Policy uncertainty is a pain point that continues to spook investors, the calendar year return was relatively unsatisfactory. Still, Chinese markets slightly rebounded in the last month of the year, both the Shanghai Composite and CSI 300 Index gained 2.13% (2.26% in US$ terms) and 2.24% (2.38% in US$ terms) respectively over the month of December, whereas the Hang Seng Index continued to slide under the regulatory pressure, shedding 0.33% (0.34% in US$ terms).

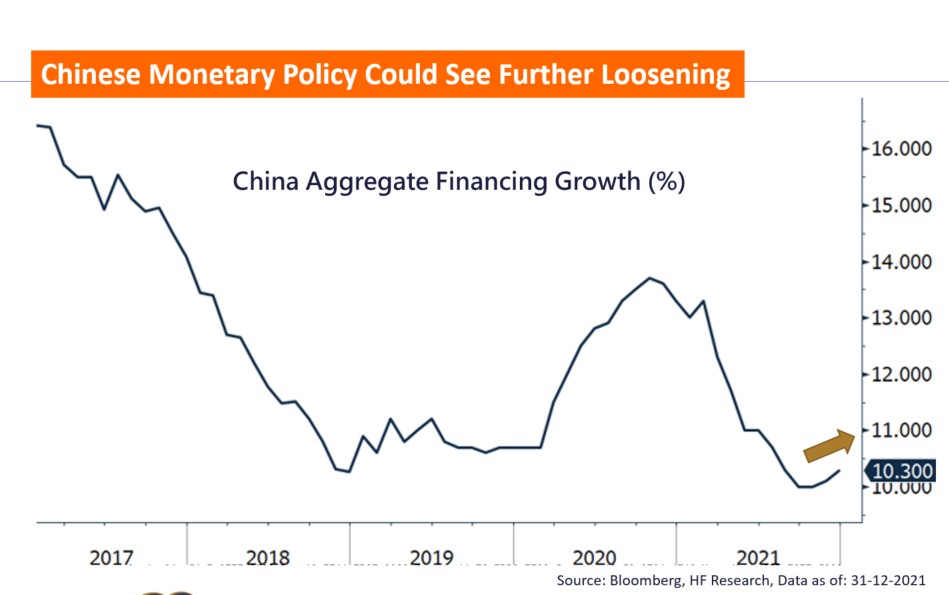

Indicators for major industries show a continued slip in the YoY figures, supporting the view that Chinese fundamentals are weaker. The real estate sector continues to be the biggest detractor for the economy, more Chinese developers are waiting for financing conditions to improve to avoid default. According to statements from the authority, ‘stability’ have returned as the policy priority, where the numerous credit events in 2021 was not the intended result. Therefore, if policy pressures shall ease as we expect, the Chinese economy, and especially the hard hit sector, should see better recovery.

Similarly, the tech sector has also experienced much pressure throughout the latter part of 2021. Although regulatory actions impacted the tech space business outlook, we think this trend could change in the New Year. Referencing past regulatory cycles, the tech regulatory cycle could be nearing its end. Signals coming out from the Chinese authorities have also brought hope that there will more regulatory loosening in 2022. With the pandemic likely under control, and anticipating fiscal, monetary, and regulatory loosening, we are positive on the Chinese market in 2022.