US

US

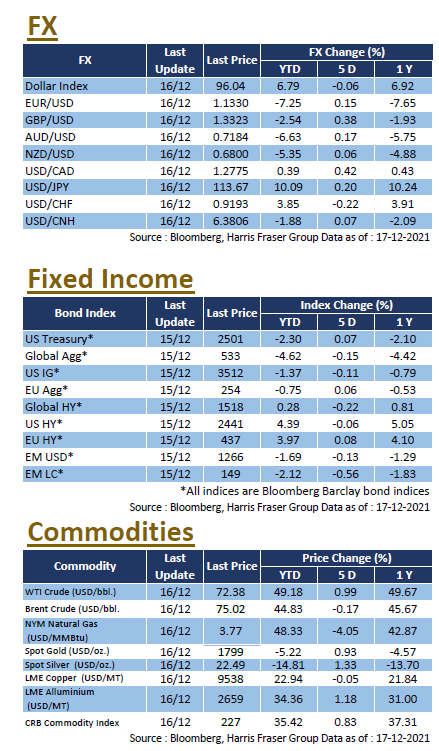

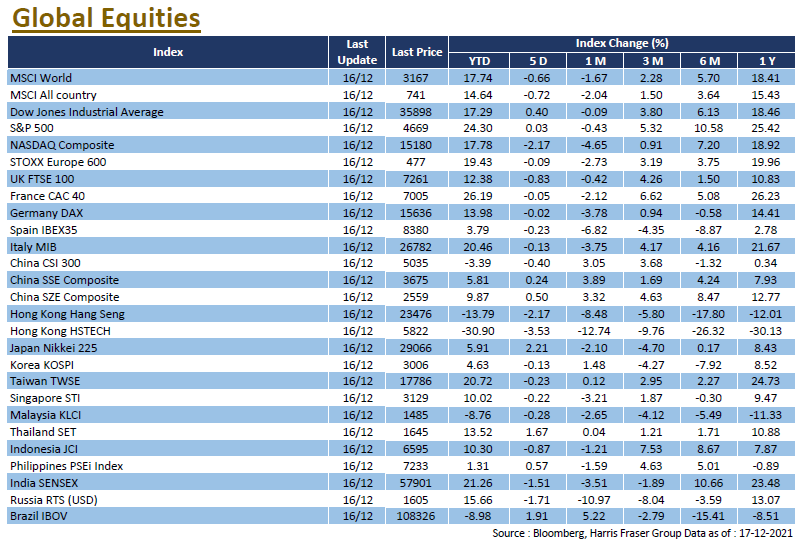

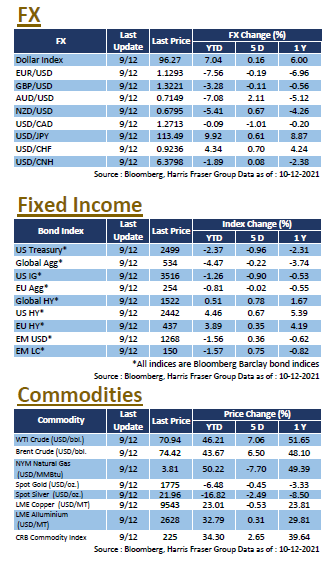

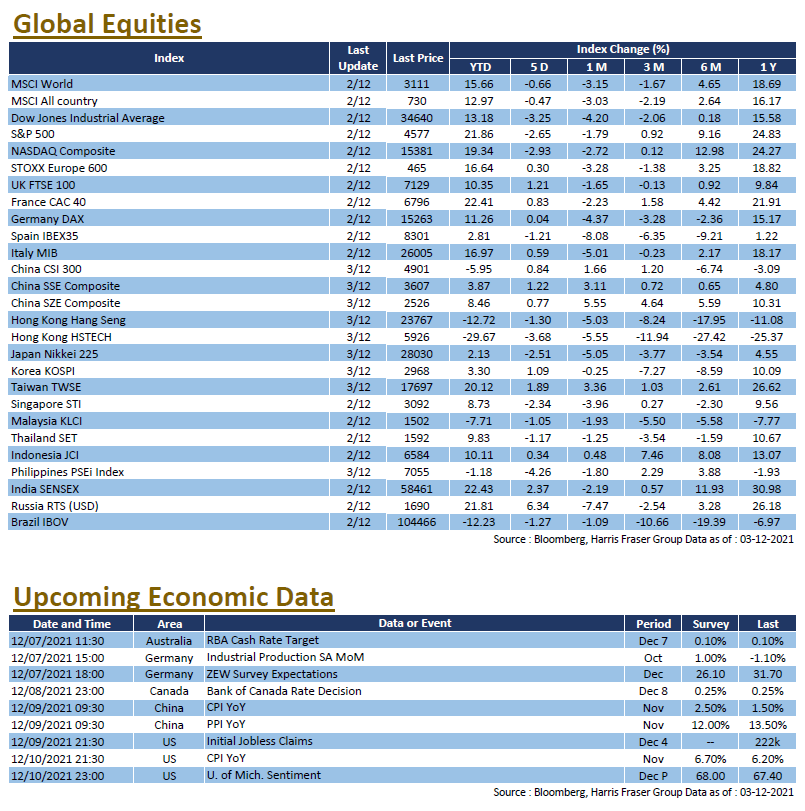

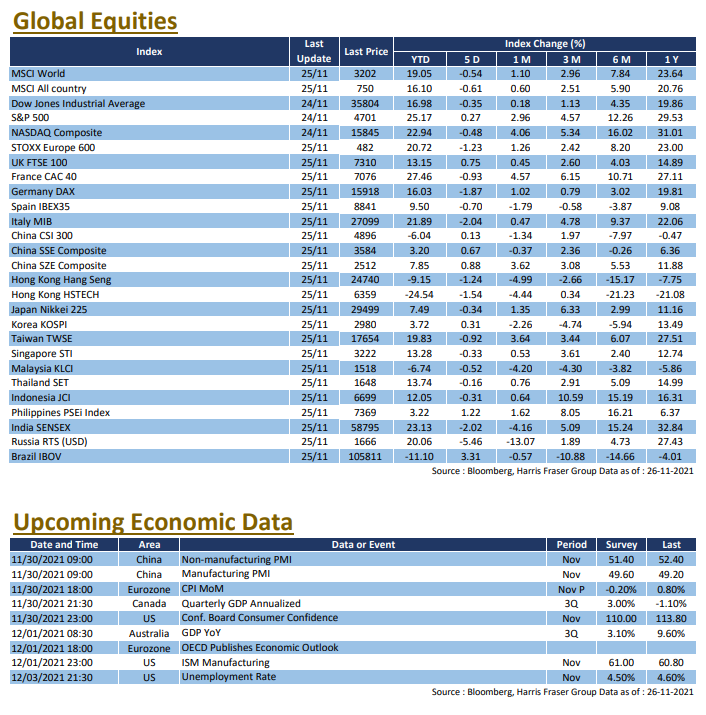

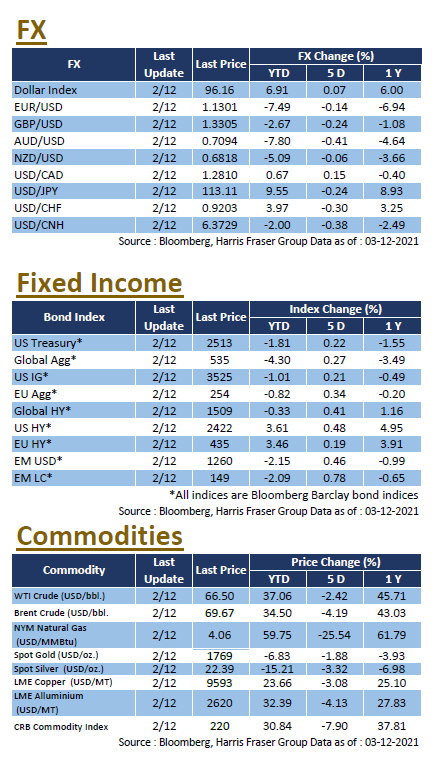

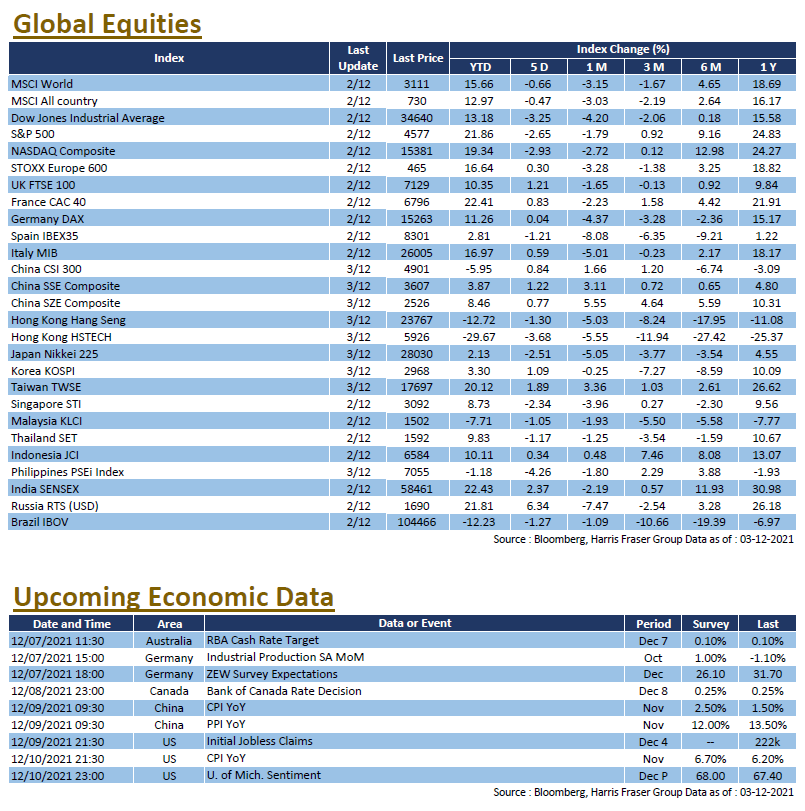

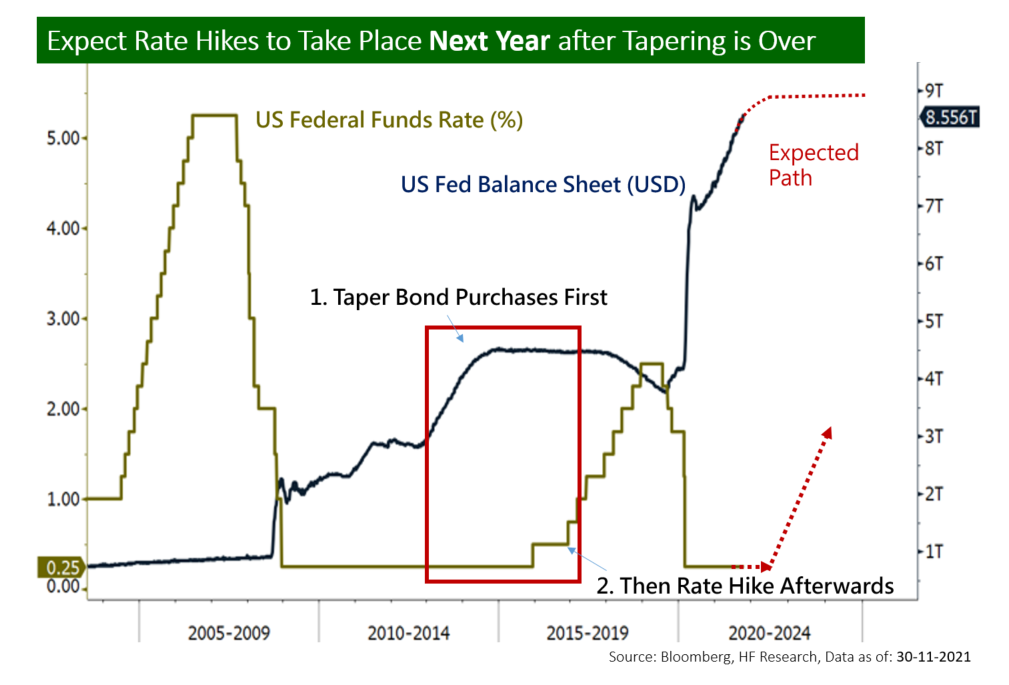

Increased uncertainty affected market sentiment, dragging US equities lower over the week. Over the past 5 days ending Thursday, the 3 major US equity indices lost 2.65-3.25%. US Fed President Jerome Powell mentioned that faster tapering would be discussed in the December Fed meeting, stating that it is appropriate considering the current inflationary and economic circumstances, other Fed members have also echoed Powell’s sentiment. Markets are pricing in the possibilities of a faster taper and earlier rate hikes, at the time of writing, Bloomberg interest rate futures is showing a 99.5% chance of the first rate hike in June 2022.

