The US market saw some wild swings towards the end of February, as tensions in Ukraine mounted. Prospects of inflation staying higher for longer further hit market sentiment. US equities remained under pressure, the Dow, S&P 500, and the NASDAQ fell 3.53%, 3.14%, and 3.43%.

Pandemic concerns are almost completely out of the picture in the US market, the economic activity is moving back to the pre-COVID levels. However, the situation in Ukraine threw the markets off guard, with concerns over energy security and the conflict itself hitting sentiment, the freshly imposed round of sanctions would likely further worsen the supply chains woes. With limited ways out of the situation in the short term, expect elevated near term market volatility, uncertainties remain for the outlook of the market.

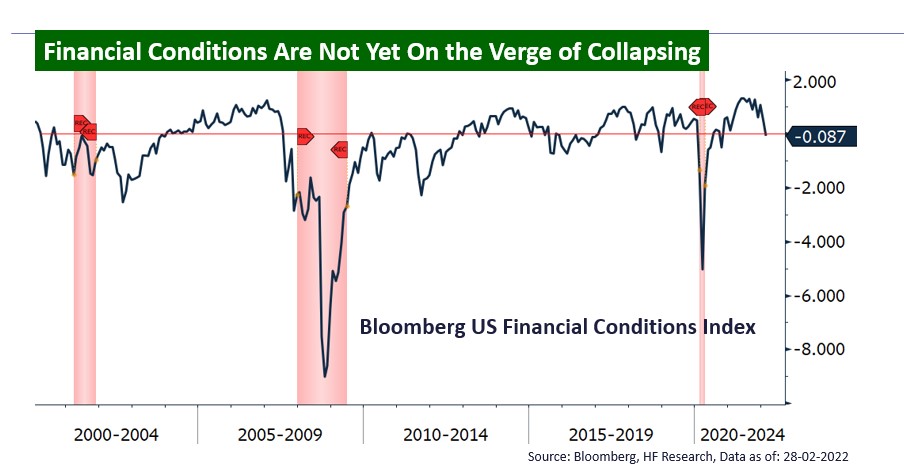

The monetary policy outlook also provides no help to the market. Although the situation in Ukraine could result in a slower tightening pace for global central banks, with the US is still facing one of the highest levels of inflation in recent decades, we do not expect any material change to Fed’s monetary policy direction, tightening is still the name of the game, we still expect more pressure onto equity valuations. In the short term, with the 2 major risk factors in play, we have reservations on the US market, and would advise against increasing exposure before the dust settles.