Weekly Insight March 18

US

US

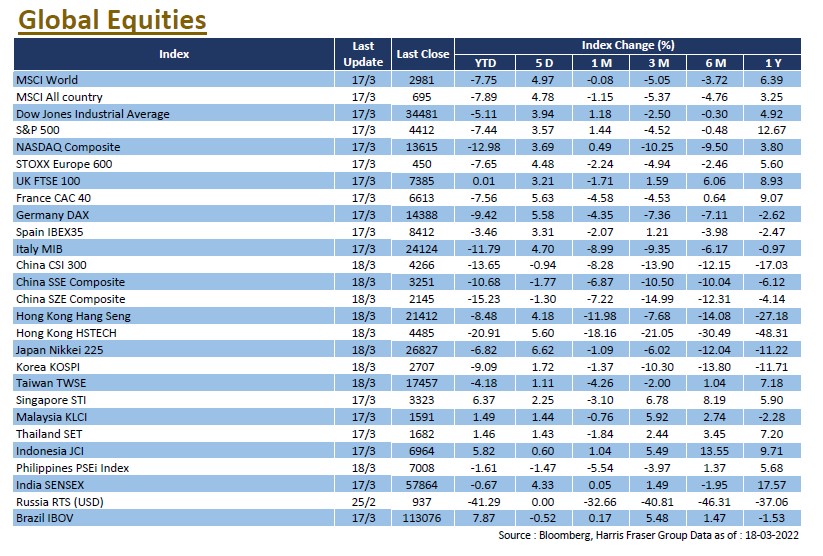

Global markets rebounded, hopes for Russia and Ukraine to reach a peace agreement grew, and crude prices briefly retreated, easing inflationary pressures. Over the past 5 days ending Thursday, the 3 major equity indices gained 3.57-3.94%. After the Thursday meeting, the US Federal Reserve announced the first rate hike since 2018, and indicates that there will be 6 more hikes in the year. Fed President Jerome Powell stated that the economy is strong and see no signs of recession within the next year, and indicates that the balance sheet reduction could start as early as May. While the FOMC projects a 4.3% inflation for the year, Powell reemphasised that Fed is focused on achieving price stability, no surprises from the Fed helped lift market sentiment.

Earlier, it was reported that neutrality plans in Ukraine were being considered, but peace talks have seemingly stalled later in the week. The House voted in a decisive manner to pass the motion to end Russia’s favoured trade status, which is sent to the Senate for the final vote. Interestingly, it was reported that Russia managed to pay the interests on its sovereign bonds, avoiding a sovereign default. However, credit rating agencies remain concerned over the prospects of a default some time down the road, with the S&P further downgrading Russia’s rating to CC. Markets will keep an eye on the conflict development, and several key economic data will be released next week, including the latest Initial jobless claims, Markit manufacturing PMI for March, and durable goods orders for February.

Europe

Europe

European equities rebounded on the back of optimism over the Ukrainian situation, as Ukrainian President Volodymyr Zelenskyy noted that the country will not join NATO, fuelling expectations of more progress on the peace talks. The UK, French, and German equities gained 4.03-7.04% over the past 5 days ending Thursday. As for the economic data, ZEW economic sentiment recorded the largest drop ever, with the indicator dropping 93.6 points to -39.3, the revised Eurozone CPI for February also set a new record high. With inflation remaining elevated, ECB governing council member Klass Knot suggested that 2 rate hikes for the year is still possible, although ECB President Christine Lagarde said the Bank is in no rush to raise rates. With peace talks stalling late in the week and attacks from Russian forces continued, markets will be keeping an eye out on the Russo-Ukrainian conflict. Next week, Eurozone will release the consumer confidence indicator and Markit Manufacturing PMIs for March, while Germany is also poised to release the IFO Business Climate for March alongside UK’s latest CPI.

China

China

Both China and Hong Kong markets experienced huge swings this week, with the Hang Seng Index plunging 4.97% and 5.72% on Monday and Tuesday, before rebounding by 9.08% and 7.04% on Wednesday and Thursday. This was mainly driven by the shift in market confidence. At the beginning of the week, the combination of (i) the absence of a clear statement from China on the Russo-Ukrainian conflict, (ii) the heightened risk of delisting of Chinese stocks, (iii) foreign capital potentially abandoning the Chinese market, (iv) the new wave of COVID in China potentially impacting the Chinese economy, as well as (v) the suspension of the Russian stock market, which could lead to funds selling other emerging market positions in exchange for liquidity. The combination of these factors led to a free-fall in the Hong Kong market. However, on Wednesday, with the news that (i) US and Chinese regulators were working to reach an agreement on delisting arrangements, (ii) Vice Premier Liu He had sent clear signals to support the Chinese economy and the healthy development of its markets, and (iii) anticipating further negotiations regarding the Russo-Ukrainian conflict, market confidence recovered and soared on Wednesday and Thursday. Next week, China will announce both the 1Y and 5Y loan prime rates (LPR).