It was a rare occasion that fixed income fell alongside global equities in March, the Bloomberg Barclays Global Aggregate Bond Index was down 2.24%, US Investment Grade dropped 7.09%, while Emerging Markets US dollar Bonds and US High-yield bonds fell a whopping 10.68% and 11.46% respectively.

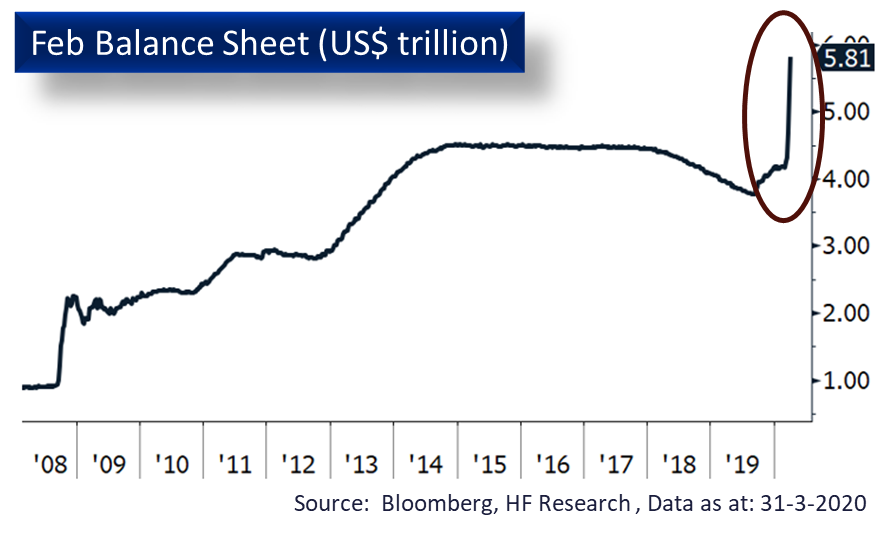

Early in March, following the dramatic oil price crash, fixed income markets showed signs of liquidity drying up and an unprecedented market crash followed. While we issued a warning in the early days of the crash, we see the recent dip as an opportunity for market entry. In order to support the market, global central banks have unanimously adopted dovish monetary policies, the excess liquidity could likely provide adequate downside protection.

As recession fears loomed and interest rates bordered zero, credit spreads have widened significantly. This could be an entry point to the market, as the liquidity crunch and the deleveraging activity sent bonds to undervalued levels. Amidst the uncertainty in economic growth outlook, fixed income exposure could improve risk adjusted returns in the portfolio. As monetary policies are expected to stay dovish throughout the economic recovery, corporations are also expected to receive sufficient support from local governments in order to save employment figures, the relative downside is minimised. The overall outlook for fixed income at this level should likely be positive over the year.