While the Chinese equity market itself was less affected by the external market conditions, policy uncertainty and epidemic situation helped drive expectations of a weaker economic growth. Over the month of January, the Shanghai Composite and CSI 300 Index lost 7.65% (7.72% in US$ terms) and 7.62% (7.70% in US$ terms), while the Hang Seng Index was one of the only few major equity markets that managed to post a positive return, ending the month 1.73% (1.73% in US$ terms) higher.

Ever since the strong initial rebound in 2020, the economy growth has been slipping, with various sectors hit by the ongoing regulatory upheaval as reflected by the corresponding indicators. As a result, equity performance has underperformed global equities. While this situation might not completely resolve by itself in the short term, considering the shifts in the message from the authorities in China, with the emphasis put on increasing the economic stability, we could be looking at a gradual loosening in terms of both fiscal and monetary policies.

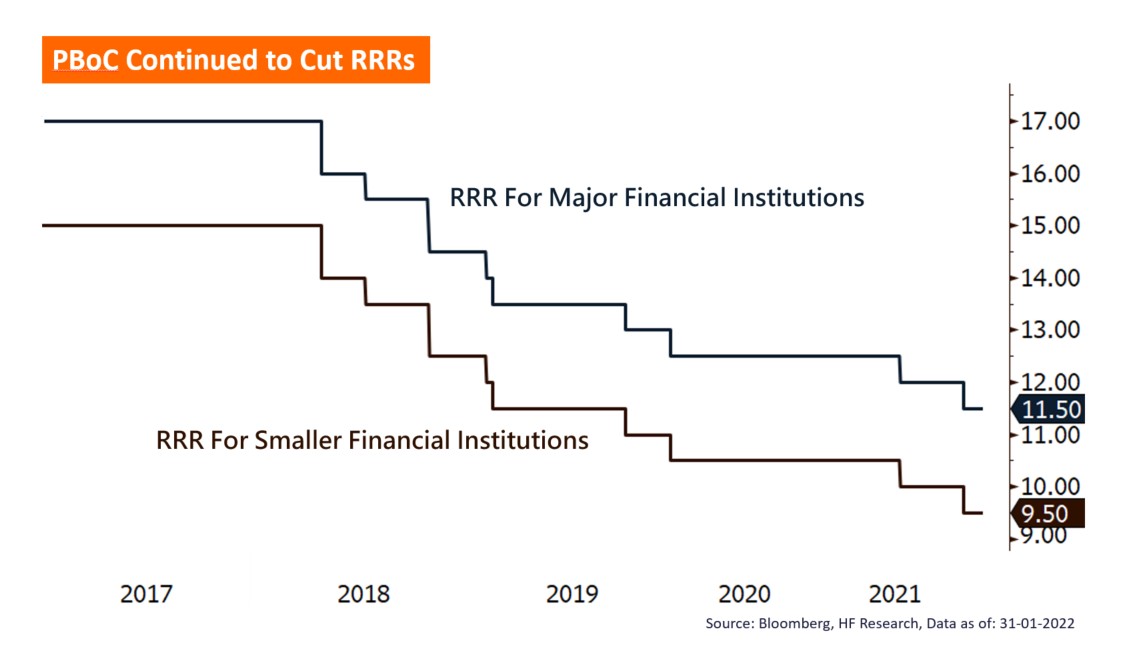

The battered real estate sector should see pressures alleviating with the loosening policies, this could also help support sectors that we are bullish on, including the technology sectors with compressed valuations, and the carbon neutral sectors. However, as China continues to adopt a zero-tolerance policy against COVID, we would avoid the relevant sectors that are more affected by the curbs on travel and services. Overall, we are positive on China for the year, as the country is likely going for a contrarian fiscal and monetary policy.