US markets bore the brunt of the correction over the month of January. Although Omicron had a relatively limited impact on the economy, the elevated inflation levels pressured the Fed to adopt more monetary tightening. US equity markets were under pressure, the Dow, S&P 500, and the NASDAQ fell 3.32%, 5.26%, and 8.98%.

Omicron continue to dominate the epidemic landscape, but the high infection figures are not deemed to be a problem, as government lockdowns and restrictions were not in place, which should help support the economy. Fundamentally, US equities are still relatively strong, although economic sentiment indicators have slightly receded, corporate earnings are still strong, with a majority of reporting S&P 500 constituents reported earnings beats; the forward EPS of US equities are still being revised up. Henceforth, the key of the equity market outlook lies in non-fundamental factors.

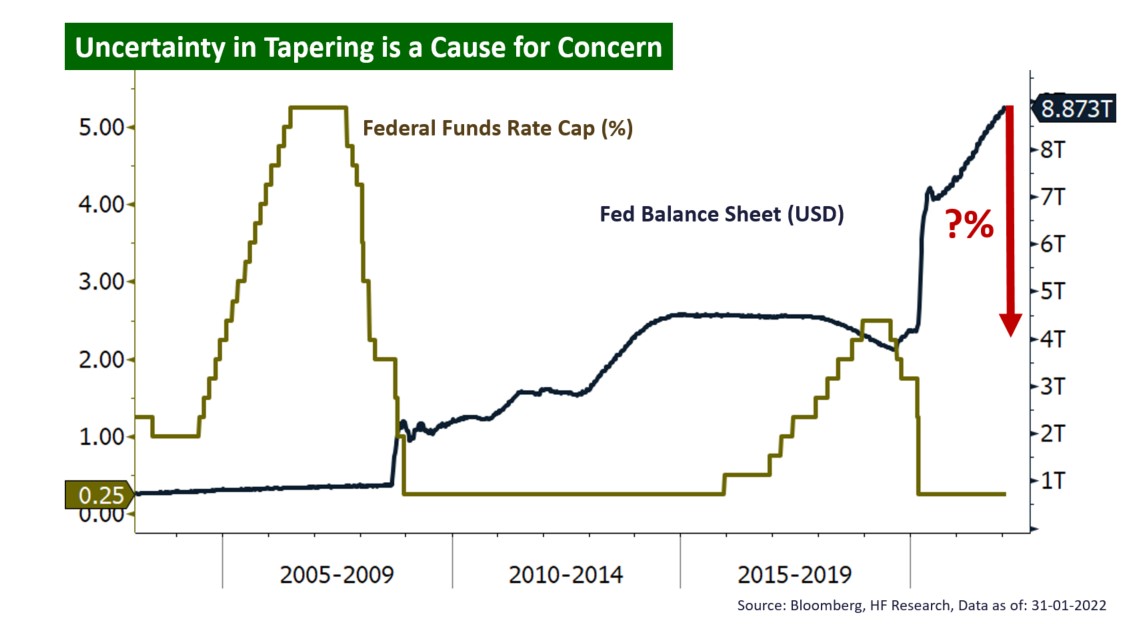

The biggest headwind came in form of the elevated inflation. The US CPI hit a 40 year high, raising concerns over faster monetary tightening. According to the US Fed, tapering of its balance sheet would happen this year, and rate hikes would start after asset purchases reach zero. This is a significant shift, which could mean a change in the post-pandemic ‘new normal’. If the current expectations were to materialise, the US equity market could see further downside via valuation compression. Although we expect the full year performance could be in the low single digits, we would opt to stay on the side-lines in the short-term given the uncertainties present.