Anticipation of the supply chains disruptions resolving gave a boost to the market. However, the unexpected resurgence of COVID in form of the new highly mutated Omicron variant, together with the rising inflation, STOXX 600 index fell significantly towards the end of the month, losing 2.64% (4.56% in US$ terms) over the month of November.

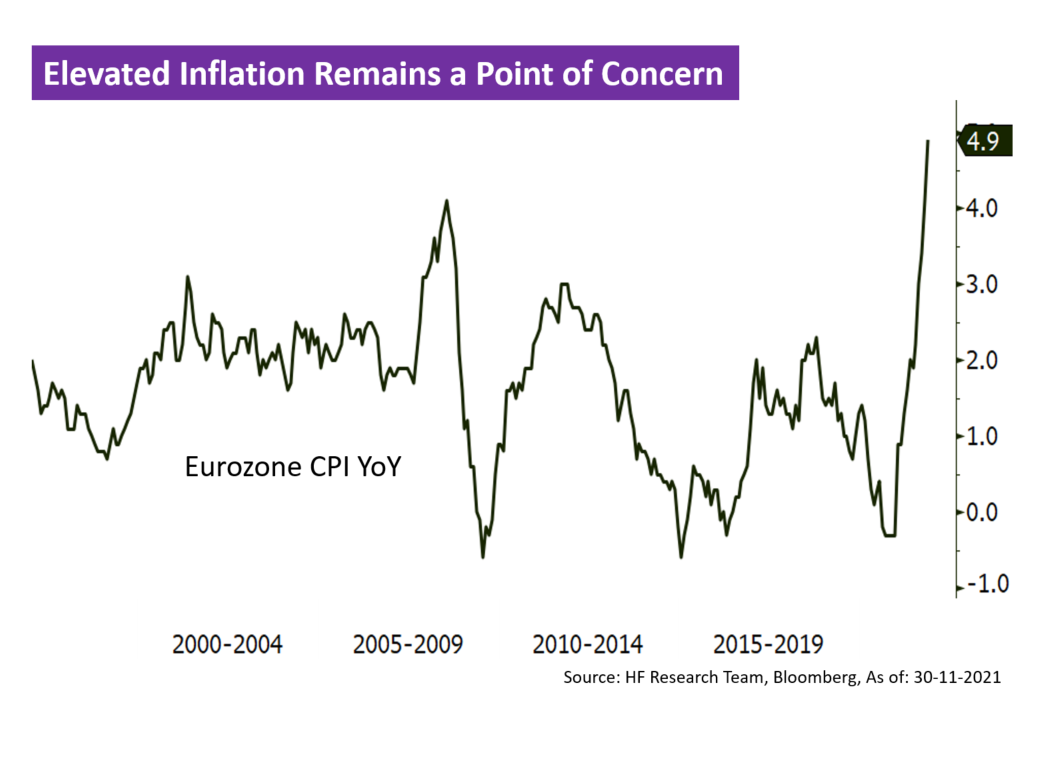

Economic fundamentals remain positive, yet inflation stays strong with the latest YoY figure of 4.9%, which was the highest reading in recent years. Contrary to other global central banks, the ECB has remained unwavering on their ‘transitionary inflation’ claim, pledging to keep the Eurozone monetary policy accommodative as the economy recovers, which should provide further support to the market. However, this also poses a risk if the supply chain troubles and the energy crisis remain in place, as an extended period of high inflation could be harmful to the economy.

As for the pandemic, several European countries have reinitiated lockdown measures just as infection numbers climb higher and a new virus strain emerges, this could hit consumer sentiment which impacts the local economic growth. The resurgence in the global epidemic could extend the current higher inflation, by disrupting more supply chains, potentially forcing the ECB to tighten monetary policy at an undesirable time, further hitting the equity market. In the short term, more headwinds are present, and we suggest investors to exercise caution as the potential impacts of the Omicron variant is being investigated by the scientific community.