Weekly Insight July 29

US

US

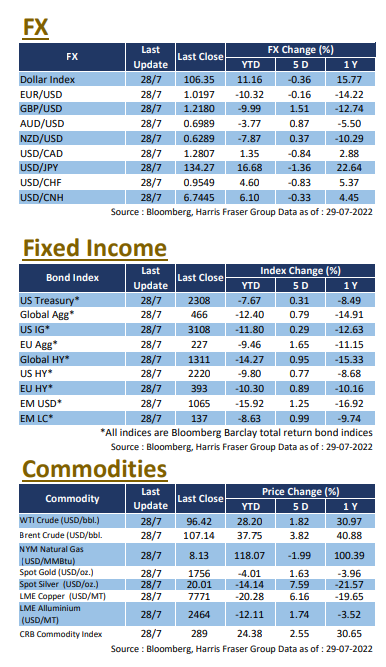

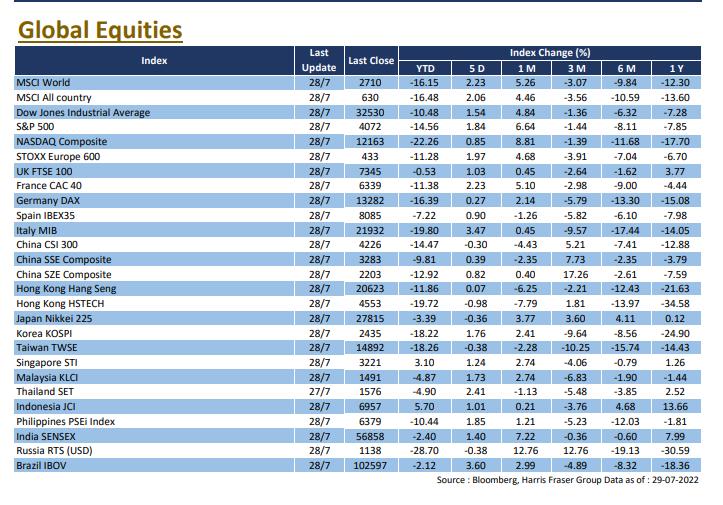

Market rallied on the back of optimism over moderation in monetary tightening, alongside some upbeat corporate earnings this week has lifted market sentiment despite ongoing worries over recession, the 3 major indices gained 0.85-1.84% over the past 5 days ending Thursday. The US Fed announced a rate hike of 75 bps, in line with market expectations. In the statement, the Fed had acknowledged that economic indicators have softened for the first time, Fed President Jerome Powell admitted that the inflation is still too high, reiterating the Fed’s determination to fight inflation, but also mentioned that a slowdown in the pace of rate hikes will be likely ‘at some point’. He also emphasised that the Fed does not believe the US is in a recession, citing the strong labour market and other factors.

On the corporate earnings front, Meta, Alphabet, and Microsoft all missed market estimates, but the latter provided an optimistic outlook for the year. Amazon and Apple on the other hand defied expectations and had a strong quarter, showing solid growth amid the slowing economy, lifting market sentiment. As for fundamentals, Consumer Board consumer confidence index of 95.7 in July missed expectations of 97.2, new home and pending home sales also missed expectations. The US preliminary Q2 GDP came in at -0.9% QoQ, lower than the market expected 0.5% expansion. With the Q1 GDP contracting at -1.6% QoQ, the US has entered technical recession. However, according to the National Bureau of Economic Research (NBER) definition, which is more commonly used by US officials, the US has yet to enter recession. Next week, US will be releasing various ISM indices for July, as well as unemployment and nonfarm payroll figures.

Europe

Europe

Despite the surprise in rate hikes earlier, European equities continued to rally on the back of improved market sentiment. Over the past 5 days ending Thursday, the UK, French, and German indices gained 0.27-2.23%. The Nord Stream 1 has returned online after the earlier maintenance, and had been operating at 40% capacity. Russian gas giant Gazprom announced further supply cuts to 20% on Monday, citing maintenance and repairs. The further cut in supplies raises concerns over a potential energy crisis, which could intensify if Russia completely cuts off gas supplies to Europe. European countries agreed to reduce usage of natural gas by 15% so as to counter Russian threats. For fundamentals, sentiment indicators in Europe continued the slide and missed expectations, CPI for July was 8.9%, hitting another new record high. Next week, Eurozone unemployment data for June will be released, the Bank of England will also hold its interest rate meeting.

China

China

Both Hong Kong and Chinese equity markets were volatile this week, the Hang Seng Index lost 2.20%, while the CSI 300 slipped 1.61%. The economy remains under pressure due to the COVID situation, affecting market sentiment. Alibaba founder Jack Ma announced the decision to give up control over Ant Group, which would complicate plans for the latter to go public in accordance to listing rules in Hong Kong. According to The Paper, former China Securities Regulatory Commission chairman Xiao Gang suggests more oversight on cooperation between financials, internet platforms, and technology companies. Industrial profits for June released earlier showed improvement over the previous month figure. Next week, China will release the Caxin PMIs for July.