United States

United States

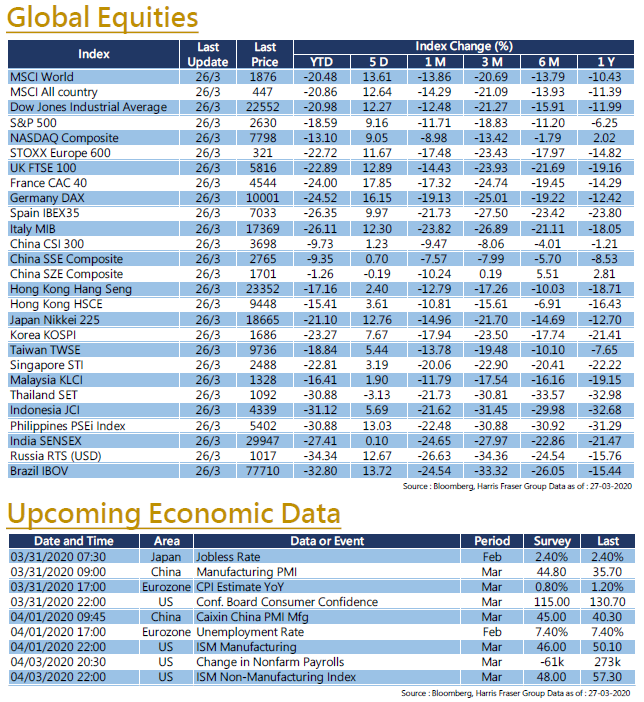

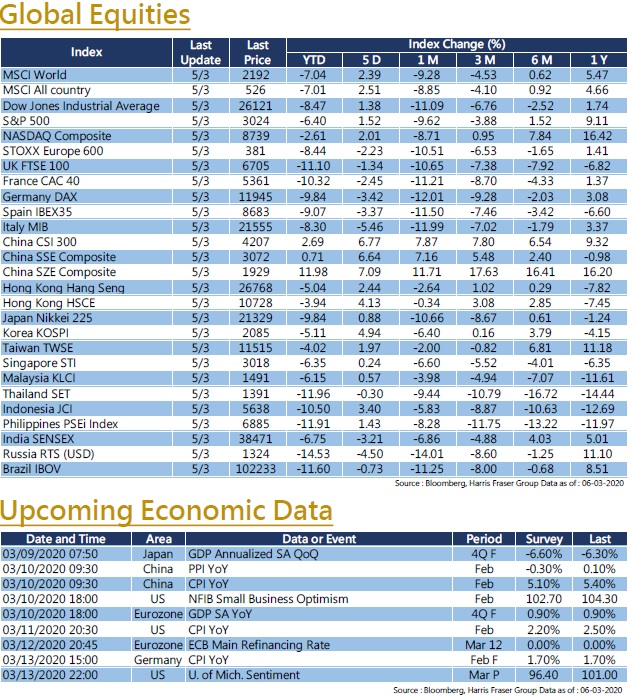

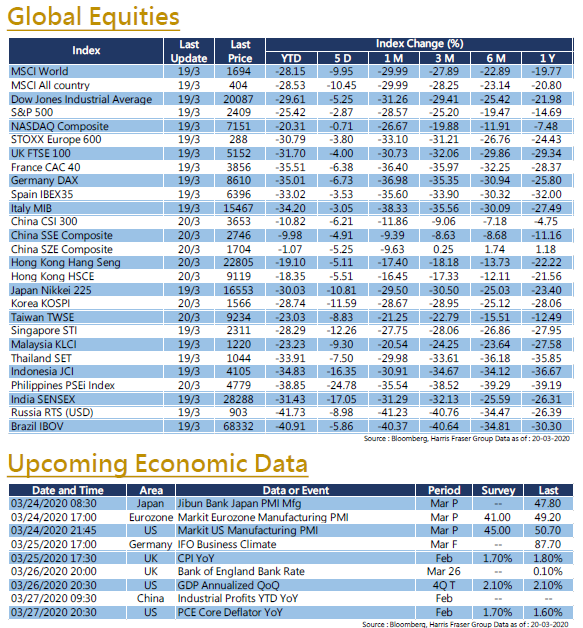

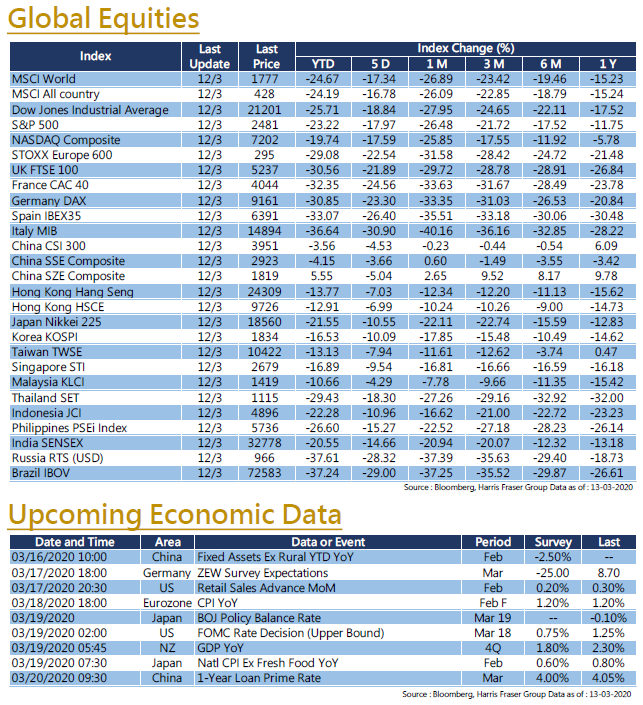

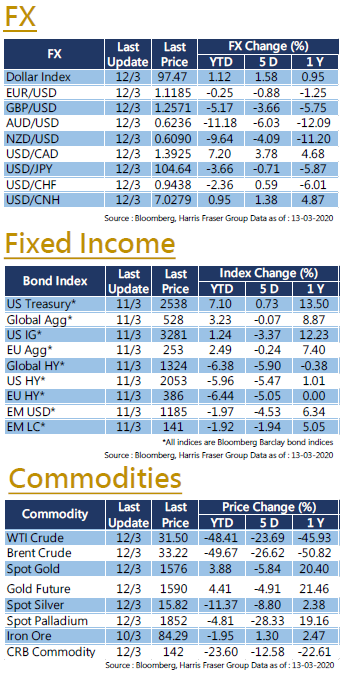

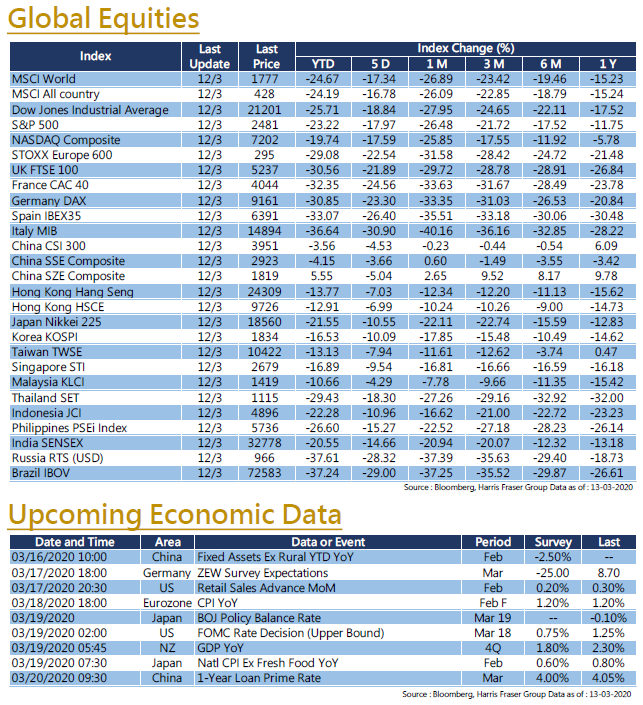

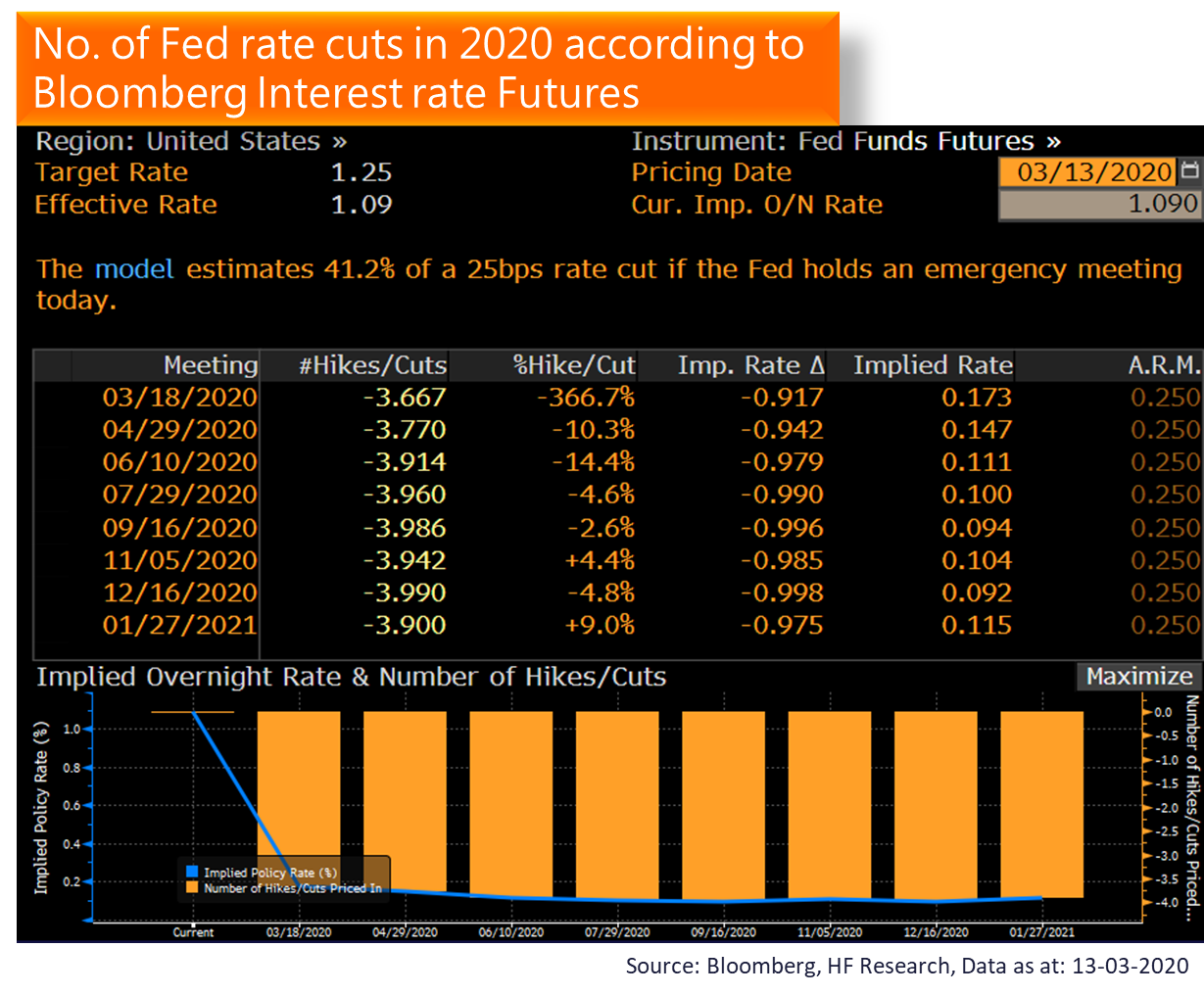

US equities continued the trend of abnormally high volatility. Just as the markets analysed the implications of the surprising emergency 0.50% rate cut from Fed, the breakdown in OPEC+ talks out of the blue triggered a dramatic fall in oil prices, falling by more than 24% over a single day. This triggered global market panic alongside the ever growing issue of COVID-19 outbreak. President Trump held a press conferences to explain the current White House plan for the financial market and economy as a whole, the Fed also announced to inject $1.5T in liquidity to prevent the investment market from drying up. However, markets remained unimpressed. US equities in particular suffered huge losses over the past 5 days ending Thursday, triggering the Circuit Breaker twice over the short timeframe, major equity indexes shed a whopping 15.59-18.84% over the period, Thursday saw one of the largest single day percentage drops since the 1987 stock crash on Thursday. All 3 major US equity indexes entered the technical bear market. The economic data this week still met expectations, earnings forecast remain largely unchanged. Despite fundamentals remaining stable, under impression that the COVID-19 epidemic is bound to happen in the US, market sentiment further deteriorated and valuations fell to minus 2-3 standard deviations from the 5 year average. Next week, retail sales, housing starts and home sales data will be released. The FOMC meeting will also be held during the week, market is currently pricing at least a 0.75% cut to Fed rates.

