US

US

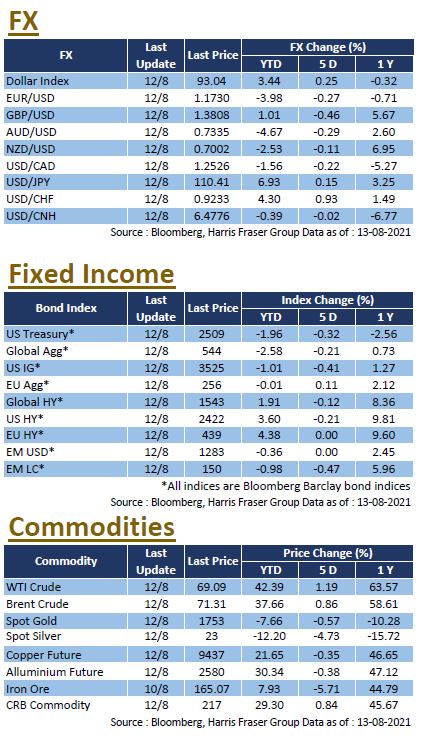

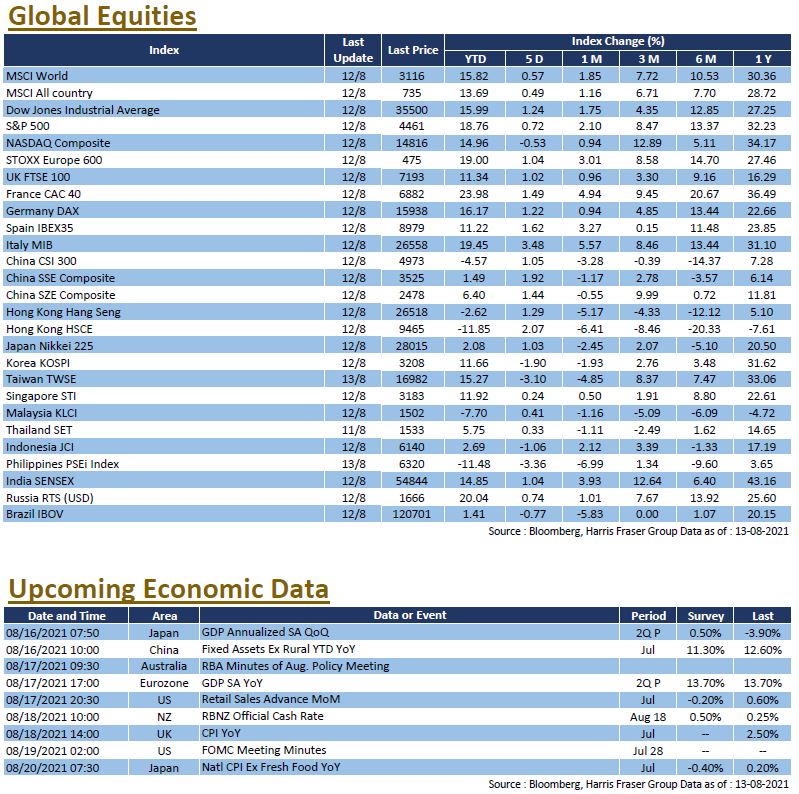

A slowdown in US inflation data eased concerns over an earlier tapering of asset purchases, and the Senate's approval of the US$ 550 billion infrastructure bill boosted market sentiment. The S&P and Dow hit new highs, up 0.72% and 1.24% respectively over the past five days ending Thursday. The US Consumer Price Index (CPI) rose by 0.5% MoM in July, easing from 0.9% in June. The core CPI, which excludes food and energy prices, also slowed to 0.3% MoM in July, down from 0.9% in the previous month, the softening data eased market fears of an earlier tightening of monetary policy. Earlier, following the release of strong US employment data, both the Kansas City and Richmond Fed Presidents suggested that the conditions for tapering would be met soon.

The US Senate passed the $3.5 trillion budget package and the $550 billion infrastructure bill, which may pave the way for President Joe Biden's future economic policies, whilst boosting the reflation trade, the 10-year US Treasury yield briefly hit the 1.377% level. The annual meeting of global central bankers at Jackson Hole will be held between 26-28 August this year, and the market will be watching for any major monetary policy announcements at the event. Next week, the US will release retail sales data for July and the minutes of Fed’s July interest rate meeting.

