US

US

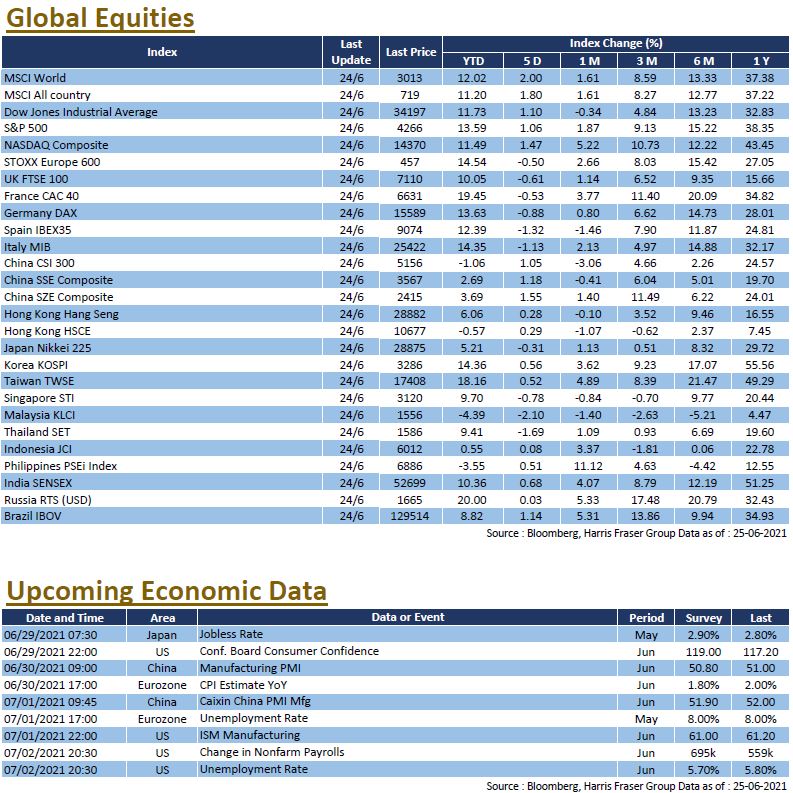

US stocks continued to reach new highs as President Joe Biden and a bipartisan group of Senators reached a preliminary agreement on a US$579 billion infrastructure plan that, if implemented, could bring further support to the recovering US economy, this helped boost the US equity markets to new record highs. Over the past 5 days ending Thursday, the three major US stock indices gained between 1.06% and 1.47%. US Senate Majority Leader Schumer hoped that the Senate would consider the bipartisan infrastructure bill so that the plan could be finalised this summer.

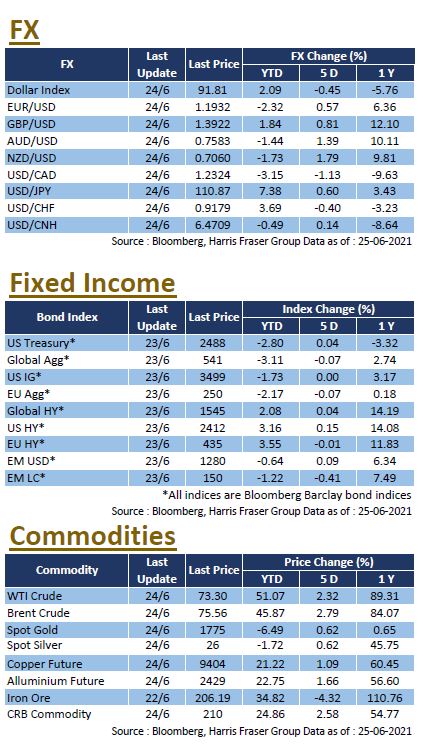

The US economy remains strong, with durable orders increasing in May by the largest amount since January this year, the Markit manufacturing PMI continued to reach a record high in June, although the service PMI slowed. Behind the strength of the economy, the market is worried about rampant inflation and the risk of interest rate hikes, with the Chairmen of the Dallas and Atlanta Feds both saying they expect interest rate hikes to begin next year, while hinting that a reduction in quantitative easing could start in the next few months. On the epidemic front, the Centre for Disease Control and Prevention (CDC) said the Delta variant is spreading rapidly and now accounts for one-fifth of all new cases in the US. The market is concerned whether the strong data from the US will continue, the ISM manufacturing PMI, consumer confidence index and unemployment rate releasing next week will likely give colour to the matter.

Europe

Europe

European stocks underperformed against the rest of the world, with the UK, French, and German equity markets falling between 0.53% and 0.58% respectively over the past 5 days ending Thursday. The Bank of England kept its monetary policy unchanged after the latest interest rate meeting and raised its inflation forecast, but stated that the surge in inflation was only transitory. Eurozone data suggest that the economy is still in recovery, with ECB vice-president Luis de Guindos expecting "significant" economic growth in the second half of the year. Isabel Schnabel, another member of the central bank's executive committee, also stated that the bank would do its utmost to support the economic recovery on the monetary policy front, while warning regional governments against a premature tightening of fiscal support. Next week, the Eurozone will release unemployment and inflation figures, with the unemployment rate expected to remain unchanged and the inflation pace slowing YoY.

China

China

Chinese stock markets have seen heightened activity, the CSI 300 Index rose 2.69% over the week, posting its fourth consecutive day of gains, while turnover in both Shanghai and Shenzhen stock exchanges topped RMB1 trillion on both Thursday and Friday; whilst Hong Kong markets were buoyed by optimism in the A-share market, with the HSI rising 1.67% over the same period. On the data front, the profit growth of Chinese state-owned enterprises accelerated, with the total profit of state-owned and state-controlled enterprises in the first five months of this year amounting to RMB179.39 billion, equating to an increase of 1.7 times YoY. On the other hand, the People's Bank of China and four other ministries jointly launched fee reduction measures to provide continued support to the real economy, which are expected to reduce the total amount of handling fees by approximately RMB24 billion. Next week, China will release the official manufacturing PMI and Caixin PMIs.

08 July 2021

08 July 2021  19:00 - 20:00

19:00 - 20:00 香港中環雲咸街8號7樓全層 (敬請預約)

香港中環雲咸街8號7樓全層 (敬請預約)

US

US Europe

Europe China

China