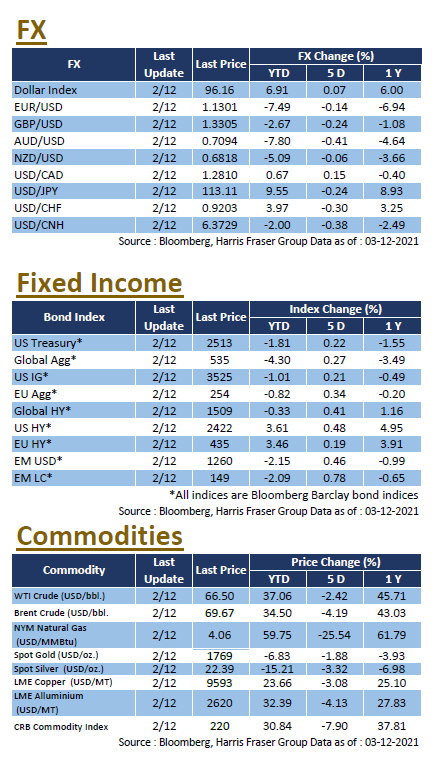

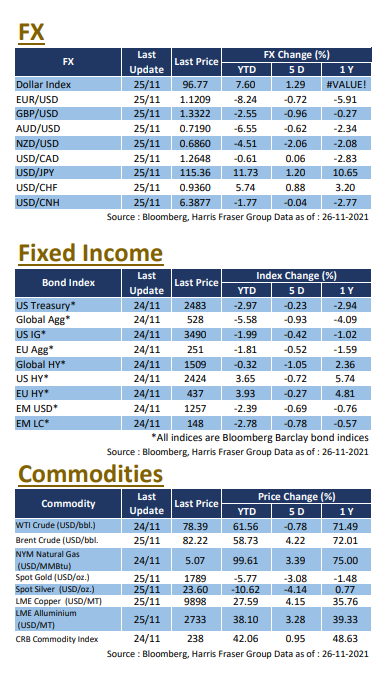

The resurgence of the COVID pandemic is the other major source of uncertainty. While there is insufficient data on the Omicron variant, global governments have taken a conservative approach, with border closures and lockdown measure re-enacted in several countries. In the US, the government shutdown was avoided as the Senate passed the stopgap bill on Thursday, which should keep the US government running until February next year. In other news, OPEC+ surprisingly announced no changes to their planned output increase. Next week, the US will be releasing important data including initial jobless claims, CPI figures, and University of Michigan sentiment index.