Europe

Europe

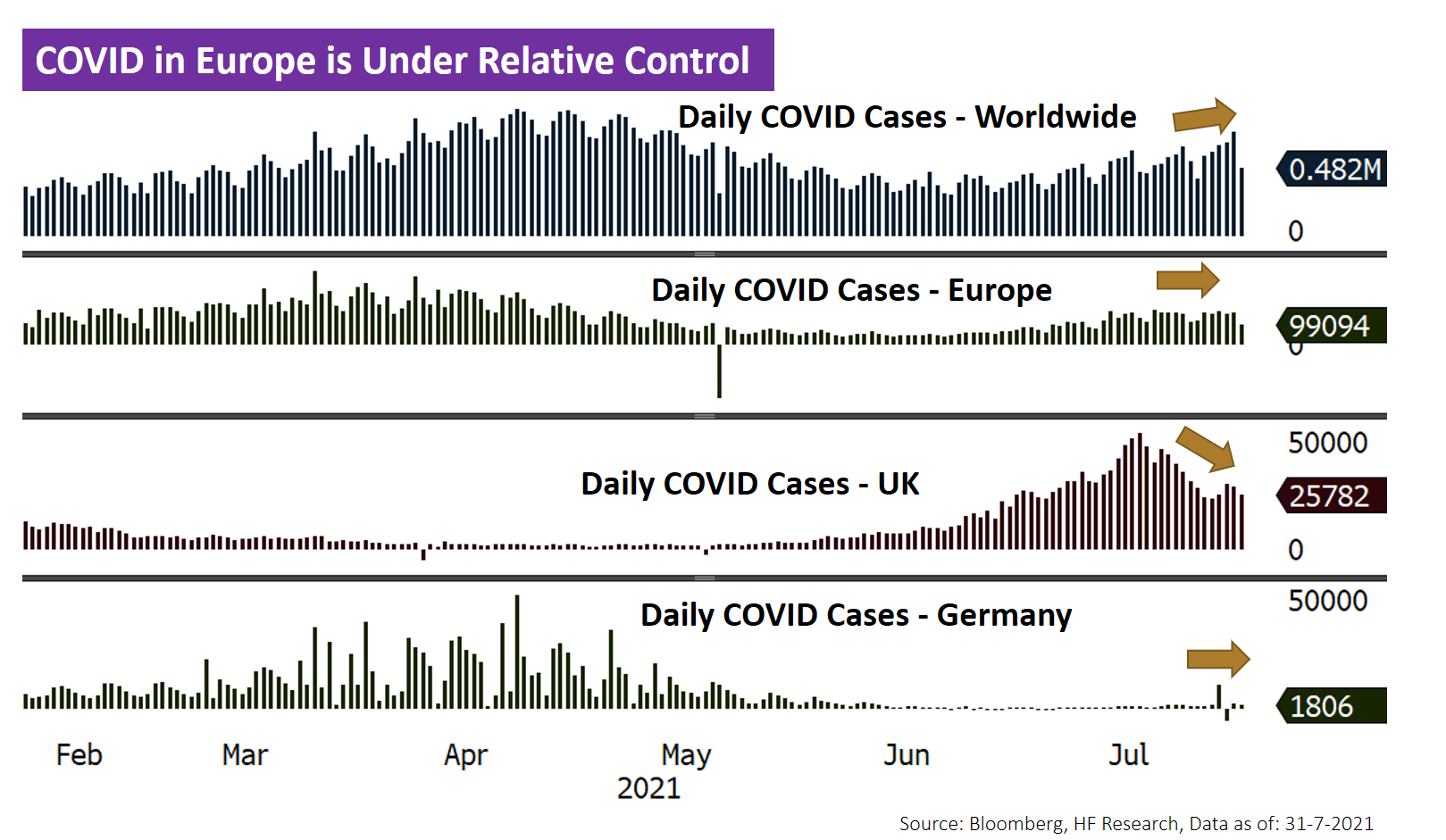

European stocks performed well, with the UK, French, and German equities gaining between 0.96% and 1.12% over the past five days ending Thursday. The UK announced its preliminary GDP growth of 22.2% YoY for 2021 Q2, which was a reversal of the 6.1% contraction seen in Q1. The Eurozone CPI rose by 2.2% YoY in July, surpassing market expectations of 2.0%. Bundesbank President and ECB Governing Council member Jens Weidmann said he would keep a close eye on the threat of elevated inflation. Next week, the Eurozone will announce the revised GDP for the 2021 Q2 and the market expects the YoY figure to remain unchanged at 13.7%.

