Emerging market equities were actually one of the few better performing geographies across global markets. Although fundamentals were still relatively weaker, there is bounce back on the back on low valuations, and the fact that monetary tightening has already been priced in. Over the month of January, MSCI emerging markets index slightly lost 1.93%.

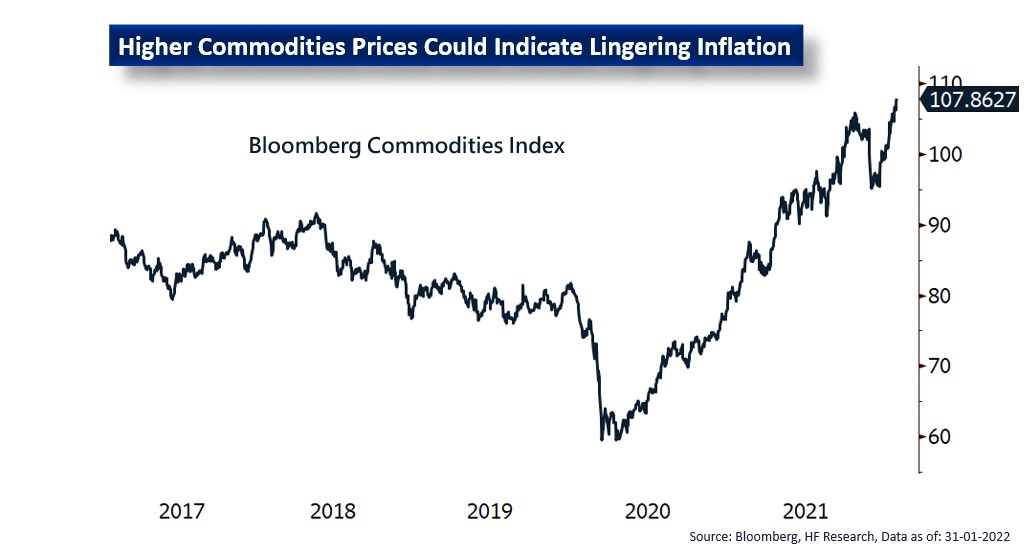

Some EM markets rebounded, the Brazilian market in particular had a good run in January, which was helped by the large amount of capital inflows, the low valuation, positive political outlook, and strong commodities prices. However, this situation is not expected to stay for an extended period, as factors such as inflows and cheap valuations will fade out in the medium term. For the 2022 outlook, we would still need to focus on the more fundamental aspects of the market.

At the moment, we are still cautious on EM as a whole, as we see no change in the pain points that we have always highlighted. While the pandemic is seemingly more serious in the developed economies figure wise, their higher vaccination rates allow them to keep economic activities relatively unaffected. Moreover, higher inflation, rising interest rates with a stronger dollar puts pressure on EM equities. Henceforth, we remain neutral on the EM outlook for the full year, and the only stay selectively positive on specific markets, namely China and southern Asian markets, as they are helped by the controlled pandemic situation, less inflationary pressures, and a stronger economic outlook.