Weekly Insight March 25

US

US

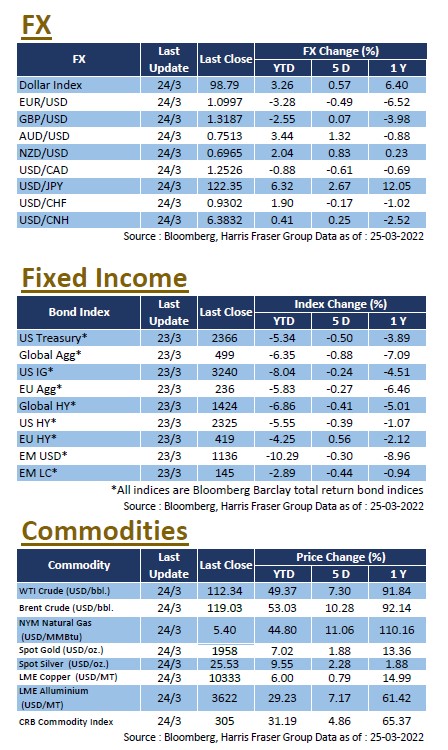

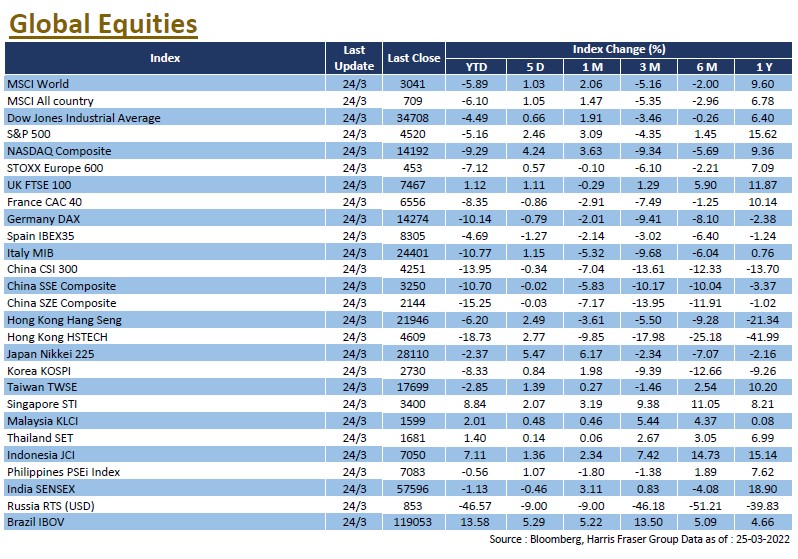

Despite the lack of visible progress in the Russia-Ukraine situation, US stocks rebounded over the past few days, as the Federal Reserve's increased clarity over the pace of rate hikes eased market uncertainty over the monetary policy outlook. Over the past 5 days ending Thursday, the NASDAQ gained more, up 4.24%, the S&P 500 rose 2.46% and the Dow edged 0.66% higher. US Federal Reserve officials were aggressive on interest rate policy, with Chairman Jerome Powell stating that a 50 basis point hike could be needed at the May meeting if the situation calls for it, and St. Louis Fed President Bullard suggesting an earlier hike would be preferable, and interest rates should rise above 3% this year. As a result of the hawkish comments, US Treasury yields rose across the board, with the 10-year yield briefly breaching the 2.4% level, the wide US bond market was under pressure.

In light of the Russo-Ukrainian War, and considering the impact of Russian sanctions on resource prices and the global economy, a number of international institutions have announced or indicated that they will lower their growth forecasts. Fitch has announced that they have lowered their global growth forecast for 2022 to 3.5%, while the IMF President has also indicated that they will lower theirs next month. Next week, US will be releasing unemployment and non-farm payrolls data, alongside with the ISM manufacturing index and consumer confidence data for March.

Europe

Europe

European stocks were relatively soft, with the French CAC and German DAX down 0.86% and 0.79% respectively over the past 5 days ending Thursday, while the UK FTSE 100 was up 1.11%. Inflation in the UK rose by 6.2% YoY in February to a 30-year high, reflecting unresolved inflationary pressures in the region. In the face of inflation in Europe, ECB Governing Council member Joachim Nagel said that interest rate hikes may start this year and should not be delayed. The ECB later said in a statement that it would phase out its temporary pandemic collateral easing measures from July onwards. Next week, the Eurozone will release data on March CPI and February unemployment.

China

China

The market volatility increased during the earnings season in Hong Kong, with the Hang Seng Index falling on Friday, wiping out all gains for the week; as for China A-shares, the CSI 300 Index was weak on Friday, dragging the index down 2.14% for the week. Many tech companies in Hong Kong announced their results, including Tencent, which posted the lowest growth in operating revenue in 2021 Q4, this was the lowest since its IPO in 2004, and also the first single-digit growth. In addition, Chinese property companies such as Sunac and Evergrande announced delays in the publication of their audited annual reports, raising concerns about their business. Next week, China will release official and Caixin manufacturing PMI data for March.