Weekly Insight February 18

US

US

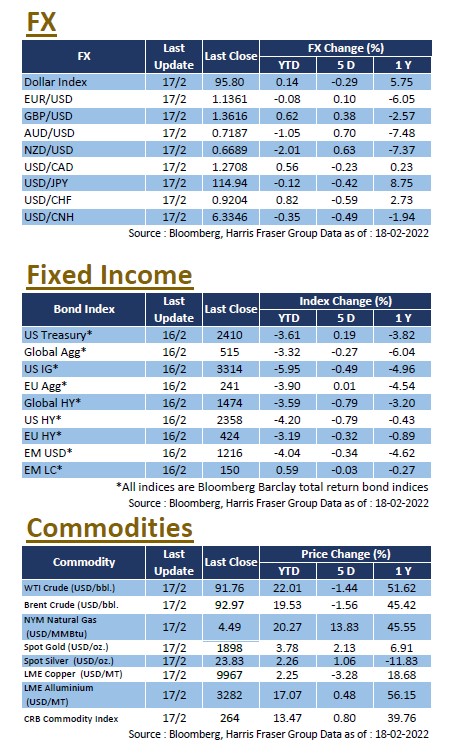

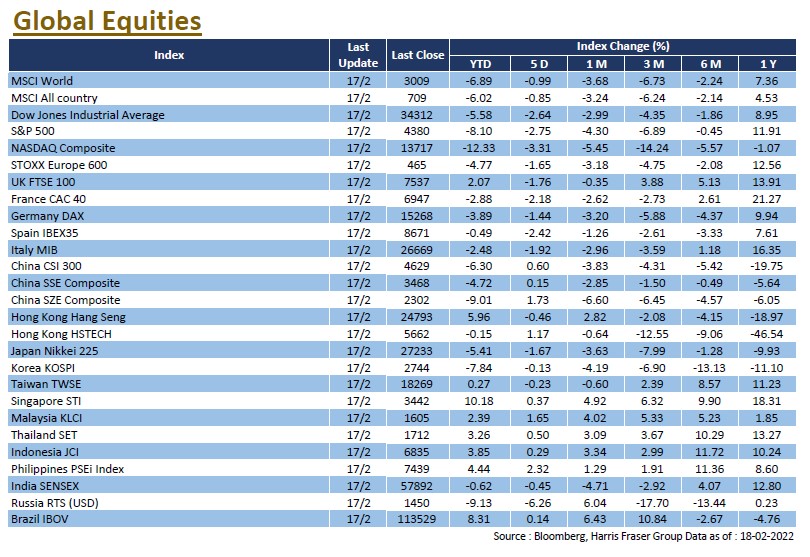

With prospects of a faster rate hike from the Fed, and the situation in Ukraine heating up, equities fell sharply, with the S&P 500 back below its 200-day average, and the three major US indices down between 2.64% and 3.31% over the past five days ending Thursday. Initially, Russia had signalled a partial withdrawal of its troops, which at one point spurred a rally in global equities. Later, the US and NATO said that Russian presence on the Ukrainian border was increasing instead, and US President Joe Biden warned that there was a ‘very high probability’ that the Russians would launch an attack on Ukraine within a few days, which led to a shift in market sentiment again, sending safe-haven assets such as gold above US$1,900 per ounce at one point.

On the interest rate front, the US Federal Reserve released the minutes of its January interest rate meeting, with officials agreeing that interest rates should be raised as soon as possible, and the Fed should remain vigilant about high inflation, some members further agreed that the current situation warrants the start of tapering later in the year. Current interest rate futures data suggest a 50 basis point hike in March and a total of 100 basis points before we move into the second half of the year. On the economic front, the US Producer Price Index (PPI) in January were higher than expected, following the earlier surprise in Consumer Price Index (CPI), reflecting that inflation in upstream raw materials remained worse than expected. Next week, the US will release important data including the Markit Manufacturing PMI and the Consumer Confidence Index for February.

Europe

Europe

European stocks followed external markets as the geopolitical tensions in Ukraine intensified, with the UK, French, and German equities falling between 1.44% and 2.18% over the past 5 days ending Thursday. Markets were focused on the ECB's monetary policy position for the year, as ECB President Christine Lagarde expressed her concerns about inflation earlier, and then said she would act at ‘the right time’ and would not rush to exit the Eurozone’s current simulative measures. In addition, the International Monetary Fund (IMF) has said that the supply chain problems in the Eurozone may continue until 2023. Next week, the Eurozone will release data including the Markit Manufacturing PMI for February.

China

China

Hong Kong stocks were under pressure partly due to the situation in Ukraine, ending the week with a 2.32% drop, while China A-shares recovered modestly, with the CSI 300 Index rising 1.08% over the week. Against the backdrop of surging inflation in Europe and the US, China's January Consumer Price Index (CPI) slowed to 0.9% YoY, down from 1.5% YoY in December, while the PPI also moderated. On the other hand, there were further regulatory guidelines from Chinese authorities, with the National Development and Reform Commission urging takeaway platforms to lower their service charges, pressuring shares of a number of takeaway platform companies. Next week, China will announce the 1-year and 5-year LPR rates.