Despite the global rebound over the month, EM equities still lagged behind, largely dragged down by underperforming markets such as Latin America. In the month of October, MSCI emerging markets index only edged 0.93% higher, while the MSCI LATAM index lost 5.38%.

Our view on EM equities remains unchanged, expect them to underperform in the shorter term. Sources of downside risks have not dissipated, concerns over vaccinations, external debt, weak currency, and political uncertainties all contribute to the weaker outlook of EM equities. Many DM countries have achieved herd immunity, economic activities have mostly returned to normal with COVID treated as an endemic; the opposite is happening in EM economies, and without a robust and effective vaccination programme, EM economies will likely remain lagging behind their DM counterparts in the scope of economic recovery.

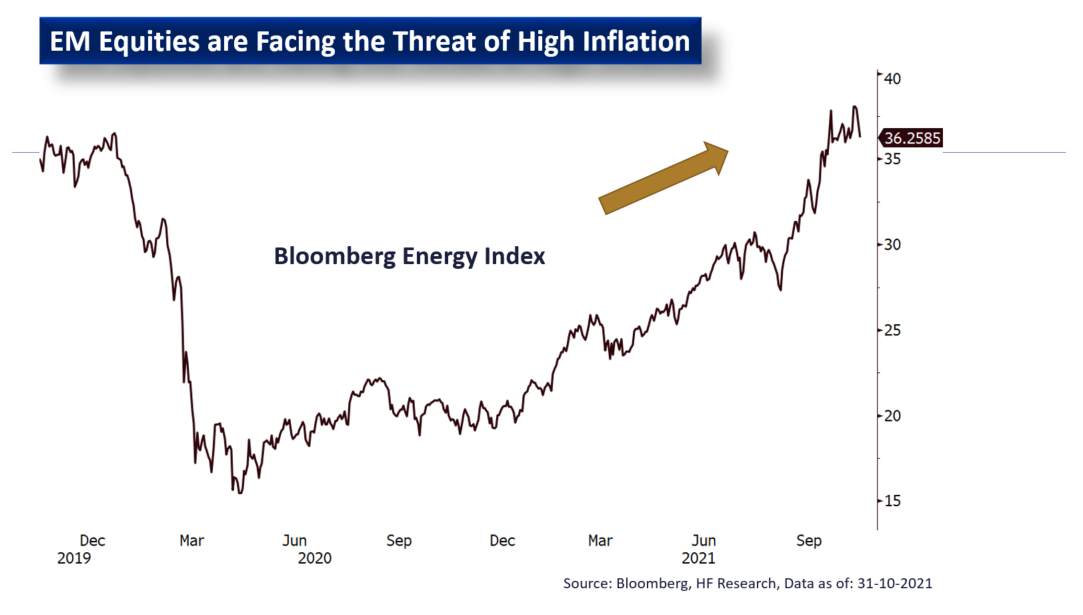

To add on, inflation continued to stay as the forefront issue, global central banks have moved forward with monetary tightening as a countermeasure. The most influential US Fed has already announced the start of tapering in asset purchases, the policy turnaround is more pronounced in EM countries with multiple rounds of rate hikes, and this rapidly tightening monetary landscape likely puts more pressure on EM equities. Moreover, limited fiscal ammunition available to EM due to higher external debts also limits further acceleration in the economy, hitting recovery from both fiscal and monetary sides. Henceforth, we still hold reservations over EM equities in the shorter term, and would suggest a more conservative approach if one allocates to EM equities.