Weekly Insight November 8

United States

United States

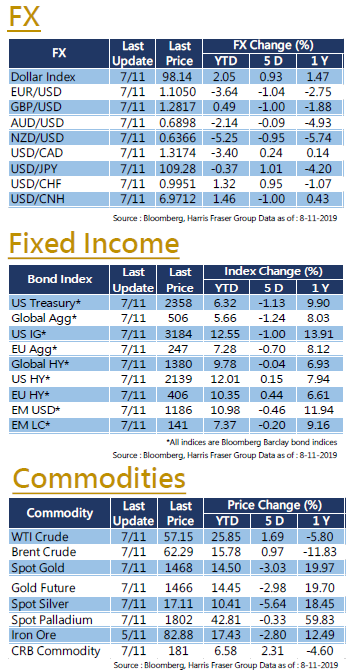

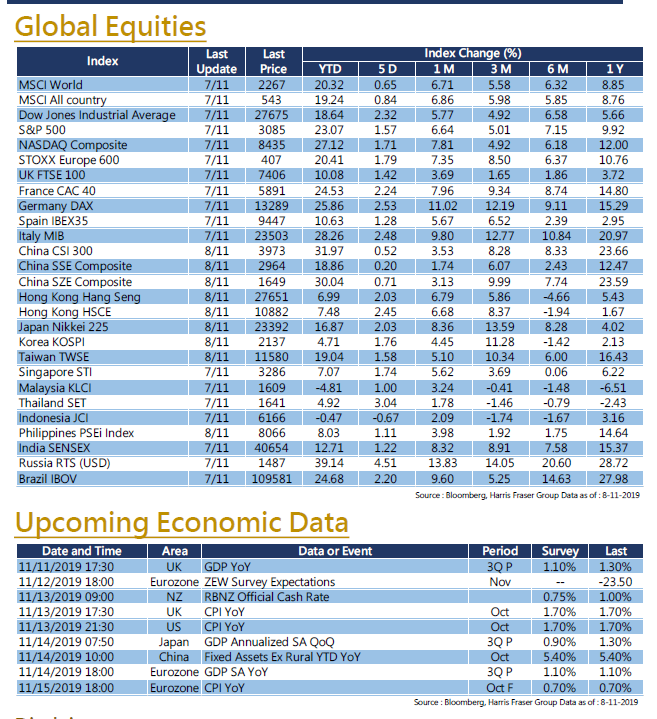

Sino-US trade negotiations showed signs of resolution, and the improving market sentiment pushed US equities to a historic high. Over the past 5 days ending Thursday, the Dow, S&P 500, and NASDAQ rose 2.32%, 1.57%, and 1.71% respectively. During Asian hours on Thursday, there were rumours that China and the United States will uplift the tariffs in place on both sides in stages, immediately boosting Asian equities, European and US equities also rose early on Thursday. Later on, it was reported that negotiations were still in progress, the time and place of signing the agreement have not yet been set. The US stock market retreated in the afternoon. As for economic data, the US figures were mixed. The October Markit US Service PMI reported a final value of 50.6, missing market expectations. However, the ISM non-manufacturing PMI in the same period reported 54.7, which improved over the previous period and was a positive surprise. Next week, the focus will be on the October US inflation data.

Europe

Europe

European markets outperformed global markets over the week. Over the past 5 days ending Thursday, the UK FTSE, French CAC, and German DAX gained nearly 2.2%, over 2.8%, and over 3.3% respectively. Regarding the Brexit drama, the general election will be held on 12th Dec as the parliament is officially dissolved. While the Conservatives are still expected to lead the House of Commons after the coming election, market participants are waiting for elections results before making further judgements on UK’s economic future. The Bank of England announced no changes to the interest rate as the market expected, and the BoE is unlikely to cut rates in the remaining portion of the year. On the other side of the Channel, the German Market Manufacturing PMI slightly improved by 0.4 points to 42.1. While the figures are improving, the economic leader in the EU is still experiencing a contraction in the manufacturing sector for 9 consecutive months. More European economic data will be released next week, with multiple CPI and GDP figures coming out.

China

China

Driven by the progress in Sino-US trade negotiations, Hong Kong equities had a strong performance, the Hang Seng Index rose nearly 2% over the week. The PBOC lower the interest rate of MLF and it support the market sentiment. Also, sources reported that China and the United States would cancel the imposed tariffs in stages. The optimistic sentiment pushed the HSI to break through 200-day moving average, briefing hitting the 27900 level intraday. However, the Index retracted on Friday. Another focus this week is the strengthening of the Renminbi. At the moment, the mid price of the USD/CNH has broken though the 7 level and reported at 6.9813. Next week, there will be data on China's fixed asset investment, retail sales and industrial production.