Weekly Insight April 8

US

US

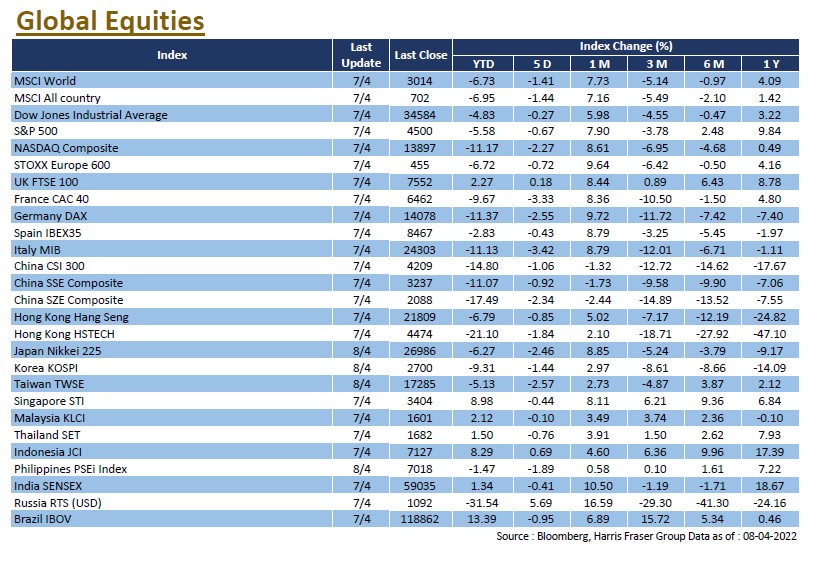

US equities were under pressure after the Fed minutes showed hawkish officials, combined with increased US sanctions against Russia, the S&P 500 and Dow were down 0.67% and 0.27% respectively and the NASDAQ lost 2.27% over the past 5 days ending Thursday. The Fed released the minutes of its March meeting, which showed that the authorities are considering tapering the balance sheet up to US$95 billion per month, and officials believe there will be at least one 50 bps rate hike in the future. The President of the Kansas City Fed said that a one-off 50 bps hike in May was one of the options that must be considered, and the President of the St. Louis Fed suggested that interest rates should be raised to 3% to 3.25% by the end of the year.

As for Western powers' response to Russia, the US announced a new round of sanctions against Russia, which will include the country's two largest banks and Putin's daughters. The US economy performed reasonably well amidst concerns over the inverted yield curve, with non-farm payrolls increasing by 431,000 in March and the unemployment rate falling to 3.6%. The ISM Services Index rose to 58.3 in March, accelerating for the first time in four months. Next week, CPI data and retail sales data for March, as well as University of Michigan market sentiment, will be released.

Europe

Europe

With inflation in the Eurozone hitting new highs, worries over accelerated tightening by the European Central Bank increased, as the French CAC and German DAX fell by 3.33% and 2.55% respectively in the five days to Thursday. Prices in Europe were fuelled by the Russo-Ukrainian war, with the Eurozone's consumer price index (CPI) surging by 7.5% YoY in March. ECB Governing Council member Klaas Knot said interest rates may start hiking as early as September. The Bank's chief economist, Philip Lane, said that if the economic outlook deteriorates, the Bank would reconsider the timing of the stimulus withdrawal. According to the ECB meeting minutes, officials said they felt the need to set a firm date for the end of the asset purchase programme.

China

China

Hong Kong's stock market started the week on a high note before sliding lower, the HSI was trading around the 22,000 level, with turnover dropping to just over $100 billion on Friday. The HSI was down 0.57% for the week, while the Hang Seng Tech Index was down 2.97%; the China A-share market remained range bound, with the CSI 300 index down 0.55% for the week. On the economic front, the Caixin China Services PMI fell to 42 in March, a more than 2 year low, while the Caixin China Manufacturing PMI was 48.1 in March, also falling into the contraction zone. The World Bank lowered its forecast for Chinese economic growth to 5% this year, down from 5.4% earlier. Next week, China's consumer price index (CPI) for March will be released.