Weekly Insight January 17

United States

United States

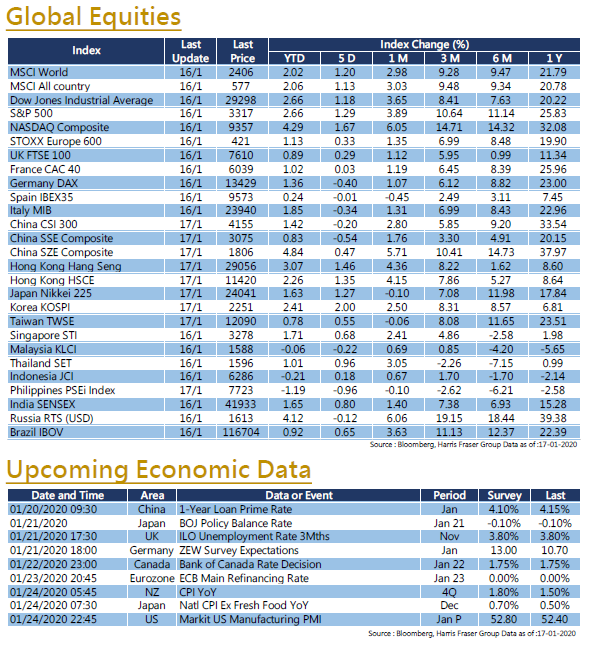

China and the United States signed the first stage trade deal this week, driving the equity market up, 3 major US stock indexes rose 1.18-1.67% over the past 5 days ending Thursday. The other market focus is the commencement of the 2019 Q4 earnings season, the financials led the charge with a majority having satisfactory report cards. In particular. JP Morgan Chase and Citibank's fixed income businesses have rebounded significantly in Q4. At the time of writing, about 64% of the 38 companies reporting in recorded better-than-expected net profit, indicating that corporate profits remains relatively healthy. Although the non-farm payroll figures in December missed market expectations, and wage growth was at the lowest point since 2018, with the satisfactory corporate earnings and the easing tensions between China and the United States, US equity indexes continued to set new record highs. The US Senate will kick off the President Impeachment process next Tuesday. In addition, the United States will also announce the manufacturing PMI for January 2020.

Europe

Europe

European stock markets underperformed global markets over the past 5 days ending Thursday. Apart from the UK FTSE, both the French CAC and German DAX recorded declines. On Thursday, the European Central Bank (ECB) released the minutes of the first Interest Rate Decision after Lagarde became the president of the ECB. Members emphasized paying attention to the possible side effects of the current monetary policy, indicating some members have reservations about the current loose monetary policy. This cooled down the market sentiment in the Eurozone equities, limiting the performance over the week. As for economic data, the December UK consumer price index released this week in rose 1.3% YoY, which is lower than both the market expectation and previous value. The ECB will hold an interest rate meeting next week, and Germany will announce the January ZEW economic sentiment figures.

China

China

As for the Chinese and Hong Kong stock markets, the mainland stock market fell slightly over the week, while the Hong Kong stock market slightly rose. In light of easing tensions in the Middle East and the US's reversing China’s currency manipulator status, the Hang Seng Index continued its upward trend over the week. However, the first-phase Sino-US trade agreement was signed in Washington on Wednesday, and China promised to increase purchases of at least US$ 200 billion in US goods and services over the next two years. The general market is worried about China's ability to fulfill its commitments, the ambiguousness of the second-phase trade deal, coupled with profit taking in the market, the Chinese and Hong Kong stock markets narrowly edged up. In addition, the PBOC stated that it will continue to adopt a prudent monetary policy in 2020 to maintain the growth of money supply (M2) and financing scale. M2 in China increased by 8.7% YoY, exceeding market expectations. China also released December import and export data this week, exports grew by 9% YoY while imports grew by 17.7% YoY, both beating market expectations, the 2019 figure also set new record highs for the annual import and export figures. 2019 China GDP data was released this week, a YoY increase of 6.1% is in line with market growth expectations.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”, “iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)