Weekly Insight April 1

US

US

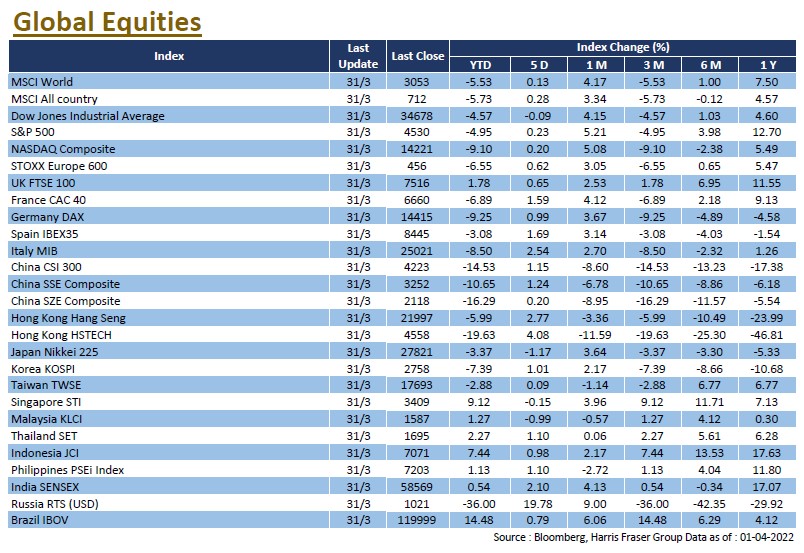

Positive news on Russo-Ukrainian talks boosted market sentiment early in the week, but hopes were dashed later on and US stocks turned lower on Thursday, with the Dow, S&P 500, and NASDAQ seeing limited movement over the past five days ending Thursday. Russia had said it would reduce its military operations near Kiev and Chernihiv, but the Kremlin later said there had been no breakthrough in the peace talks in Turkey, keeping the market under pressure.

On the other hand, the inversion of US treasury yield curve has raised investors' eyebrows as historical data shows that an inversion of the 2-10 year yield has occurred before each of the last four recessions in the US. Even though rate hikes may increase the pressure on the inverted curve, Fed officials are still very open to accelerating interest rate hikes in the face of the lingering high inflation. Next week, the ISM Services Index for March and the minutes of the 16th Mar interest rate meeting will be released.

Europe

Europe

Russian President Vladimir Putin claims that Russian forces will withdraw from Kyiv, while western governments remain dubious over the motives behind the action. Fortunately, the situation in Ukraine saw no further escalation, calming markets despite no further progress in the peace talks. Over the past 5 days ending Thursday, UK, French, and German equity indices edged 0.65 – 1.59% higher. ECB chief economist Philip Lane suggested that the Bank is not fixated on raising rate within the year, which contrasts to the markets’ expectations of 2 hikes by the fourth quarter this year. He further claims that current levels of inflation will not last, echoing ECB President Christine Lagarde’s view that stagflation is unlikely. As for economic data, Eurozone CPI was a whopping 7.5% YoY in March, setting a new record high. Next week, Sentix investor confidence and Eurozone services PMI, as well as retail sales figures will be in focus.

China

China

Both Hong Kong and Chinese equity markets recouped more ground over the week with limited negative news. External market sentiment were also mildly positive with no worsening in the Ukrainian situation. Over the week, the Hang Seng Index gained 2.97%, while the CSI 300 was also 2.43% higher. Recent economic data releases have been underwhelming, with the Caixin manufacturing PMI at 48.1 for March, and both official manufacturing and non-manufacturing PMIs in the contractionary zone. The COVID situation in China is another point of concern, as cases remain on the rise. In Hong Kong, trading in more than 30 listed companies in Hong Kong are temporarily suspended after the companies missed their deadlines on submitting annual results, raising concerns over the financial health of Chinese developers. Next week, China will release Caixin Services PMI for March, as well as the latest foreign reserves.