Weekly Insight April 14

US

US

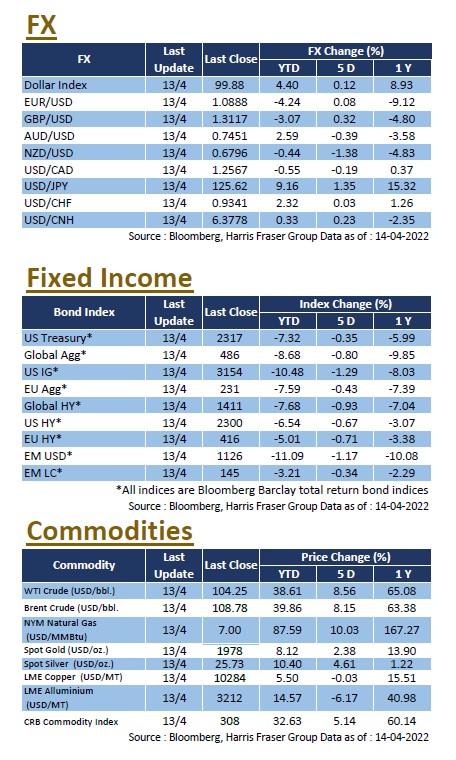

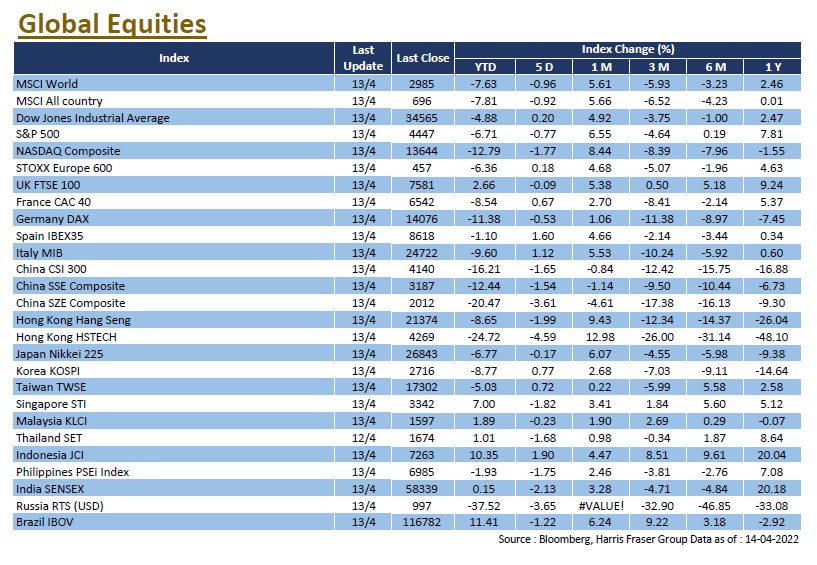

US inflation rose to a 40-year high, with US equities weakening on the back of volatility, the NASDAQ fell 1.77% and the S&P 500 lost over the past 5 days ending Wednesday. The US Consumer Price Index (CPI) rose by 8.5% YoY in March, the highest since 1981. In addition, the US PPI also hit a record high in both YoY and MoM measures, suggesting continued inflationary pressures on industrial raw materials. The United States NFIB Business Optimism Index also fell to a near two-year low in March, amid rising cost pressures. Against the backdrop of high inflation in the US, Fed Vice-Chairman nominee Lael Brainard said the authorities would move quickly to raise interest rates to a neutral level, and may decide whether to start tapering as early as May.

Earnings season has commenced in the US, with financials leading the charge. JPMorgan Chase (JPM) reported a 42% YoY drop in earnings for Q1 this year, spurring a 3.2% loss in a single day, while BlackRock (BLK), the world's largest asset manager, reported a 21.6% YoY increase in earnings. The market will pay close attention to the earnings performance, US will also release the manufacturing PMI data for April and the economic beige book next week.

Europe

Europe

The French presidential election piqued markets' attention, with European equities lacking clear direction after the sharp rebound in March. The first round of voting in the French presidential election has concluded and incumbent President Emmanuel Macron has received 27.6% of the votes, ahead of key rival Marine Le Pen's 23.4%. The next and final round of voting will be held on the 24th of this month. In addition, the market is eager to hear more from the ECB on its monetary policy at the next interest rate meeting on Thursday night, with Governing Council member Yannis Stournaras saying that inflation will be controlled at all costs. Next week, the Eurozone will release manufacturing PMI data for April.

China

China

Despite the news that the mainland might cut the reserve requirement ratio (RRR), the Hong Kong equity market remained soft, with the HSI down 1.62% for the shorter week due to the Easter holiday on Friday, the China A-share market was also weaker, down 0.93% from Monday to Thursday. Premier Li Keqiang said at a State Council meeting that monetary policy tools such as RRR cuts should be used in a timely manner, reinforcing market expectations that the next cut could come soon. On the data front, China's aggregate financing and new RMB loans in March were both higher than the previous month, as well as the March CPI YoY. Next week, China will release its 2022 Q3 GDP, as well as fixed investment, production and retail sales data for March.