Europe

Europe

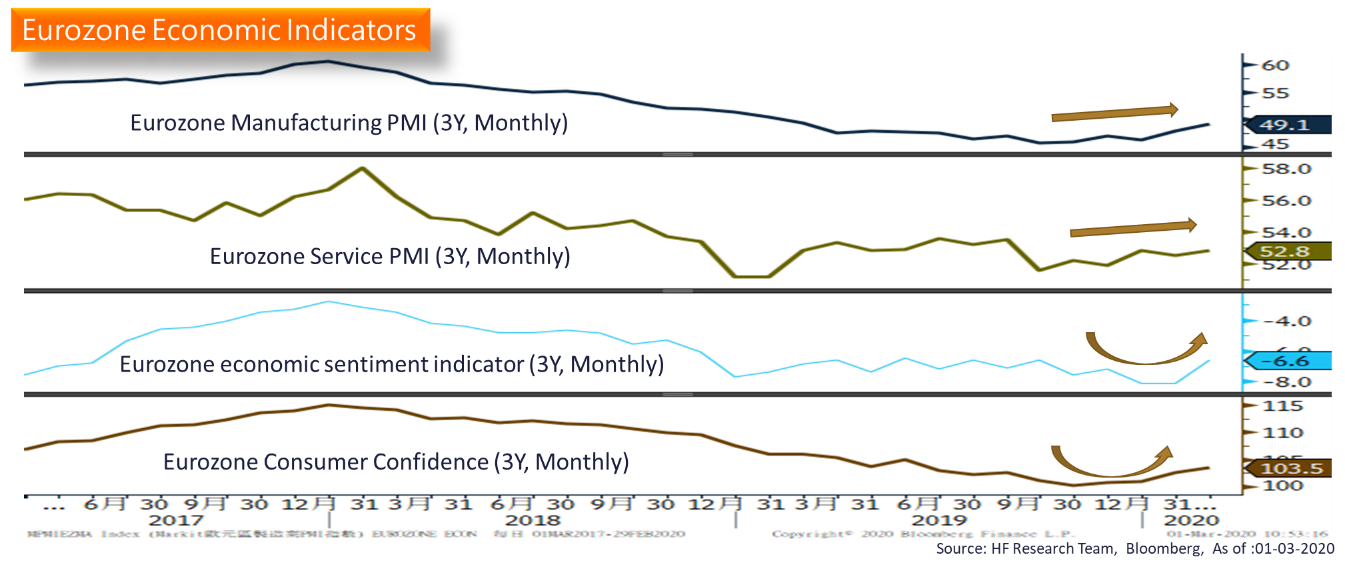

Over the past 5 days ending Thursday, the European stock market had one of the worst performances in history. The UK FTSE, French CAC, and German DAX fell 21.89%, 24.56, and 23.30% respectively, while the Italian MIB fell a whopping 30.90%. The oil shock joined hands with the COVID-19 outbreak, causing great fear in the market, the forward P/E of the European STOXX 600 Index even fell to over minus 4 standard deviations from the 5 year average. The COVID-19 outbreak in Europe remains the elephant in the room, with newly confirmed cases showing no signs of slowing down. The WHO finally declared the COVID-19 crisis a pandemic, the epicenter of the outbreak, Italy, has taken drastic measures and put the whole country under lockdown, many fellow European countries banned public events and gatherings for the time being in order to curb the virus spread. In an unexpected manner, the ECB did not follow the Fed and announced no changes to the existing interest rate. Even though the quantitative easing in form of an additional EUR 120 billion Asset Purchase Plan (APP) should continue to provide support to the market, markets reacted poorly and market sentiment remained on the lower end. Next week, Eurozone CPI figures and ZEWS Survey Expectations will be released next week. Market expects CPI to stay flat while the ZEWS expectations should fall into deep negative territory.

