Weekly Insight April 3

United States

United States

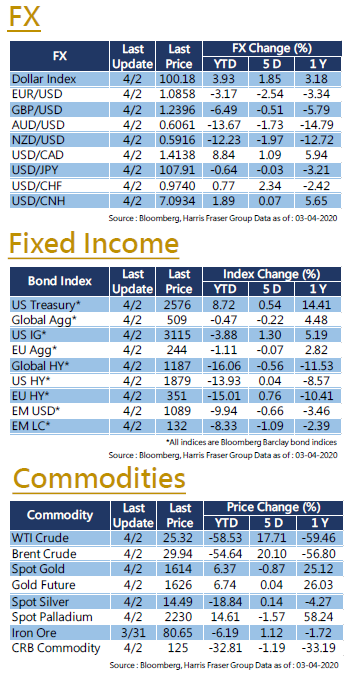

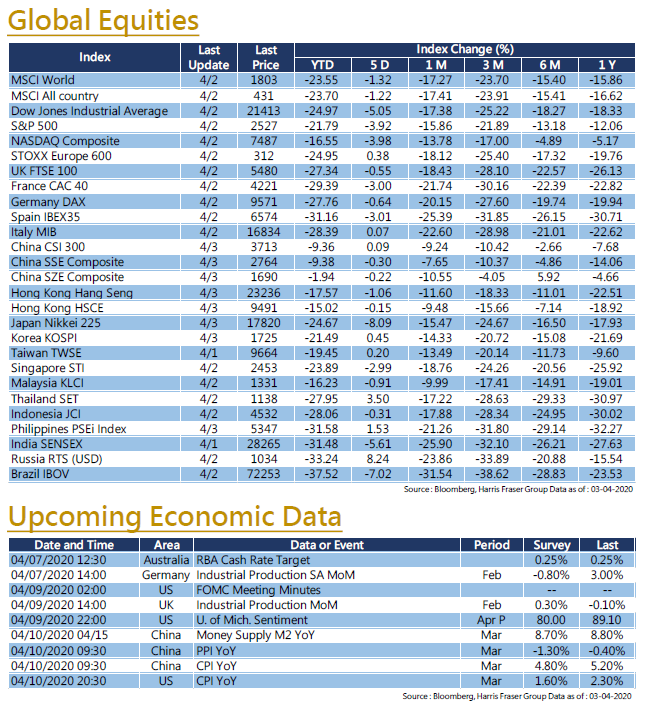

After the strong but short-lived rally last week, global stock markets faltered in the face of the widening epidemic. Over the past 5 days ending Thursday, the Dow, S&P 500, and NASDAQ fell 5.05%, 3.92%, and 3.98% respectively. Just as President Trump has signed the record $2 trillion stimulus bill in order to stop the economic bleed due to the covid-19, House of Representatives Speaker Nancy Pelosi noted that the congress is already considering the fourth response package to combat the epidemic fallout. However, Treasury secretary Steven Mnuchin and Republican representatives are not committed to drafting an additional bill before fully implementing the current package, and any further floor vote will likely take place not earlier than mid-April until the House and Senate returned from recess. The COVID-19 situation is USA continues to grow as daily number of cases continue to grow at double digit percentages daily, all 50 states in the US has taken various measures including stay-at-home orders. As jobless claims continue to grow, markets remain concerned about the extent of economic recession in the country. Next week, University of Michigan Sentiment, CPI figures, and FOMC meeting minutes will be released, markets will keep an eye on the jobless claims as a proxy for the economic health.

Europe

Europe

After the amazing rebound last week, European equities once again came under pressure this week. Over the past 5 days ending Thursday, UK, German, and French indexes went down 0.55 – 3.00%. The 2 epicenters in Europe, Spain and Italy, have exceeded the 100,000 mark in confirmed cases. With both economies innately frail and at the brink of collapse, the two countries have called for joint European responses to the ongoing epidemic. The point of controversy being the joint recovery bonds, also known as corona bonds, which are joint debt issued to member states of the EU, this allows both debt-laden countries to fund any meaningful post-crisis economic recovery programmes. However, the proposals met great resistance from better-off members of the union, in particular Netherlands, France, and Germany. The strong opposition towards the new issue from the Netherlands proves to be a great obstacle, while France and Germany raised their alternative solutions over the corona bonds. The apparent North-South divide is likely next in line to present as a challenge to the union, as the former European commission president Jacques Delors warned. Next week, we will see more data on UK and German industrial production.

China

China

China and Hong Kong stock markets had a fair week, the Hang Seng Index dropped 1.06% over the week, while the CSI 300 Index stayed flat, slightly rising 0.09%. Regarding the situation of the epidemic, according to Chinese official figures, the number of locally transmitted cases was close to zero over the past week, and the former Covid-19 epicentre Wuhan begins to reopen over the week, marking the beginning of the end for the outbreak in the country. The PBoC have announced 100 bps of RRR cuts for qualifying banks, implementing in 2 phases effective as of April 15 and May 15, releasing 400 billion yuan to the market. As the latest PMI figures implies a swift recovery, the Chinese economy is poised to play catch-up for the lost progress in the first quarter. Next week, China will announce PPI, CPI, and money supply M2 figures for March.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, AttendedBloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”,“iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”,“OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)