The emerging markets faltered again in the month of June. Problems persist, epidemic remains an issue, and liquidity crunch continues to weigh down on various markets. Chinese equities fell, alongside major ASEAN markets, putting a cap on the overall emerging markets’ equity performance. Over the month, the MSCI emerging markets index slightly fell 0.11%, while the FTSE ASEAN 40 Index fell 3.85%.

Heading into the second half of the year, our view on the market outlook remains unchanged, maintaining the suggestion of DM over EM. The main reasons for us to hold reservations over the EM outlook remains in play: epidemic is still largely out of control, vaccinations are lagging behind, and further fiscal and monetary stimulus are likely limited. These altogether would likely lead to a weaker and slower economic recovery, which in turn doesn’t bode well for equity markets.

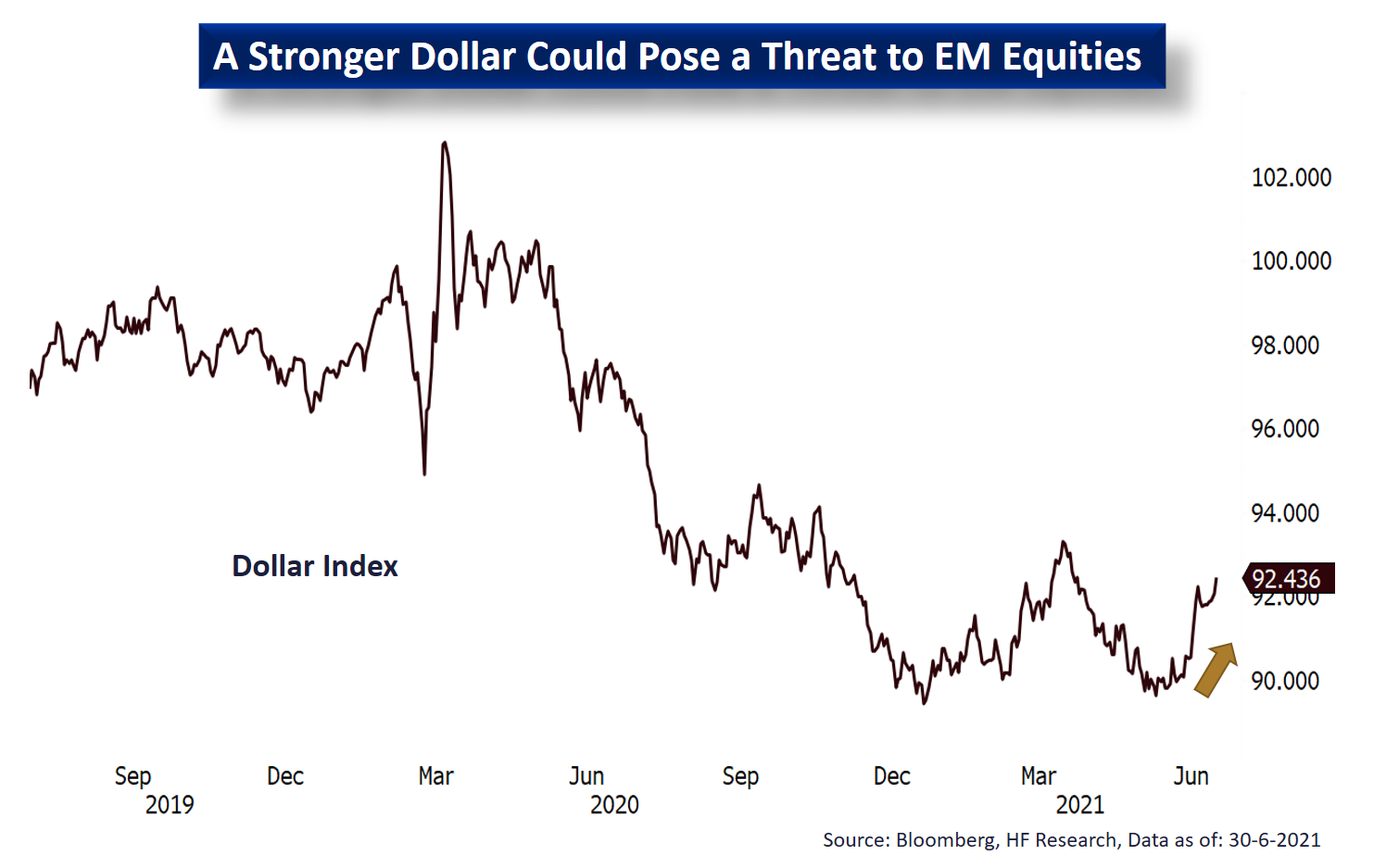

To add on, with the headline inflation figures in the US going higher than the long term average, there have been more calls from Fed members for monetary tightening. Anticipating tighter liquidity conditions, the Dollar has reversed its previous downtrend and rebounded sharply, which will likely put a greater pressure on EM equities, as it did in the past. The further increase in real interest rates in the US will also pressure EM central banks to raise their interest rates to prevent excess capital outflow, which could possibly cause a dent in their economic recovery. In short, we remain more positive on DM equities in the short term, and would not suggest investors to overweigh in EM in the short to mid-term.