Europe

Europe

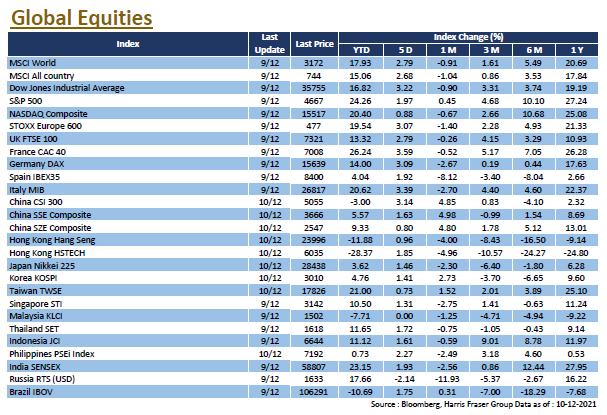

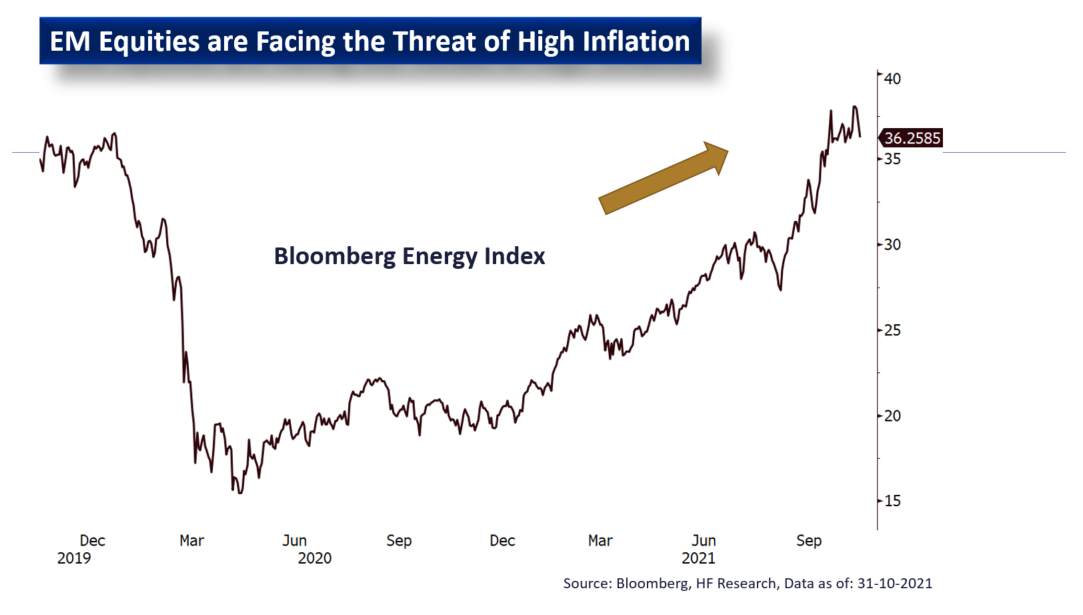

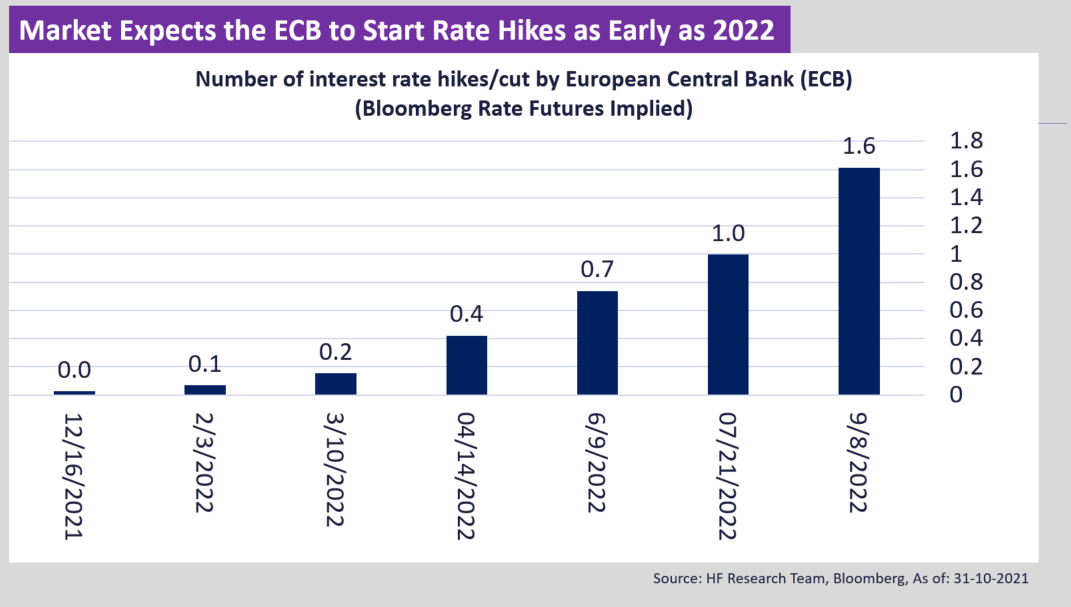

Similar to the rest of the world, the European market sentiment was hit by the rise of the new Omicron variant, countries in Europe exercised extra caution in response, as the pandemic in Europe was already worsening over the past weeks. Over the past 5 days ending Thursday, equity indices in the UK, France, and Germany lost 2.48-4.11%. The resurgence of COVID in Europe began earlier, and the latest discovery of the Omicron variant resulted in increased uncertainty in the outlook, several countries have tightened restrictions in response. As for the latest economic data, inflation remains as one of the forefront issues. The latest Eurozone CPI have exceeded expectations and hit 4.9% YoY, which is the highest reading since 1991. Markets are looking at the ECB if they would change their inflationary outlook, which could provide clues to the future tightening timeline. Next week, Germany will release their industrial production figures and the ZEW economic sentiment index.

China

China

Local markets have largely priced in the fear of the new COVID variant, the China A-share markets defied global trends, with the CSI 300 index gaining 0.84% over the week; the Hang Seng index on the other hand was dragged down by the Chinese tech heavyweights, falling 1.30% over the same period. The Chinese tech sector which came under fresh pressure as the US SEC announced new rules regarding audit requirements for foreign stocks, DiDi is reportedly preparing for its delisting from the US stock exchange and move to Hong Kong. The debt crisis in the Chinese real estate market continues, Kaisa Group’s proposal to extend the bond maturity failed, risking potential default. On the economic data front, PMIs were a mixed bag, as both Caixin PMIs missed market expectations, while the official manufacturing PMI managed to return above the 50 level. Next week, China will release both the CPI and PPI figures for November.

US

US Europe

Europe China

China