US

US

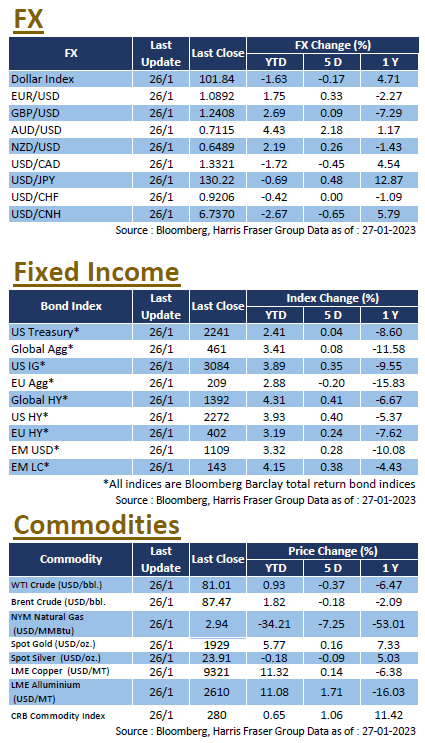

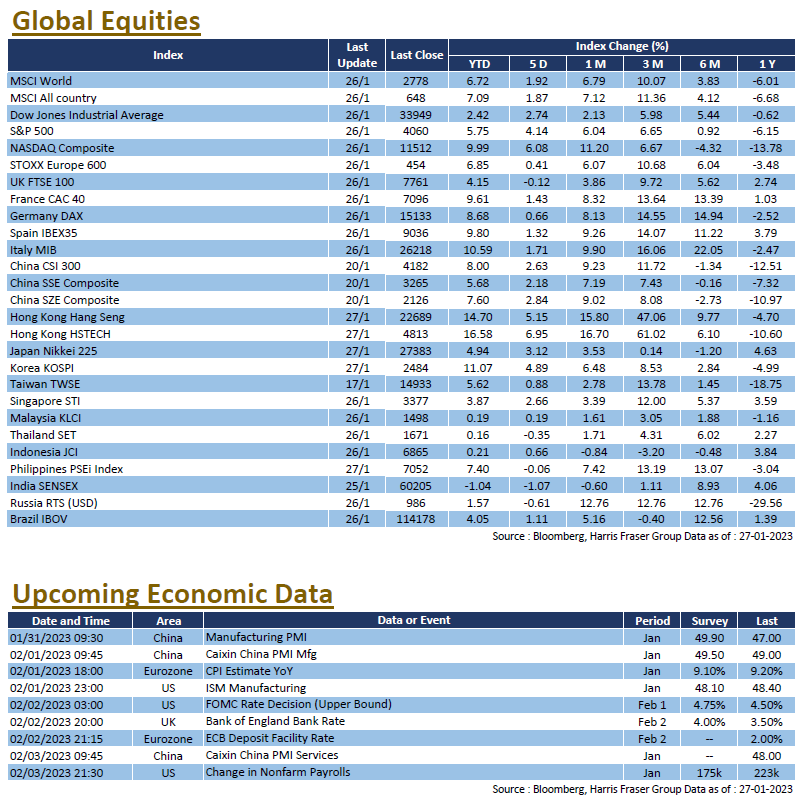

US markets remained strong, on the back of positive economic data and several uplifting earnings reports. Over the past 5 days ending Thursday, the 3 major equity indices gained 2.74-6.08%. Corporate earnings season continued, Microsoft offered weak guidance citing slowdown in growth, Intel missed estimates and suggested that demand is weaker, Tesla on the other hand was optimistic on the outlook and the stock jumped over 10%. Further layoffs were announced across the tech sector, including Google, Meta Amazon, and Microsoft. The debt ceiling debacle continued, it was reported that Republicans are considering to extend the debt ceiling to September, but both sides remain uncompromising, cash is expected tom run out around June, and default risks remain on the table.

The US released the latest GDP figures for Q4, which grew 2.9%, beating market estimates. The slowdown of the economy raised expectations for a soft landing of the US economy. Markit manufacturing and services PMIs in January both beat market estimtes, but remained below 50. Labour market data remains mixed, initial jobless claims unexpectedly fell, and was lower than market estimates, continuing claims on the other hand increased, which was higher than estimates. Next week, the US will be releasing a lot of economic data, including Conference Board Consumer Confidence Index for January, ISM manufacturing and services index for January. There will also be a lot of January labour market data, including ADP employment change, non-farm payrolls, unemployment rate, as well as the usual initial and continuing jobless claims. The US Fed will also hold their first monetary meeting in 2023 next week. At the time of writing, markets are pricing in a modest 25 bps hike in the meeting.

Europe

Europe

European equities rebounded over the week, the UK, French, and German indices gained 0.18-2.07% over the past 5 days ending Thursday. Ahead of the monetary meeting next week, European Central Bank President Christine Lagarde reinstated that the Bank will continue the fight against inflation, to prevent the high inflation from being entrenched. The latest European economic data leans positive, Eurozone consumer confidence was -20.9 in January, which slightly missed market expectations. January PMIs on the other hand beat estimates, services PMI in particular returned to the expansion zone for the first time since August. The German IFO business climate index in January met expectations, further improving from the December figure. Next week, Europe will be releasing the latest Q4 GDP figures, as well as CPI data for January, both the ECB and the Bank of England will also hold their first monetary meetings in 2023. At the time of writing, Bloomberg interest rate futures show that markets are pricing in a 50 bps hike from the ECB, while there is also a high chance for the BOE to hike 50 bps as well.

China

China

The Chinese equity market is closed for the week in observance of the New Year, while the Hong Kong equity market had a great start to the year of rabbit, gaining 2.92 % over the past 2 days ending Friday. With the pivot in COVID policy, China is starting its return to normalcy. Travel and tourist over during the New Year holidays surged, visitors to Macau grew by more than 300%, online travel agency trip.com reported that travel and ticket demand this year has surpassed comparable figures in 2019. The Ministry of Transport estimated that 2.1 billion trips will be taken this year, which will be double of that of 2022. Box office sales also surpassed 2022 figures as of Friday morning, reaching 6.2 billion yuan, hinting at some recovery in Chinese consumption. Next week, China will be releasing more economic data, including NBS official manufacturing and non-manufacturing PMIs for January, Caxin manufacturing and services PMIs for January, and industrial profits data for December.