Global equity markets overall started off the year with a weak January, European markets were also affected. With the energy crisis exacerbated by worries over the Ukrainian situation, inflation spiked, COVID outbreak continued, and monetary policy tightening is seemingly on the way. In January, the European STOXX 600 index fell 3.88% (5.29% in US$ terms).

Pandemic remains a hot topic, as the Omicron variant swept through the region, bringing cases far above previous waves. However, we expect a limited impact to the economy compared to previous outbreaks, as government restrictions and lockdowns are less stringent. That said, even though the economic growth is expected to stay decently in line with early projections, the fast-spreading virus still reduced the workforce available, adding further pressure to the strained supply chain. This is also one of the contributing reasons why the inflation level is high.

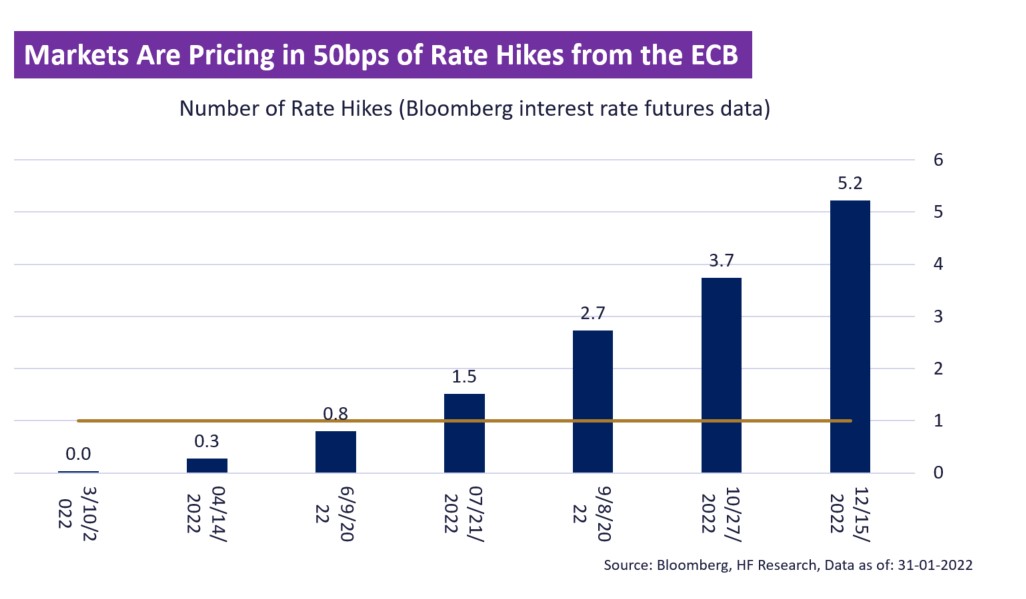

The latest CPI print in Europe was a whopping 5.1%, representing a problem for the central bank. ECB President Christine Largarde was surprisingly hawkish, announcing tapering of asset purchases, and even refused to rule out a rate hike before the end of the year. Markets have started pricing in faster tightening, with the ECB widely expected to increase rates by 50bps within the year. The sharp turn from the ECB could bring forth more downside pressure in the equity market even as corporate earnings and economic conditions improve. With the high levels of volatility in the market due to uncertainties, before market conditions stabilise, we would opt for a wait-and-see approach in the meantime before actually entering the market.