Weekly Insight February 25

US

US

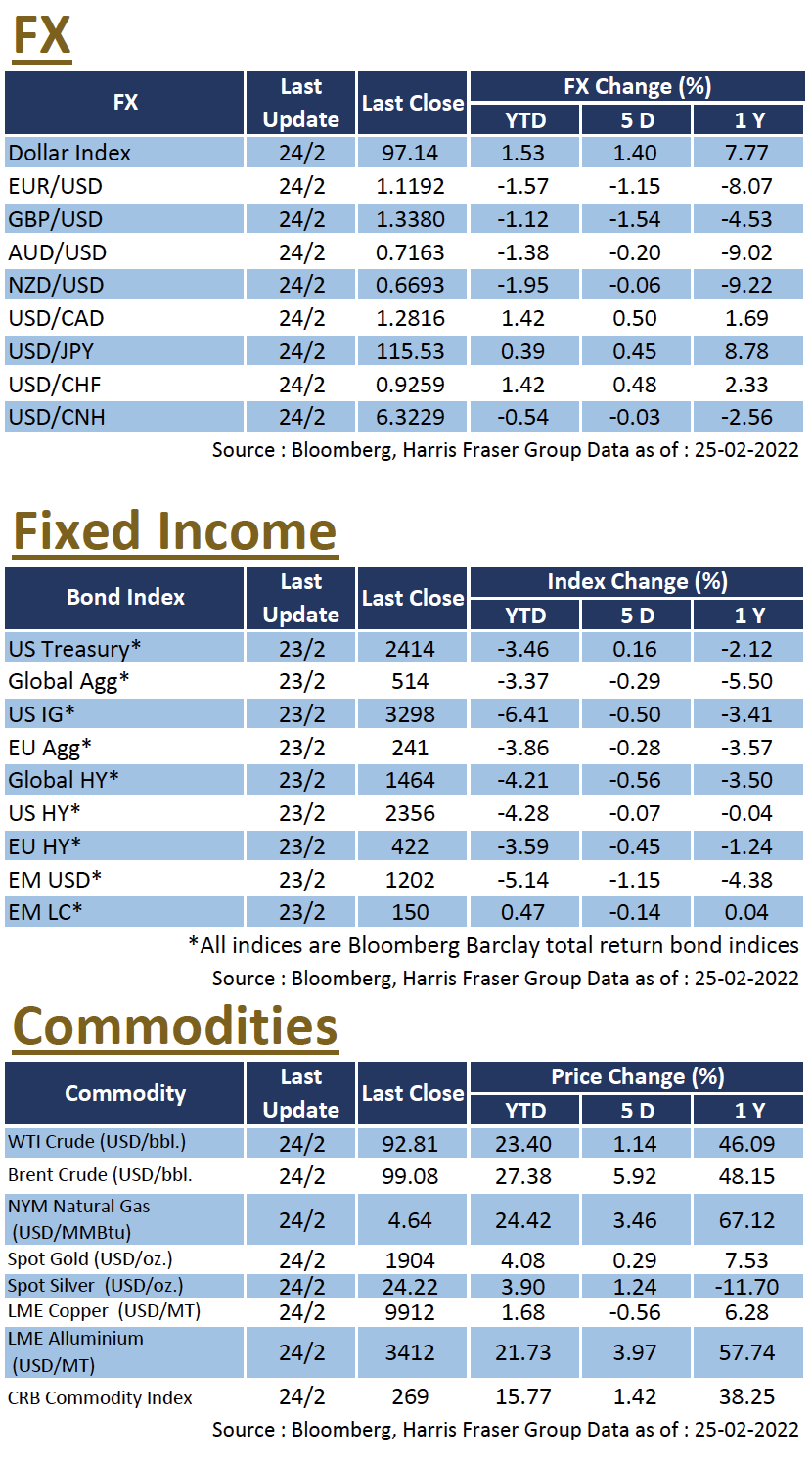

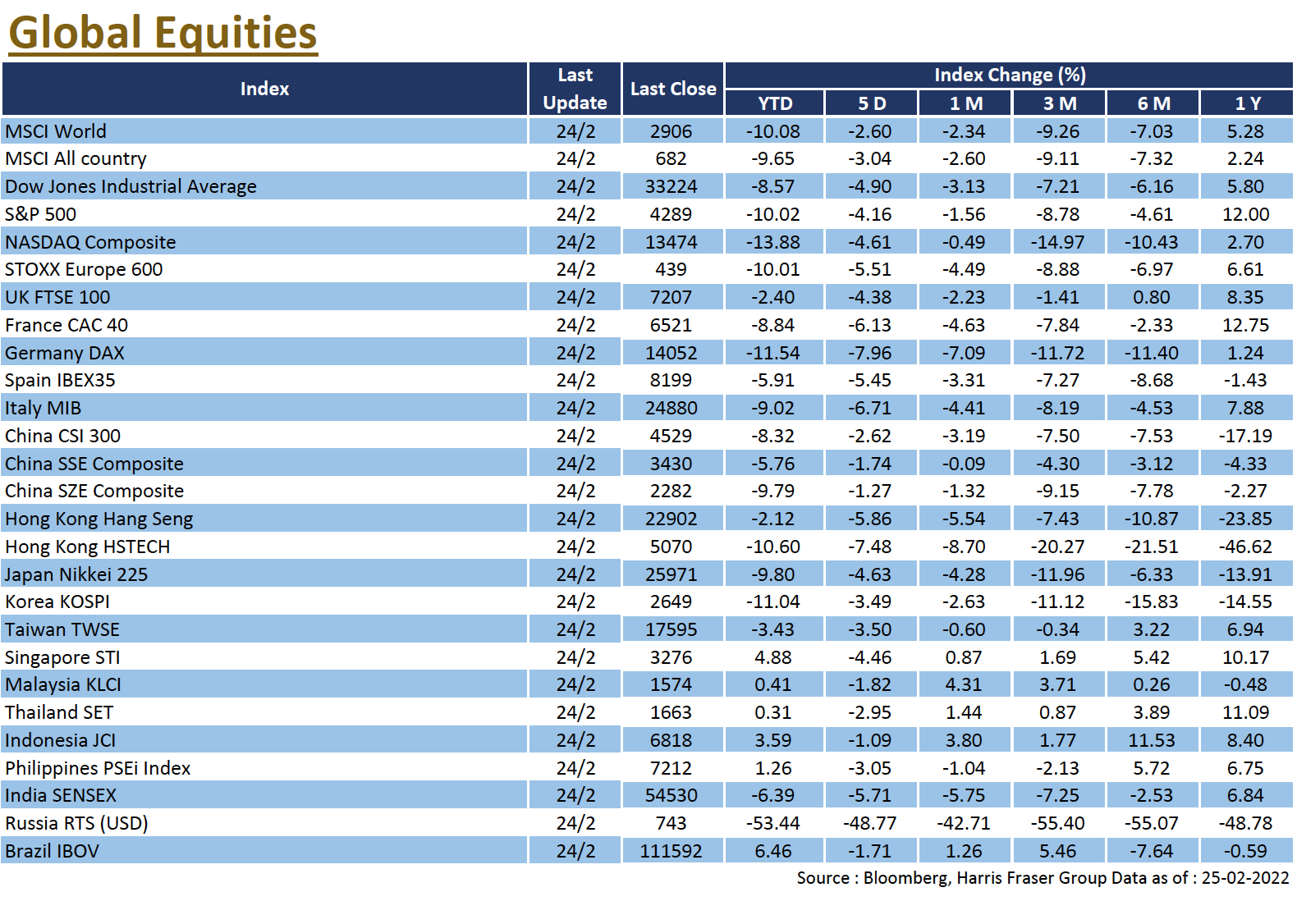

Tensions in Ukraine escalated, and it was later reported that Russia began military operation in Ukraine, impacting the global investment market, Asian equities fell across the board on Thursday; the S&P 500 was down 2.62% at one point, the NASDAQ down 3.45% and the Dow down 859 points, after which the three major indices rebounded later in the session. Still, the three indices were still down between 4.16% and 4.90% over the past 5 days ending Thursday.

After Russian President Vladimir Putin recognised the independence of the two regions of eastern Ukraine and dispatched "peacekeepers" to those regions, he then authorised a special military operation to the Donbass region. The Ukrainian capital, Kiev, was hit by a series of missile attacks on military facilities, with the Ukrainian army claiming that its forces had shot down Russian jets and helicopters, which Russia denied. Russians also denied attacking Ukrainian towns, stressing that they only targeted military facilities and air defence systems. In response to the incident, a number of Western countries, including the US, imposed a new round of sanctions on Russia.

As for the interest rate policy, some Fed officials acknowledged the risks associated with the war between Russia and Ukraine, but also stressed the need to address high inflation, with Fed Governor Michelle Bowman expressing support for a rate hike in March, and not ruling out the possibility of a 50 basis point hike. The next Fed meeting will be held on 16-17 March, while the US will release data including ISM manufacturing index, non-farm payrolls, and the Fed Beige Book next week.

Europe

Europe

On Thursday, reports that Russia had officially authorised a special military operation against Ukraine, coupled with the announcement of increased sanctions against Russia, led to an intraday fall of over 50% in the RTS index, before narrowing its loss to 38.3% at market close. Apart from Russia, major European stock markets in proximity to Ukraine were also affected, the DAX, CAC, and FTSE 100 indices also lost between 3.83% and 3.96% over the day. As the geopolitical situation in Eastern Europe escalated, some ECB officials said that the pace of the exit of its stimulus measures might be slowed down, while Bank of England Governor Andrew Bailey said that the planned tapering might be suspended during the market turmoil. Next week, the Eurozone will release the Consumer Price Index (CPI) for February.

China

China

Hong Kong equities fell sharply this week and wiped out the gains made so far this year, with the Hang Seng Index down 6.41% for the week and down 2.69% YTD, while the CSI 300 Index fell 1.67% for the week and extended its YTD losses to 7.43%. Recently, the focus has been on the situation in Ukraine, sending the price of commodities such as gold and oil up, and the market is mostly speculating on sectors that benefit from the rising gold and oil prices, related sectors are performing well, the market will continue to pay attention to the situation in Ukraine. Next week, China will release the Official and Caixin Manufacturing PMI data.