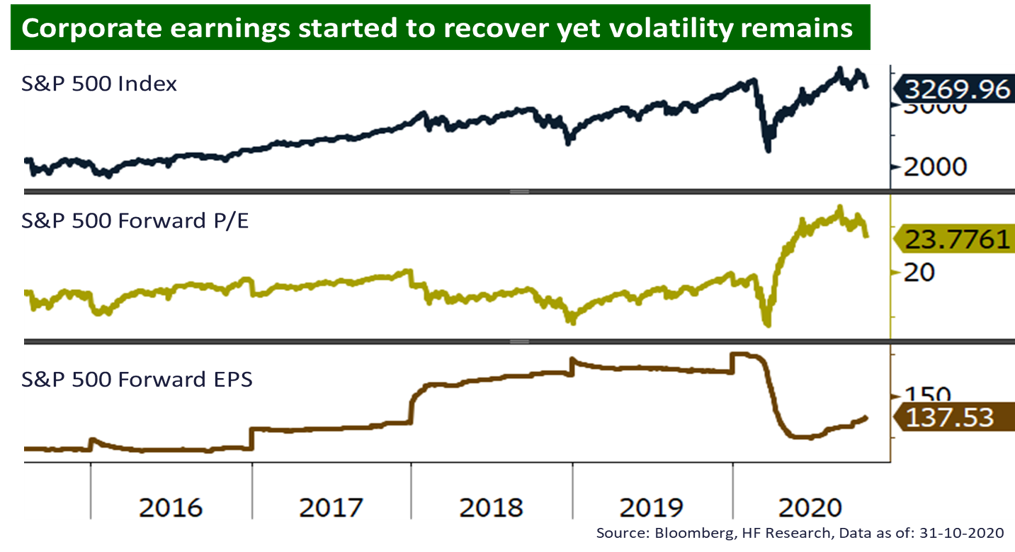

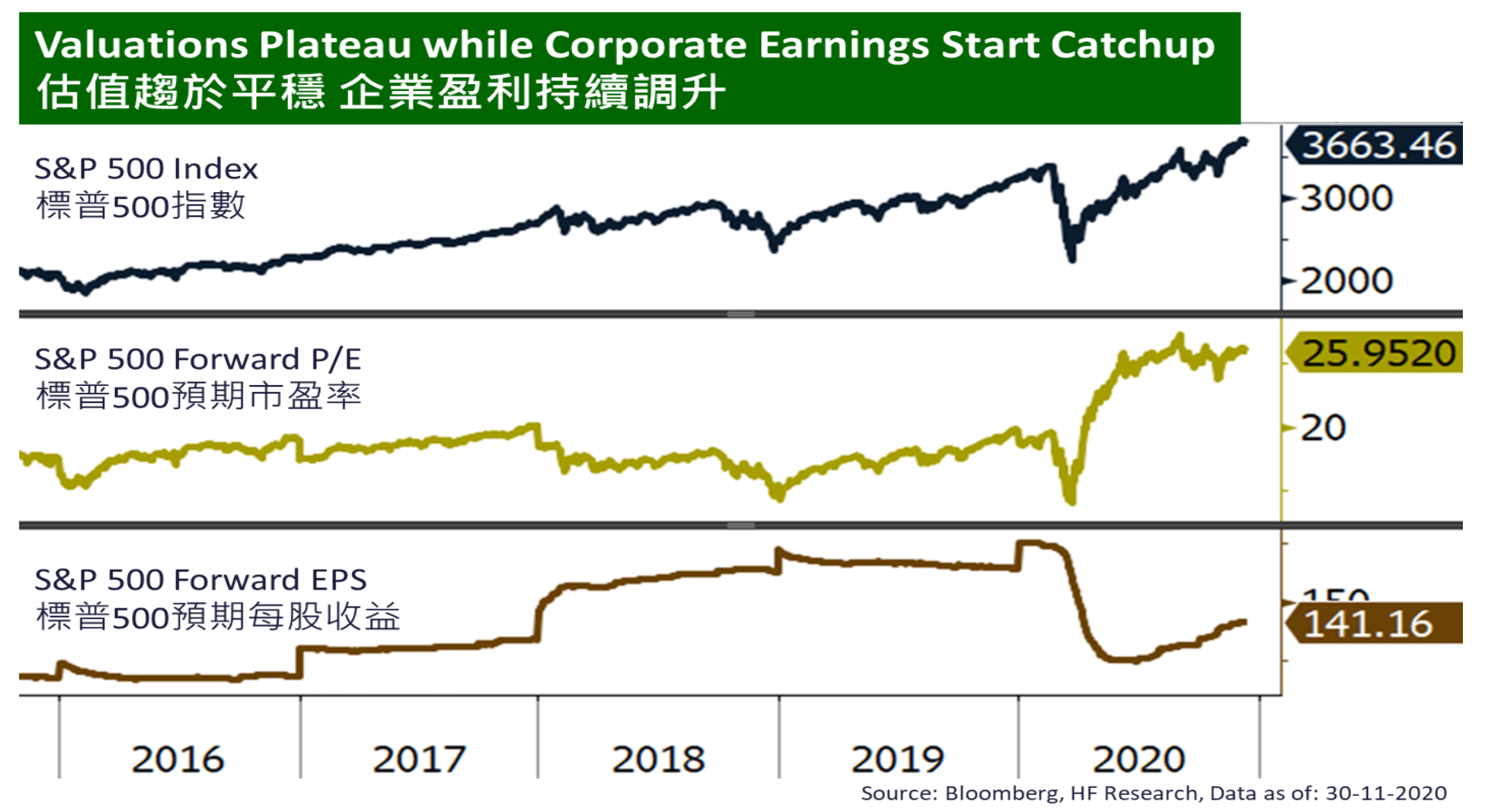

Straight off the start of the month, the US equity markets staged an unbelievable rally. Election uncertainties dissipated early on, fuelling market optimism based on anticipated clarity in policy direction. Equities saw further boost from vaccine breakthroughs, which boosted traditional economy sectors as investors grew more optimistic on a return to normal, the S&P 500, Dow Jones, and NASDAQ gained 10.75%, 11.84%, and 11.80% in November respectively.

Biden is essentially announced the winner of the election, Trump has also announced the official commencement of the transition procedure, signalling an end to the whole post-election fiasco. While the Democrats have control over both the Presidency and House of Representatives, if the Republicans win at least one of the seats in the Georgia Senate run-off, they will maintain control over the Senate. This would likely block the more radical policies from the Biden administration, which should be positive for the overall market.

Moving on, the focus is gradually shifted back to the economy, market sees improvement in the outlook with a number of vaccine leads showing breakthrough. However, questions still remain regarding potential mid to long-term side effects, the actual rate of production, and potential resistance from the anti-vax community, these could pose as obstacles to a speedy full reopen. With the current valuations at a higher level, investors should stay cautious and selective, choosing quality names that doesn’t only focus on the impulse of economic reopen, but rather has a larger growth potential.

US

US Europe

Europe China

China