Weekly Insight March 11

US

US

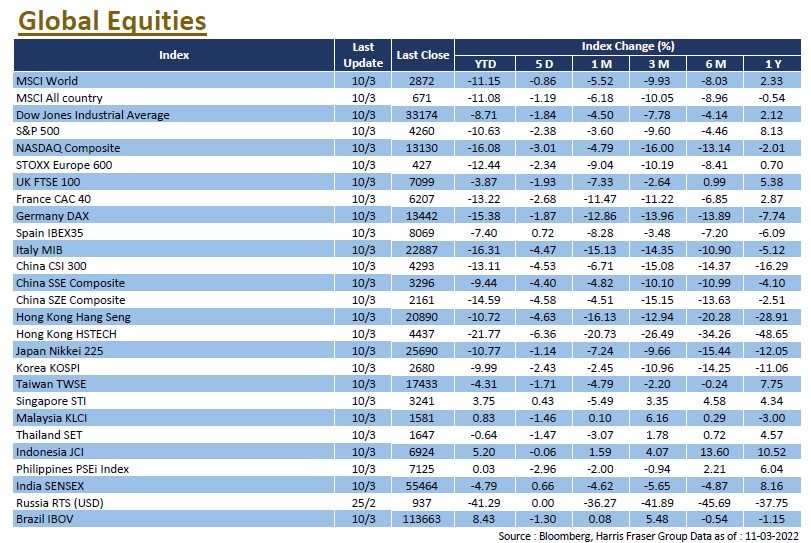

The rebound in the global stock market was initially strong when Ukrainian President Volodymyr Zelenskyy said he would not insist on joining NATO, but then the lack of significant progress in the Russo-Ukrainian talks, coupled with the continued high energy prices and the heightened fears of an impending recession in the US, weighed on the US stock market, with the Dow, S&P, and Nasdaq falling between 1.84% and 3.01% over the past 5 days ending Thursday. As for the ongoing conflict, the Russian army is still stepping up its attacks on the Ukrainian capital Kiev, no substantive consensus has been reached in the foreign ministerial talks between the two, and the sanctions imposed by the West on the Russian side are still in place.

While the situation in Ukraine and Russia is still ongoing, worries about the US economic outlook are mounting as the US Federal Reserve's rate hike expectations for March have markedly cooled. According to Bloomberg interest rate futures data, the expected rate hike in March has been reduced to 25 basis points from 50 basis points, possibly suggesting that the escalation in the Russo-Ukraine situation is considered a constraint on the Fed's policy tightening. As a reference, the 10/2 year US Treasury spread, which has been an accurate predictor of US recessions in the past, has now fallen to a lower level of around 28 basis points, which may mean that the US could soon be at risk of another recession. The US Federal Reserve will meet on 16th March and the market is already expecting one rate hike. The focus will be on the post-meeting statement and Chairman Jerome Powell's comments on inflation and tapering. The retail sales data for February will also be released next week.

Europe

Europe

Although European stocks briefly rebounded as the situation in Russia and Ukraine eased, the region still posted losses over the past five days ending Thursday, with the UK, French, and German equities posting cumulative losses ranging from 1.87% to 2.68%. The European Central Bank kept interest rates unchanged after its interest rate meeting, but unexpectedly announced an accelerated exit from their accommodative policy. President Christine Lagarde said that with inflation expected to rise further and the economic environment highly uncertain, asset purchases would cease by the third quarter of the year unless the medium-term outlook has changed. Markets will continue to monitor the central bank policy and the European economy, while Germany will release data including the ZEW economic sentiment index next week.

China

China

In addition to the continued escalation of the Russo-Ukraine situation, China stocks listed in Hong Kong and the US were further weighed down by US regulatory news, which saw the Hang Seng Index testing the 20,000 level again, while the China A-share market remained weak over the past week. The SEC released a list of five Chinese companies during US market hours on Thursday, stating that these companies would be required to provide evidence to refute the decision to delist, triggering a sharp drop of the China concept stocks in the US market, which later extended to the same segment in the Hong Kong stock market. As for the two sessions, Premier Li Keqiang said in response to a reporter's question that China's economy had grown to more than RMB110 trillion last year, and that the current growth was on top of a high base, and that it would be a big challenge for such a huge economy to maintain a medium-to-high speed of growth. Next week, China will be releasing key figures on fixed investment, industrial production, and retail sales in February.