Want to learn more about investing in the bond market?

There is a wide range of investment vehicles for bond investing. What are their characteristics? What should we pay attention to?

3 main ways to invest in bond market

There are three mainstream instruments to invest in bond market today, namely direct bonds, bond funds and bond ETFs. Direct bond refers to directly holding the bonds issued by an entity, corporate or sovereign. Holding direct bonds is basically equivalent to being a creditor of the company, the bond holder has the right to directly claim the principal from the issuing company. One might be more familiar to instruments like the “i-Bond”, which is a retail bond issued by the Hong Kong Government through the Hong Kong Stock Exchange.

As for bond funds, they are funds that invest in the bond market, usually holding direct bonds. Since bond funds can gather more capital, they can hold more bonds in its portfolio, achieving better risk diversification. In addition, the bond funds also have different investment objectives, some invest by region, others by type or theme.

The last of the bunch is bond or fixed income ETFs. For those who are unfamiliar with the term “ETF”, its long-form is Exchange Traded Funds, ETFs tend to hold securities with the same composition as its corresponding index to track the performance of the index. One of the biggest advantages of using ETFs is the existence of the secondary market, so you can buy or sell them on the listed exchange. The Hong Kong Stock Exchange listed Tracker Fund (2800) is one of the best-known equity ETFs that tracks the performance of the Hang Seng Index. Similar to the equity ETFs, fixed income ETFs operate in the same way, holding a basket of bonds, instead of stocks, to track its bond index. However, currently there are less than 20 bond ETFs listed on the Hong Kong Stock Exchange.

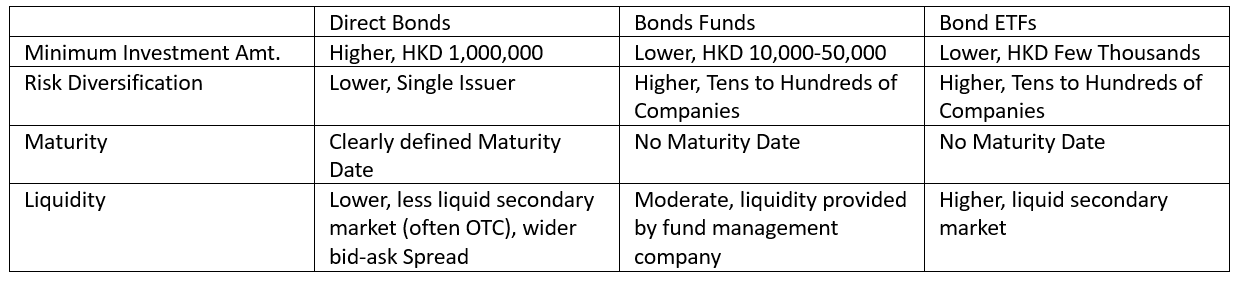

Minimum investment amount

First off, the minimum investment amounts can differ a lot. The minimum investment amount for direct bonds is relatively higher. For common corporate bonds not issued through the Hong Kong Stock Exchange and denominated in US dollars, the usual minimum investment face value is USD 200,000, with a very minority of them at USD 100,000. For HKD denominated bonds, the minimum investment face value would be HKD 1 million. If you compare it to HK listed stocks, where the minimum investment amount mostly ranged between Hong Kong dollars of several thousand or several tens of thousands, the entry barriers for investing in direct debt is much higher. Of course, the barriers to entry for retail bonds issued on the Hong Kong Stock Exchange could be lower, e.g the minimum investment amount for “i-Bond” is only HKD 10,000.

Barring retail bonds issued on the Hong Kong Stock Exchange, the entry barriers for bond funds and bond ETFs are relatively lower. Take bond funds as an example, for fund investment in retail banks, the minimum investment amount for a one-off investment ranges from around HKD 10,000 to HKD 50,000. As for the bond ETFs, the ones traded on the Hong Kong Stock Exchange also have a similarly low entry barrier, with the minimum lot averaging a few thousand HKD, which makes it one of the less demanding tools for novice investors.

Risk diversification

Secondly, the risk diversification levels are different. Direct bonds are only single bonds; while bond funds and bond ETFs hold a basket of bonds, with the number ranging from tens to hundreds of bonds, so they tend to achieve better risk diversification. Of course, investors could design a bond portfolio to achieve diversification in theory, but the investment amount of this approach will be much larger. As mentioned above, a straight bond would require a minimum investment amount of around HKD 1 million, a bond portfolio of 100 bonds would require around HKD 100 million, whereas bond funds or bond ETFs would only need a minimum of a few thousand HKD.

Maturity

The third point of focus is maturity. Most direct bonds have a clearly defined maturity, as long as there is no default or other special circumstances, investors can expect to receive the principal on the bond maturity date. On the contrary, bond fund investors could not predict the amount received at the time of redemption. As there is no maturity date, the bond fund will continue to reinvest the principal of its matured bonds. The net asset value of the fund changes daily, although investors can gain from the dividend pay-outs, there is no guarantee of a price gain at the time of redemption. Bond ETFs are essentially the same as a bond fund and it is exposed to the same risks as a bond fund.

Liquidity

The last point of focus the difference in liquidity. In terms of transaction speed, bond ETF is the fastest, a transaction can be done in mere seconds. In addition, trading on the Hong Kong Stock Exchange system, although it takes two trading days (commonly known as T+2) for cash settlement, investors could buy other securities listed on the Hong Kong Stock Exchange immediately, using the funds from selling the bond ETF. This is also known as receivable funds, which can be used for trading before the actual settlement date. In addition, issuers are usually required to bid based on the value of the investment vehicle, so the liquidity risk is relatively low with a tighter bid-ask spread.

In contrast, although direct bonds can also be traded in the secondary market, the selling amount is not usable before the settlement date, unlike receivable funds which can be used for trading on the Hong Kong Stock Exchange. Banks or other financial institutions usually need at least one working day to settle the sold amount. More commonly, bonds are traded on the OTC market, where they might be thinly traded, having sparse bids in the market, which gives rise to a greater liquidity risk. Even if there are open bids, the bid-ask spread might be rather large.

Bond funds are fundamentally different in liquidity terms, as transactions are not conducted in the secondary market, but only via subscriptions and redemptions between investors and the fund companies. Barring any special circumstances, the subscription and redemption of open-end bond funds should 100% be done, so the liquidity is quite adequate. But one should also note that you would not know the actual unit price for subscription and redemption, which is only known after the transaction, and the whole redemption process often takes two working days.

After comparing the three instruments, you may have a deeper understanding of investing in the bond market. Next up, we would further look into bond or instrument selection, and determine which bonds would best benefit from a given situation.