China

China

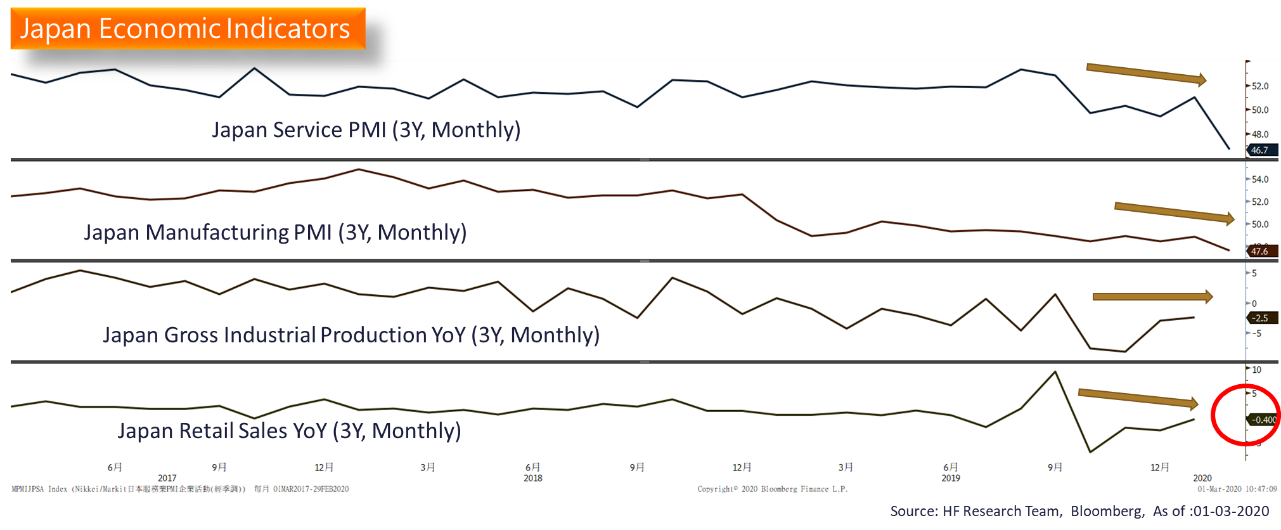

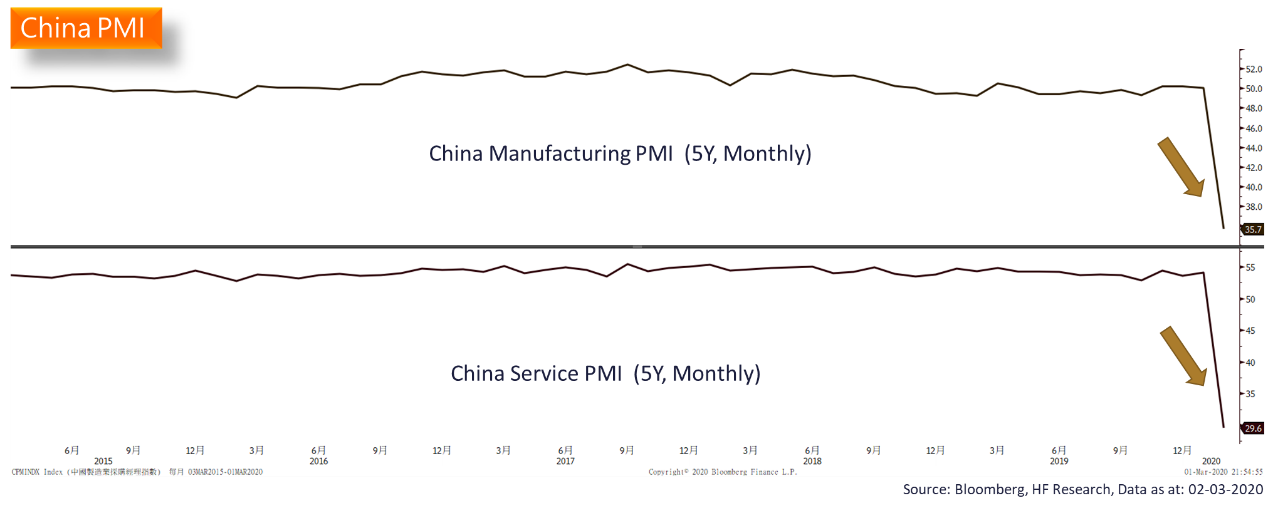

Compared to the global stock market, the China and Hong Kong stock markets have experienced relatively smaller declines this week. The CSI 300 only fell 4.53%, while the Hang Seng Index dropped 7.03%. Just as the World Health Organization confirmed the COVID-19 as a pandemic, there was greater market panic in the markets outside China and Hong Kong, resulting in greater selling pressure in overseas stock markets. As for China, recent news indicated that the central government may soon reduce the RRR and announce consumption incentive plans and other stimulation measures, the news provided support to the market. Economic data showed that China’s annual inflation rate slightly slowed to 5.2%. At the same time, new RMB loans in February also fell sharply, reflecting the impact of the epidemic on the real economy. Next week, China will release February fixed investment, industrial production and retail sales data, as well as the Loan Prime Rate (LPR).

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”, “iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)

United States

United States Europe

Europe China

China