Weekly Insight April 22

US

US

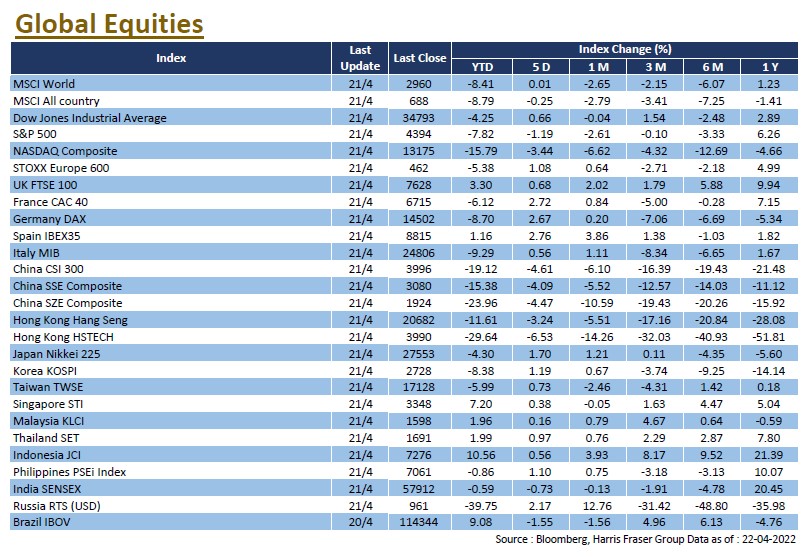

The US stock market had initially rebounded strongly after the Easter holiday, but Fed Chairman Jerome Powell's hawkish comments triggered another sharp fall in technology stocks, with the tech-heavy NASDAQ tumbling 3.44% over the past 5 days ending Thursday, the S&P 500 fell 1.19%, while the Dow rose slightly by 0.66%. Powell mentioned that a 50 basis point hike would be discussed at the meeting, and also mentioned that he saw merits in a ‘front-loaded hike’, implying that he was in favour of a more aggressive approach to inflation. Bloomberg interest rate futures data suggests that the probability of a 50 basis point hike at the May 4th meeting has reached 100%.

As for corporate earnings, 91 S&P 500 constituents have reported their latest quarterly results, with 73 of them beating market expectations (80.22%). Two companies caught the market's attention: Netflix's share price plunged 35% in a single day after announcing that it lost 200,000 subscribers in the quarter; while Tesla's stock rose more than 10% intraday following its impressive earnings report, but later narrowed to about 3.23% at market close. In addition, the World Bank lowered its forecast for global economic growth to 3.2% in 2022, down from its original forecast of 4.1%. Next week, the US will release data on GDP for 2022 Q1 and consumer confidence for April.

Europe

Europe

European equities were relatively stable, with the UK, French and German equities markets gaining between 0.62% and 3.63% in the past 5 days ending Thursday. On the economic front, the data all point to an improving economy, with the preliminary Eurozone Manufacturing PMI at 55.3 in April, ahead of market expectations of 54.9, and the preliminary Eurozone Consumer Confidence Index of -16.9 in April was also better than the expected -20. ECB Deputy Governor Luis de Guindos said that the central bank should end its asset purchase programme in July and that a rate hike in July is possible. Next week, the Eurozone will release important data including 2022 Q1 GDP and April CPI.

China

China

Fears that the US Federal Reserve might speed up its tightening policies triggered worries over tighter market liquidity, pressuring the Hong Kong equity performance, with the Hang Seng Index falling by 4.09% over the week; China A-shares also failed to rebound, falling 4.19% over the same period. On the other hand, China's economic data was positive, with GDP rising by 4.8% YoY in 2022 Q1, up from 4.0% in the previous quarter. The recently announced 1 and 5 year LPR rates remained unchanged at 3.7% and 4.6%, no further cuts were made. The market will continue paying attention to the liquidity situation. Next week, China will announce industrial profits data for March.