Weekly Insight June 5

United States

United States

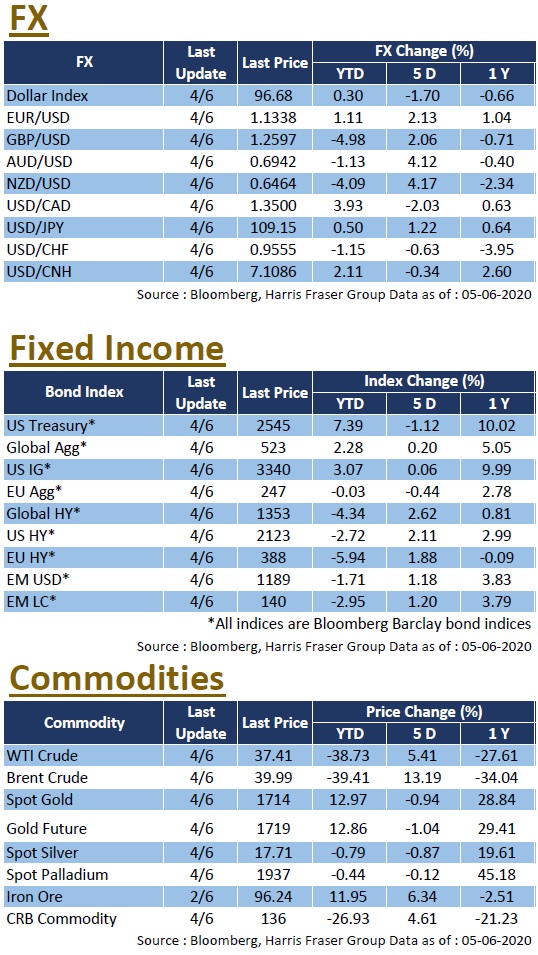

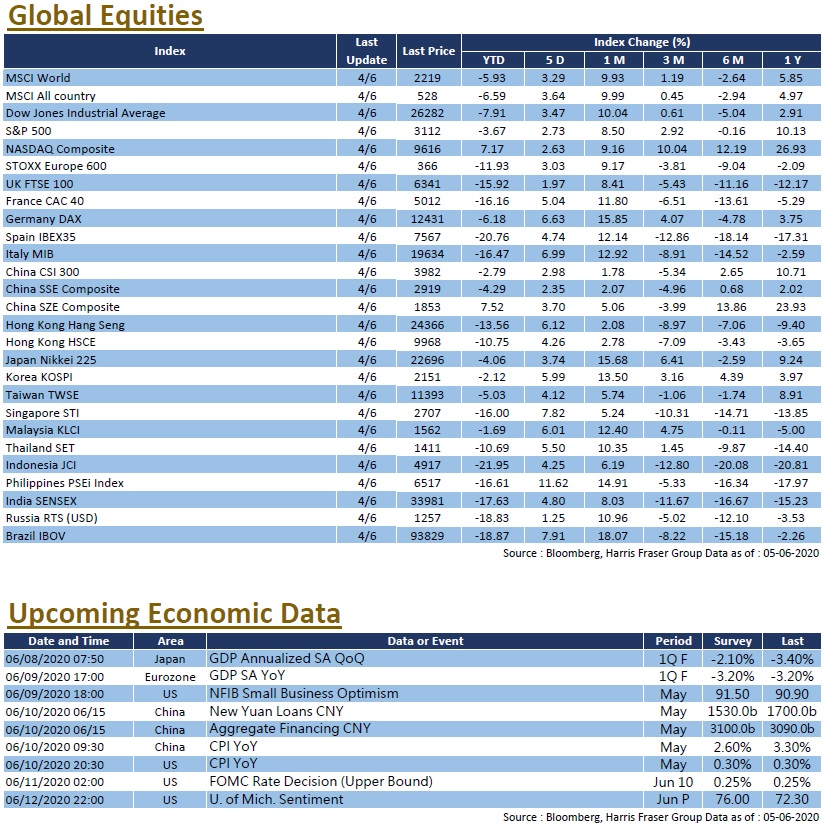

Despite the negative news, markets retained its optimism, and global equities continued to trend up, the NASDAQ index even briefly hit a new intraday high, but failed to close above that. Over the past 5 days ending Thursday, 3 major equity indexes rose between 2.63% - 3.47%. Against the backdrop of rising Sino-US tensions, riots broke out in many cities in the States, State governments ordered curfews to curb the situation, yet it remains unsubdued. Moreover, the latest epidemic development in the United States remains tough, with the latest infection figures reaching 1.87 million, alongside more than 108,000 deaths. Some of the economic data hinted at a bottoming out US economic outlook, as the ISM manufacturing index rebounded from the low of 41.5 last month to 43.1 in May. On a side note, it was reported that the White House officials in the United States are drafting a stipulation that the scale of the next round of economic stimulus plan should not exceed US$1 trillion. Next week, the Federal Reserve will hold an interest rate meeting on Thursday, market expects it to be kept unchanged; In addition, the United States will also release data such as CPI and market sentiment.

Europe

Europe

In anticipation that the European Central Bank (ECB) may increase the scale of asset purchases, European stocks performed relatively well in recent weeks. The final announcement from ECB exceeded expectations in the scale of asset purchases, further improving market sentiment, driving European stocks up. Over the past 5 days ending Thursday, anticipating capital injections from the ongoing quantitative easing, German and French indexes went up 6.63% and 5.04% respectively, while the UK index gained 1.97%. After the ECB interest rate meeting, the policy rate remained unchanged, while the scale of the Pandemic Emergency Purchase Programme (PEPP) was increased by 600 billion Euros, and the plan period was extended to the end of June 2021. The market will focus on whether the funds are sufficient to relieve the downward pressure on the European economy. The Eurozone will announce the final figures of 2020 Q1 GDP next week.

China

China

The Hong Kong and Chinese stock markets performed well over the week, the CSI 300 index rose more than 3% in the week, while the Hang Seng Index gained over 7%. It was reported that China has suspended imports of certain US agricultural products, while the US further toughened its stance towards China, potentially jeopardizing the earlier first stage Sino-US trade agreement. Despite the deterioration of Sino-US trade relations, anticipating various fiscal measures supporting the economy, speculation in the market continued. The expected dual listing of China concept stocks in HK further supported the stock price of the Hong Kong Stock Exchange, boosting the local market performance. Next week, China will release data such as the May consumer price index, aggregate financing, and new RMB loans.

<Harris Fraser Research Team>