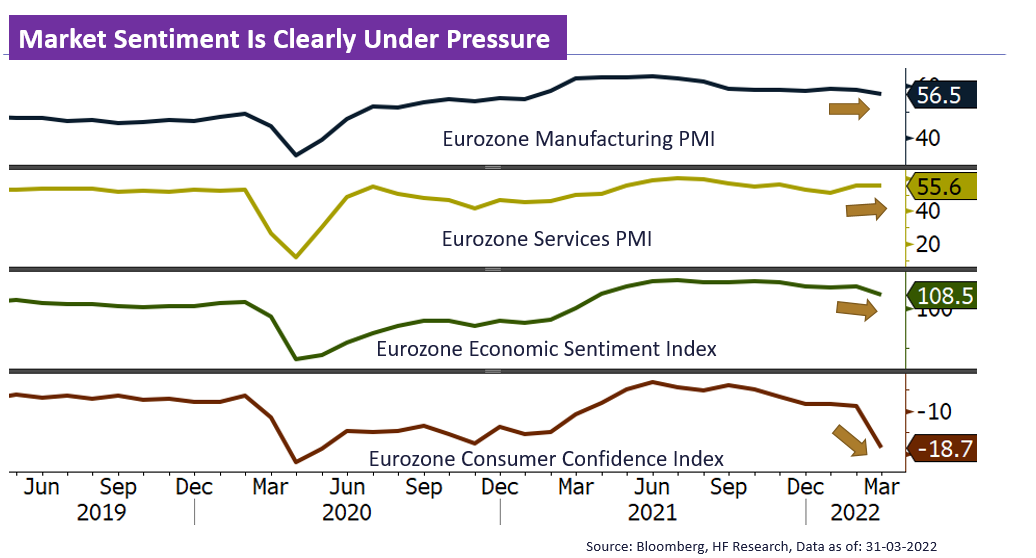

While European markets did manage to slightly bounce back, existing headwinds didn’t really dissipate. Although the Russo-Ukrainian conflict is mostly priced in earlier, the market sentiment is still marred by the high inflation, geopolitical tensions, and concerns over the economy. Over the month of March, STOXX 600 index only edged 0.61% higher (-0.50% in US$ terms) higher.

Regarding the Ukrainian conflict, unless the highly unlikely event of a full blown war actually takes place, we do not expect further deterioration in the situation, and the majority of downside risks have likely been priced in. Instead, we see risks arising from the fallout of the conflict, namely sanctions and disruptions to the supply chain. Russian and Ukrainian exports have drastically reduced, European supply of key commodities reduced significantly, contributing to the surge in inflation, which will be the next focus of attention. The latest Eurozone CPI was 7.5% YoY, which was a new record.

To reign in the problem, the ECB is poised to tighten its monetary policy, and market is already pricing in 5 rate hikes before the end of the year. With monetary policies shifting from a highly accommodative one to a tight one, equity valuations would likely remain under pressure. And with the economy is still affected by the weaker sentiment due to the ongoing conflict, as well as the sky high inflation, German think tank have warned that the region could enter technical recession. With a less optimistic outlook, we remain slightly negative on the European equities in the short to medium term.