Weekly Insight March 4

US

US

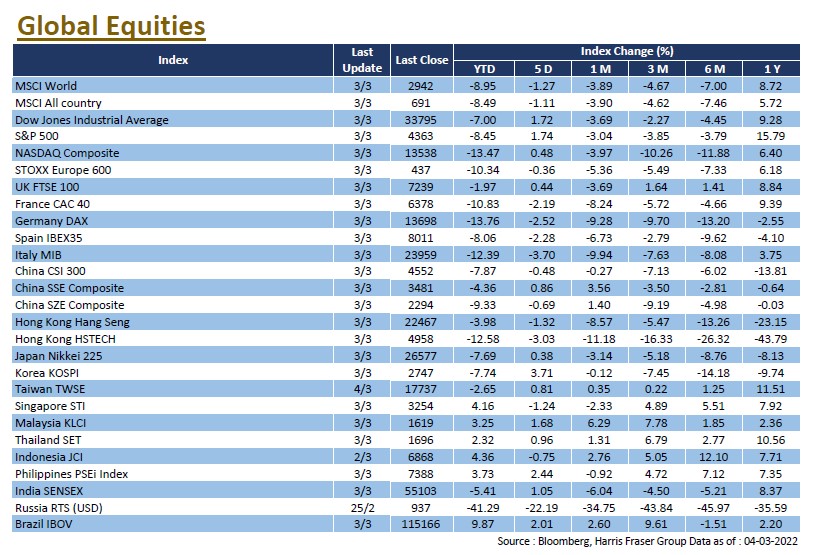

The war between Russia and Ukraine continued into the second week, the Russian offensive showed no sign of slowing down, and there was no visible progress in the ceasefire negotiations. However, market expects rate hikes from the US Federal Reserve to be milder, fuelling a rally in the US stock market, as the three major indices rose by between 0.48% and 1.74% over the past five days ending Thursday. Despite greater gains in the south, Russian forces are making slow progress in northern Ukraine. The two sides have now reached an agreement in the second round of talks on the evacuation of civilians and other issues, and will continue to negotiate.

During this period, many Western countries have stepped up their sanctions against Russia, with the White House announcing a ban on US individuals and companies from doing business with the Russian central bank, the Russian National Wealth Fund, and its Ministry of Finance. The EU has reportedly agreed to ban seven Russian banks from using SWIFT, but the number one bank Sberbank and Gazprombank are off the hook for the time being.

US Federal Reserve Chairman Jerome Powell expressed support for a 25 basis point rate hike in March and remained open to a 50 basis point hike in the future, noting that the US economy was strong enough to withstand a faster pace in rate hikes. However, he reiterated that the Russian invasion of Ukraine has created both inflationary and economic risks, suggesting that the Fed would take a "cautious" approach when raising interest rates. Next week, US will release CPI data and the University of Michigan market sentiment.

Europe

Europe

The Russo-Ukrainian conflict continues, rising oil prices, and increased Western economic sanctions against Russia are three factors weighing on the European economic outlook, with European equities underperforming the rest of the world. Over the past five days ending Thursday, the UK, France, and German indices fell between 3.35% and 5.96%. The ECB's chief economist said the central bank is closely monitoring the economic impact of the Russo-Ukrainian war and will use all necessary measures to support the economy when the situation becomes clearer. According to the latest ECB meeting minutes, officials believe that the geopolitical situation increases inflationary pressure, and that if the surge in energy prices continues, inflation will surpass expectations in the coming months. The ECB will hold an interest rate meeting on 10th March.

China

China

On Friday, reports of explosions near Europe's largest nuclear power station raised fears of an escalating war, Asian stocks were down for the day, the Hang Seng Index fell 2.5% on Friday, extending its weekly loss to 3.79%; the Hang Seng Technology Index fell 7.33% over the week, while the CSI 300 Index also shed 1.68% over the week. China's official manufacturing and non-manufacturing indices both improved in February compared to the previous month. Sectors such as oil and resource companies gained on the back of higher energy and raw material prices. Next week, China will release CPI and PPI figures for February.