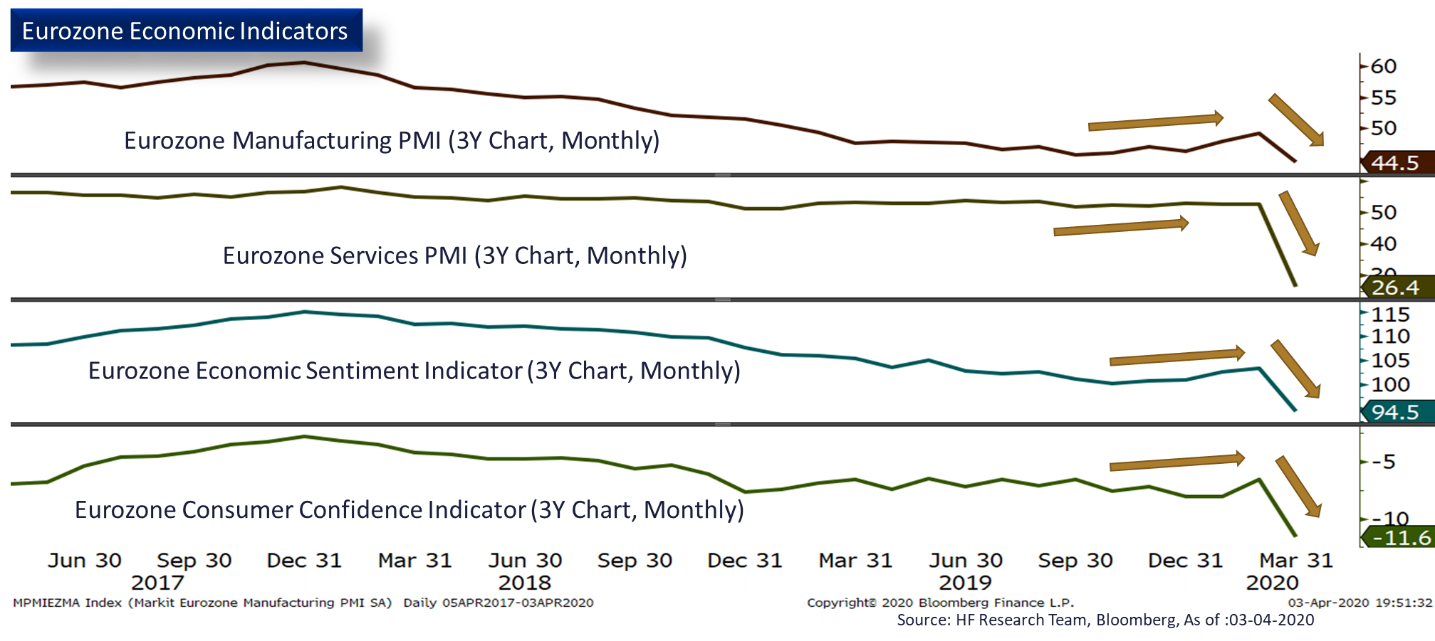

With numerous countries held under nationwide lockdown, economic activities thinned out, likely pushing the whole Europe into recession. Unsurprisingly, Eurozone manufacturing and services PMIs came in at 44.5 and 26.4 respectively, both staying in the contraction zone. The Eurozone Economic Sentiment Indicator and Consumer Confidence Indicator also marked large drops, these figures outlined a pessimistic outlook for economy in the region.

The biggest challenge for the region is the disjointed fiscal response to the crisis, governments from wealthier states refuse to act in unity, rejecting the pleas of Italian and Spanish governments to issue ‘Corona Bonds’ under the EU banner, the further North-South divide could damage the Union’s unity and prove detrimental to the economic recovery in the region. Overall, as the economy fundamentals are weaker with greater external reliance, we expect a longer recession and slower recovery in Europe even if the ongoing pandemic miraculously dissipates.