US

US

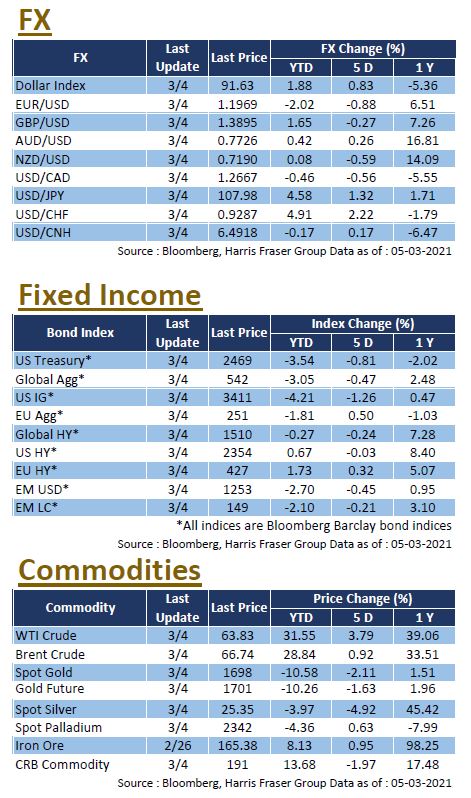

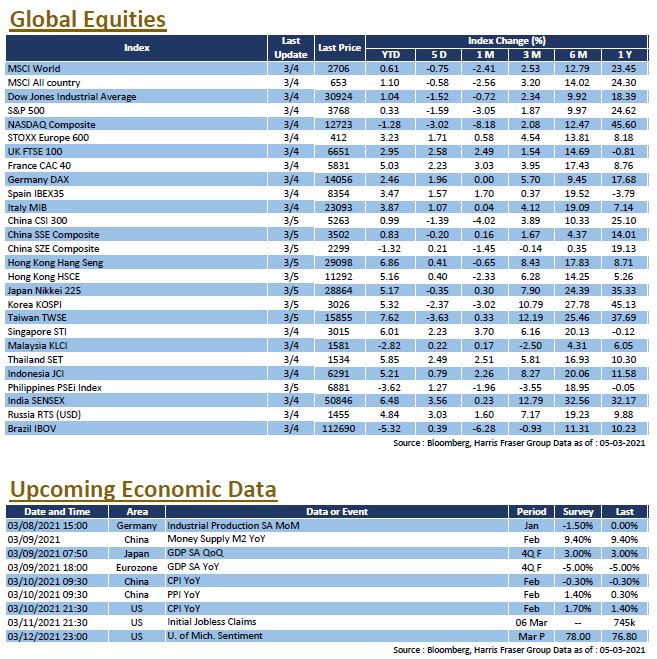

Continuing the recent trend, US treasury yields went up again on Thursday, climbing as high as 1.57%. In turn, equity markets reacted to the spike with yet another correction, the S&P 500 and the Dow recorded losses of over 1.5% over the past 5 days ending Thursday, while the NASDAQ saw a larger correction of over 3%, bringing the YTD performance into negative territory once again. Fed chair Jerome Powell earlier mentioned that the inflation is still far from the Fed target level, and the lack of full employment in the US necessitates the loose monetary policy in the near future. As a result of his remarks, yields shot up, causing spot gold to briefly fall below USD 1,690 per oz, while the Dollar index rose 0.83% over the past 5 days ending Thursday. As for the fiscal side of things, the Senate is expected to pass the stimulus bill soon, which could boost the somewhat struggling economy. In other news, OPEC+ decided to keep the current production cuts intact after the meeting on Thursday, Saudi Arabia also promised to keep her voluntary 1 million bpd cut in place. Crude prices jumped as a result, WTI futures rose over the USD 64/barrel mark. Next week, fresh data on CPI, Michigan Consumer Sentiment, and jobless claims will be in focus, possibly giving investors a better picture on the US economy.

Europe

Europe

European stocks performed better this week as sentiment in the region seems to be insulated from the surge in US Treasury yields. Individual equity indexes was mixed bag, German equities led the way with a 1.28% gain over the past 5 days ending Thursday, while the UK FTSE slightly lost 0.02% over the same period. Traditionally, the steepening of the yield curve actually hints at an improving economy, cyclicals such as European financials could likely benefit from the trend. Epidemic wise, vaccination progress in the Eurozone still lags behind other developed countries such as the UK and the US, investors could follow that closely if this could potentially undermine future economic recovery. As for the economy, manufacturing data in the region remain strong, but the weak retail sales and services PMI figures hints at potential weakness. Next week, the ECB will hold another interest rate meeting. Considering the situation of the current economy, market expects no changes to the loose monetary policies. Europe will also release data on industrial production, German CPI, and Eurozone GDP.

China

China

The US equity market correction continue to have ripple effects across the globe, the selloff in the more expensive tech stocks extended to Chinese and Hong Kong markets. We saw more profit taking in the new economy sector, the overall market however saw relatively limited correction. Over the week, the CSI 300 were down more than 1%, the Hang Seng Index edged slightly higher, while the Hang Seng Tech Index lost more than 3%. The national ‘Two Sessions’ have commenced on Thursday, the largest takeaways up till now is the target economic growth of 6% this year, which is close to our estimates at the beginning of the year; and carbon reduction shall be a national policy direction, considering the targets of reaching peak carbon by 2030 and carbon neutrality by 2060, his should continue to benefit relevant sectors, with electric vehicles and clean energy sectors being the largest likely beneficiaries. Next week, China will announce the latest medium-term lending facility (MLF) rates, and release figures for money market M2, CPI, and PPI.

US

US Europe

Europe China

China