China

China

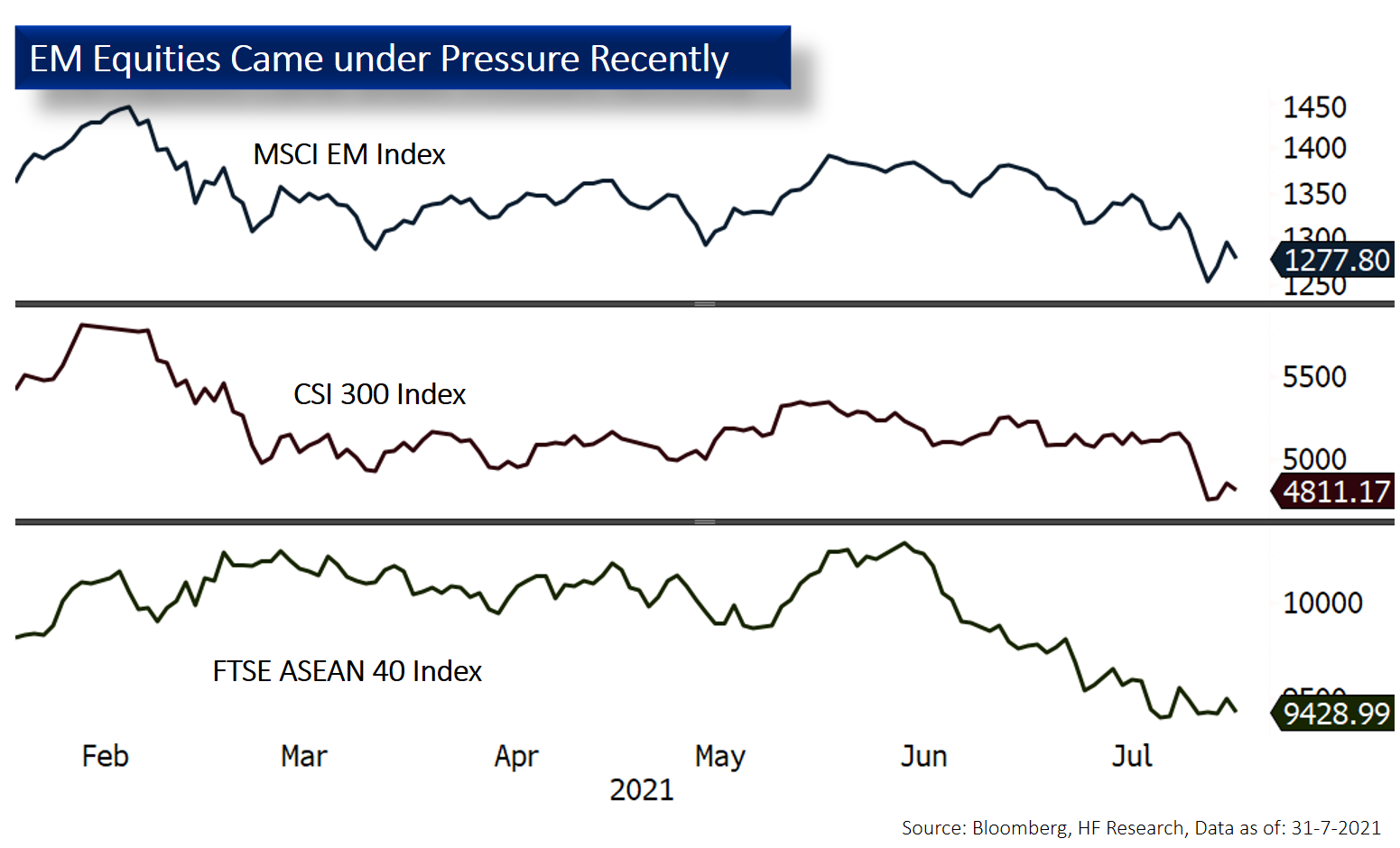

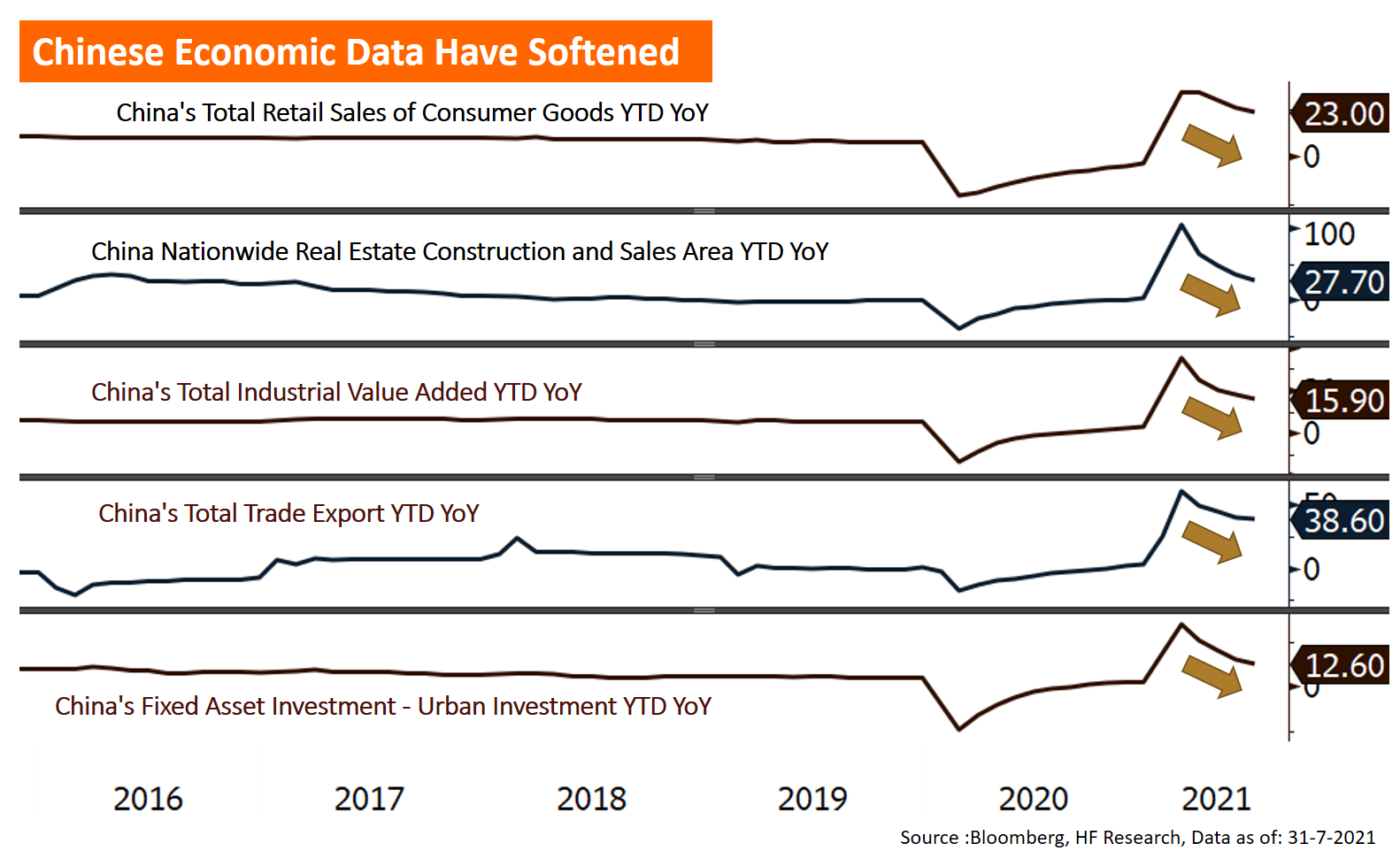

Although the market is still digesting the latest regulatory signals from Chinese authorities, the Hong Kong and Chinese stock markets have rebounded this week after the recent sharp correction, Hang Seng Index rebounded 0.81% over the week and CSI 300 Index was 0.50% higher. China's total social financing and new RMB loans in July both fell short of market expectations and were lower than the previous value, suggesting that the domestic economy could be slowing down. In addition, the China Banking Regulatory Commission announced that it would step up oversight of insurance technology platforms, triggering a sharp fall in related equities. The State Council announced the implementation framework for the next five years, stating that it will step up monitoring of key areas such as food, pharmaceuticals, as well as education and training. The market will be watching the impact of the national policy on different sectors. Next week, China will release key economic data on industrial production, retail sales, and fixed investment.

US

US Europe

Europe China

China