The 2nd wave covid epidemic spread rapidly, uncertainties arising from Brexit talks and US elections further dampened market sentiment. European equities continued its earlier weakness, and the European STOXX 600 Index fell 5.19% (5.80% in US$ terms) over the month.

Covid remained the centre of attention as the situation rapidly deteriorated in numerous European countries. Towards the end of the month, daily covid cases in many countries has far exceeded the 1st wave, resulting in local governments re-imposing full on lockdown measures. As the economy has just started its recovery, the newly ordered month-long lockdown threatens the weak recovery.

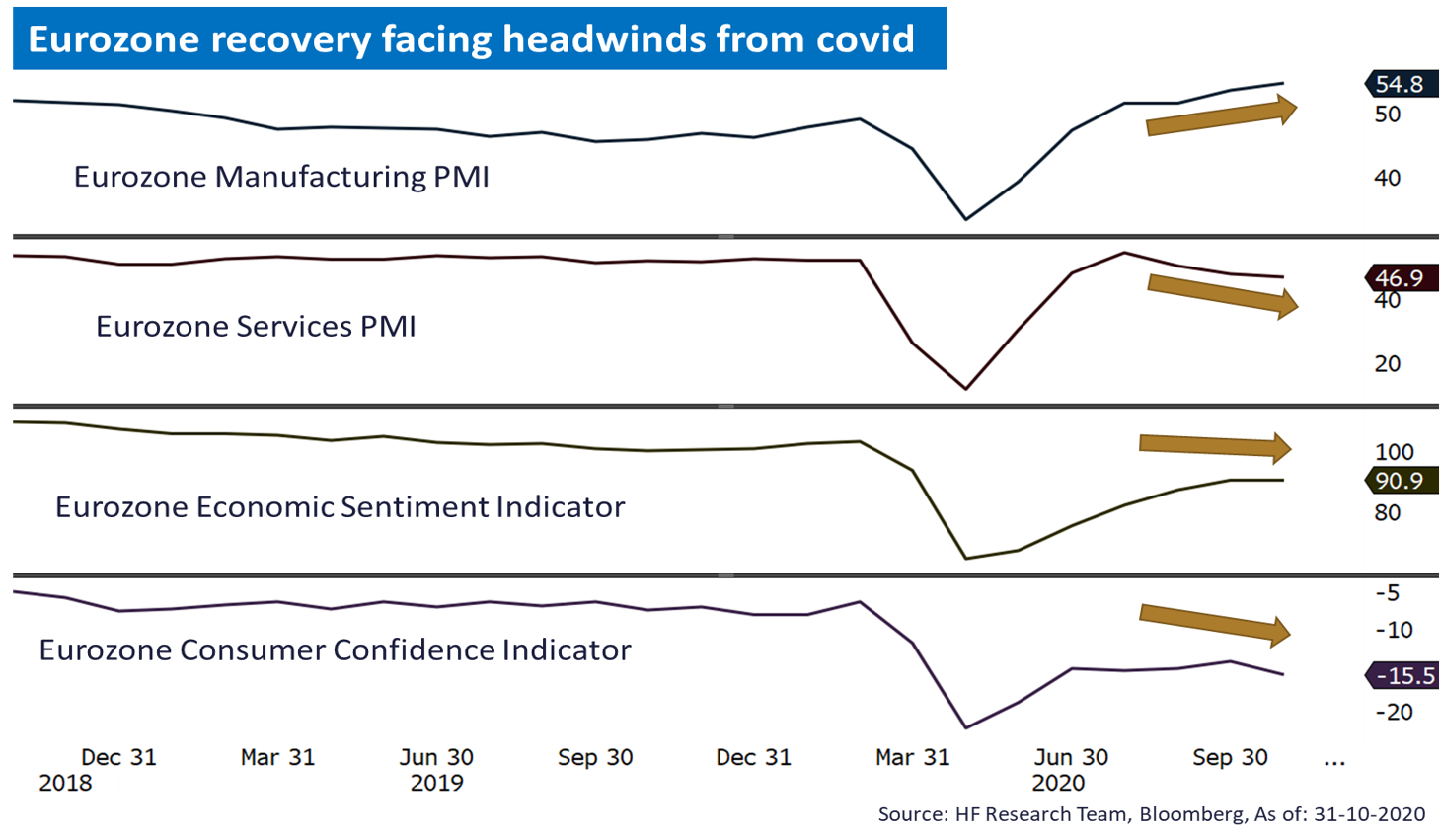

Fundamentally, Europe saw improvement in some of its fundamentals, Eurozone manufacturing PMI figures hit a recent high, yet services PMI saw a continued contraction, which is expected to further worsen with the imposed lockdowns. The market remains vulnerable to external shocks, which is compounded by the Brexit uncertainties. The scheduled deadline for a trade deal was delayed, but due to the fundamental divergence on several key issues, the risk of a no-deal Brexit by the end of the year remains high. With all the uncertainties arising from various factors in the European equity market, we expect to see a relatively larger downside risk compared to the upside potential.