Weekly Insight Sept 11

Weekly Insight Sept 11

U.S

U.S

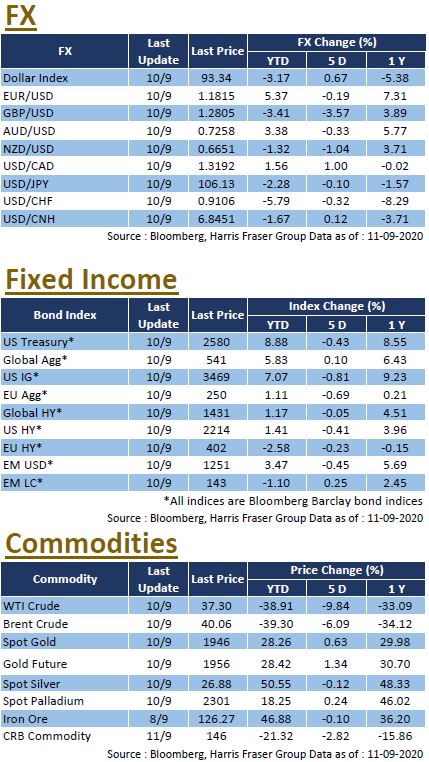

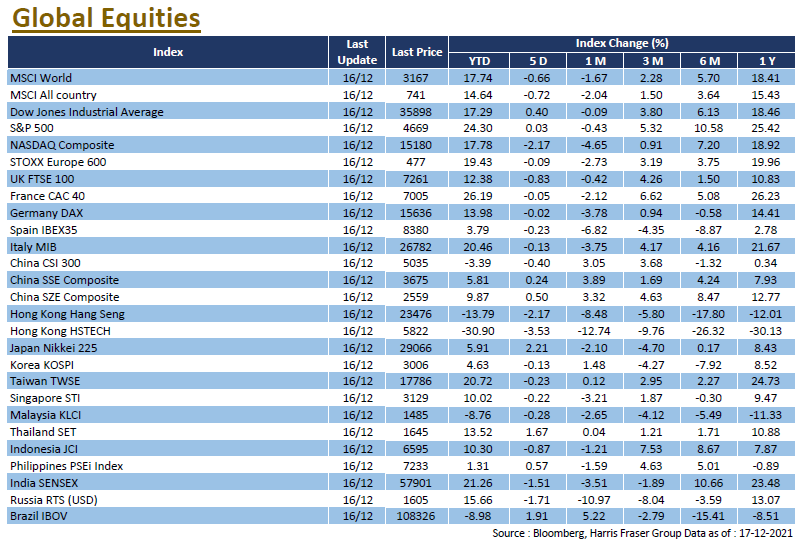

After the crash on September 3, the downtrend in US and technology stocks seems to have somewhat subsided. However, over the 5 days ending Thursday, the Dow, the S&P, and the Nasdaq are still down 5.38%, 6.75%, and 9.43% respectively. In particular, TESLA, one of the focus of the market, is down as much as 34% from its peak. Although the six weeks of additional unemployment benefits authorized by Trump at the beginning of August is coming to an end, the scaled-back version of the stimulus package proposed by Republicans failed to pass in the Senate; House Speaker Nancy Pelosi criticized that the stimulus bill failed to include measures to combat the epidemic. On the economic front, the latest figures on initial jobless claims are still higher than projected and have raised concerns in the market. The development of the covid epidemic is also worrying. India has overtaken Brazil as the country with the second highest number of confirmed cases in the world, while Europe is once again in the spotlight with more new cases than the US. Next week, the US will release data on retail sales and market sentiment.

Europe

Europe

This wave of decline in technology stocks, which mainly affected the US market, did not seem to have a significant impact on the European market, as European equities went up over the week, the UK, French, and German equity indexes rose 3.52%, 1.19%, and 2.85% respectively over the past 5 days ending Thursday. The risk of Brexit has risen again, with the European Union (EU) giving a three-week notice to the UK to withdraw the relevant legislation that is not in line with the Brexit agreement, stating that the EU will take legal action, but the UK government rejected the EU at the Thursday talks, after which the Pound plunged further to 1.2774, its sharpest one-day fall since March. On the other hand, the European Central Bank (ECB) kept its policy and interest rates unchanged, and President Lagarde said the ECB will keep a close eye on the Euro, but did not hint at any urgent policy adjustments, sending the Euro higher. Next week, the UK will release CPI data for August.

China

China

Over the past week, both Hong Kong and China's A-shares were dragged down by the fall of global tech stocks. The Hang Seng Index fell 0.78% and the Shanghai Composite Index fell 2.83%, while the Shenzhen Composite Index, the best performer so far this year, dropped 5.51%. Recent economic figures released by China were satisfactory. Exports in USD terms rose by 9.5% YoY in August, which was better than expected; foreign exchange reserves rose further to US$3.16 trillion in August; China's CPI dropped to 2.4% YoY in August, easing inflationary pressure. In addition, new RMB loans and aggregate financing also increased in August MoM. Next week, China will release data on fixed investment, industrial production and retail sales for August.