Weekly Insight May 6

US

US

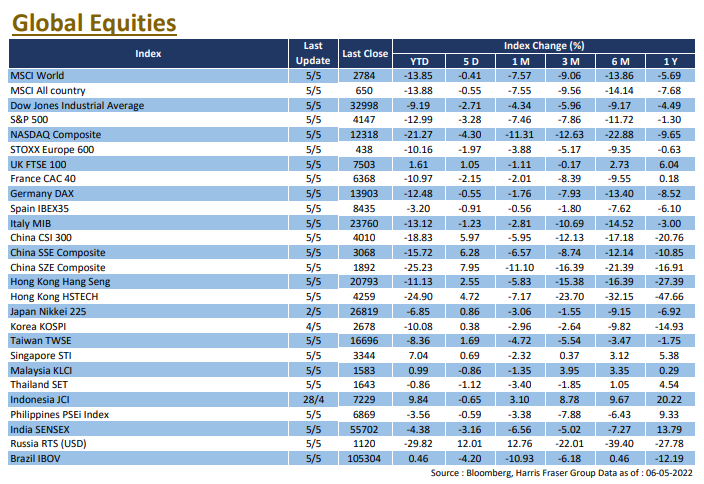

The US stock market had a dramatic turn of events, with the S&P 500 Index rallying nearly 3% on the very day Fed announced a 50 bps rate hike, only to fall 3.56% in the subsequent session, wiping out all the gains made the day before. On Wednesday, the Fed announced a 50 bps rate hike in one go, the first in over 20 years. The Fed also announced that it would start reducing its balance sheet from 1 June onwards, with a size of US$47.5 billion per month at the start, and ramping up to US$95 billion three months later. Chairman Jerome Powell also refuted that a 75 bps rate hike is not on the table in the near future. According to Bloomberg data, the G7 central banks may reduce their balance sheets by a total of US$410 billion over the course of the year.

In the US, the ISM Manufacturing Index fell to 55.4 in April from 57.1 in the previous month, the lowest since 2020; The ISM Services Index also fell from 58.3 to 57.1 over the same period. Meanwhile, job openings rose unexpectedly to a record high of 11.549 million in March, while the number of resignations also reached a record high, suggesting that employers are still having difficulty recruiting staff, reflecting the continuing severity of labour shortage. On the other hand, the US corporate earnings season is coming to an end. Of the 432 reporting S&P 500 index constituents, 78.6% of them reported market beats, but only 68.2% recorded YoY earnings growth, while 30% of them reported a drop in earnings, with the financial sector being the worst sector at 55.7%. Next week, the US will release CPI figures for April and Michigan market sentiment for May.

Europe

Europe

European stocks followed the US market and were under pressure, with UK, French and German stocks falling 0.08%, 2.53%, and 1.39% respectively over the past five days ending Thursday. The Bank of England raised interest rates by 25 bps to 1% as expected, but the Bank warned that the risk of recession had increased, stating that the country's GDP is expected to contract in 2022 Q4. Olli Rehn of the ECB's Governing Council said that the ECB should start raising interest rates by 0.25% in July this year and gradually normalise interest rates. Next week, the Sentix Investor Confidence Index for May will be released.

China

China

Due to the domestic pandemic situation and external factors such as the US rate hikes, Hong Kong and Chinese equities were weaker, with the CSI 300 Index falling 2.67% in the two trading days after the Labour Day holidays, while the HSI lost 5.16% in the four trading days this week. In terms of exchange rates, the US/CNY hit a high of 6.69, briefly approaching the 6.7 level, whereas the Hong Kong dollar also closed in to the 7.85 guaranteed limit. In other news, Hong Kong announced a 4.0% YoY contraction in GDP in 2022 Q1, which was worse than the market expected 1.3% decline. Next week, China will release CPI and export data for April.