The Chinese stock market fell in November. The CSI 300 Index and the Shanghai Composite Index were down 1.49% (1.41% in USD) and 1.95% (1.86% in USD) respectively, while the Hang Seng Index also fell 2.08% (1.96% in USD).

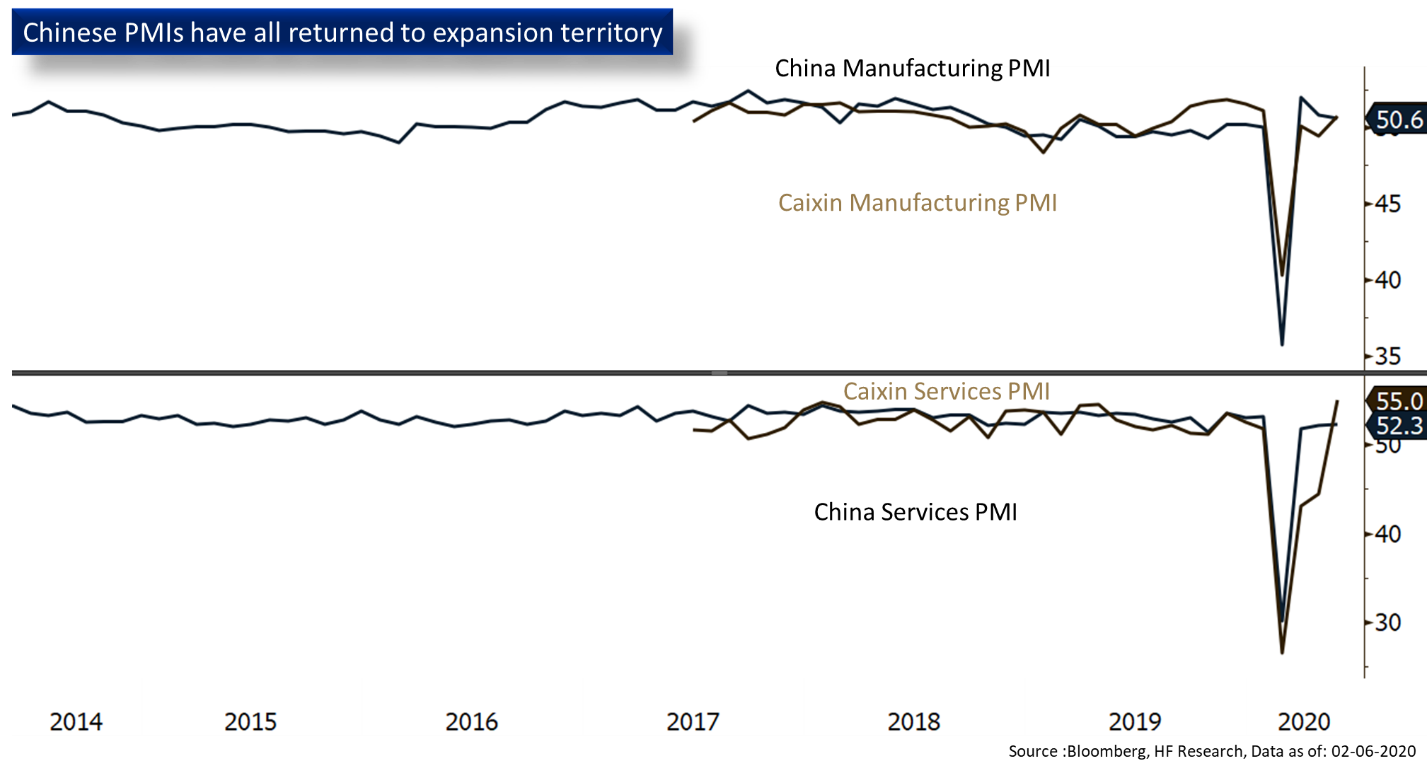

The overall economic outlook has improved somewhat, as the official manufacturing PMI came in at 50.2, breaking through the 50 level for the first time in 6 months, Caixin PMIs for both manufacturing and services also improved. GDP growth figures continue in a downtrend, we see the economy slowing down as the growth drivers in the economy falter. Investments fell, most notably in the real estate sector due to government policy emphasis on ‘Housing for living, not speculating’; Consumption is also growing at a slower rate as implied by falling retail figures; While the negative PPI, which has been in a downtrend for 5 months, further hints at weakness in exporting sectors due to the ongoing trade war.

Head of the People’s Bank of China Yi Gang commented on market rumors, stating that the Bank will keep monetary policies normalized and will stay away from currency devaluation, zero interest rates and QE. This fuels speculation that the PBOC will not slash reserve ratios in the short term as authorities might see the current economic growth adequate.

On the other hand, Chinese Vice Premier Liu He said that it is necessary to increase “counter-cyclical” adjustments, implying that there might be more economic support policies and markets remained hopeful. Overall, the fundamentals are seemingly turning for the better, the government stimulus to come might be able to revitalize the economy strained by the trade war. That said, as the volatility increases at the end of the year, investors should keep an eye on any new economic data on changes in the economy.