Weekly Insight December 20

United States

United States

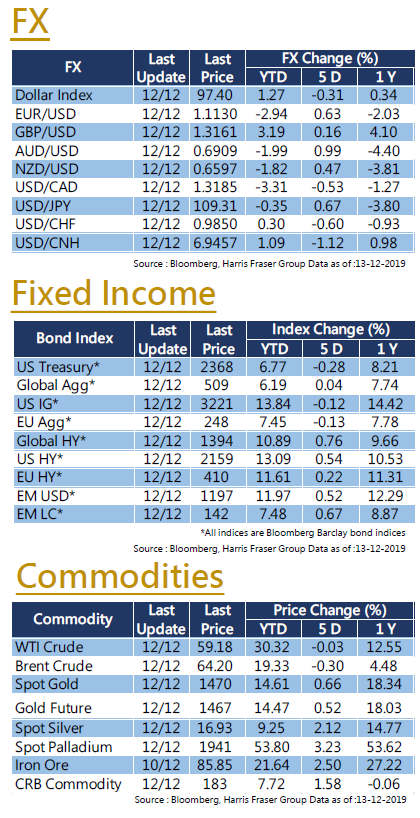

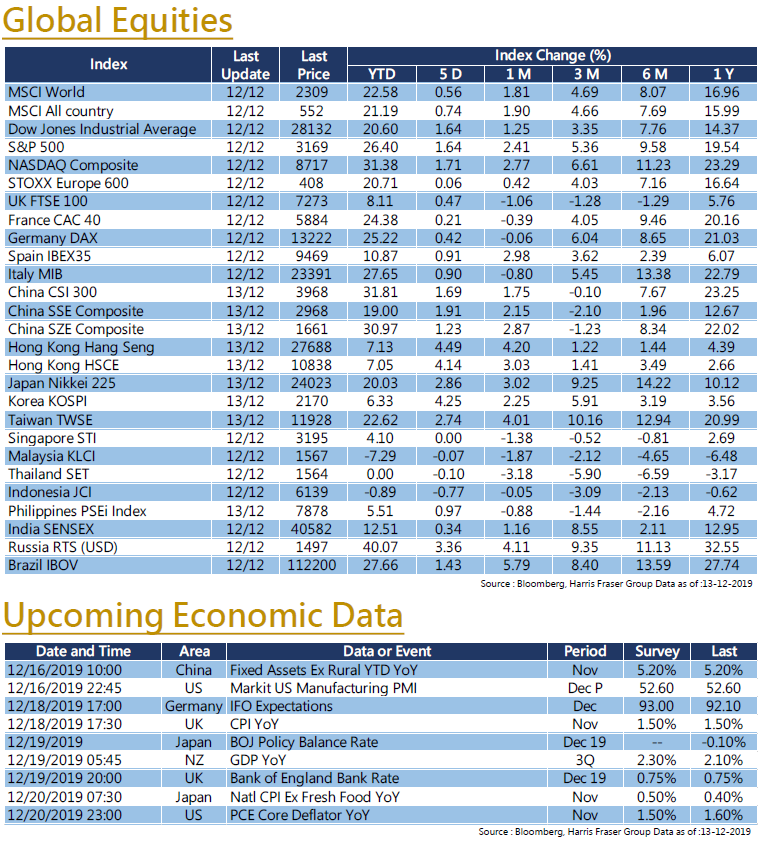

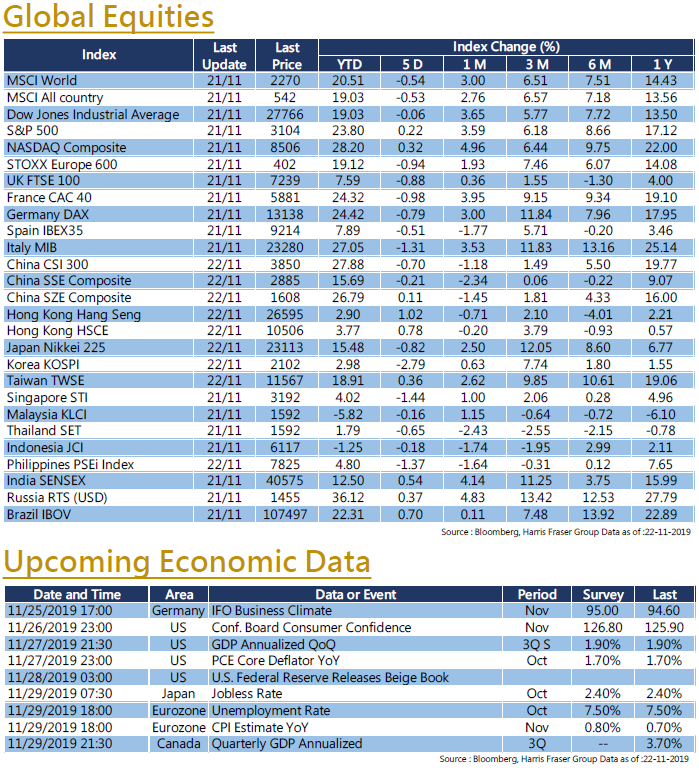

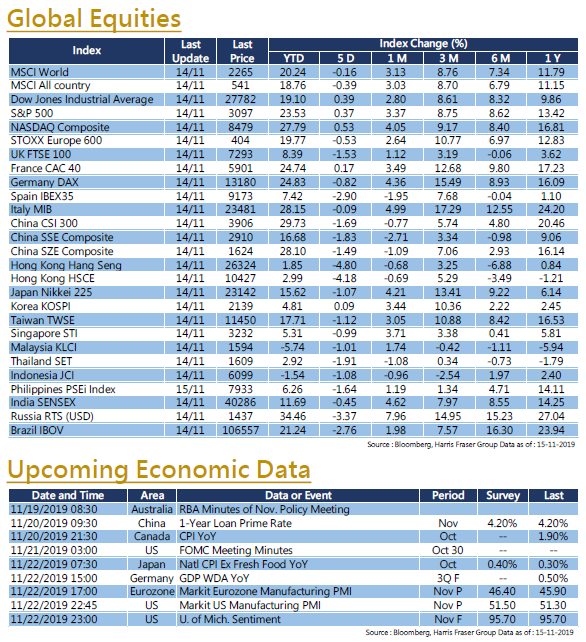

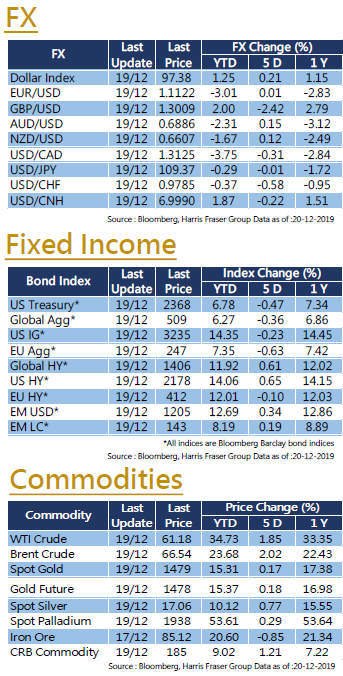

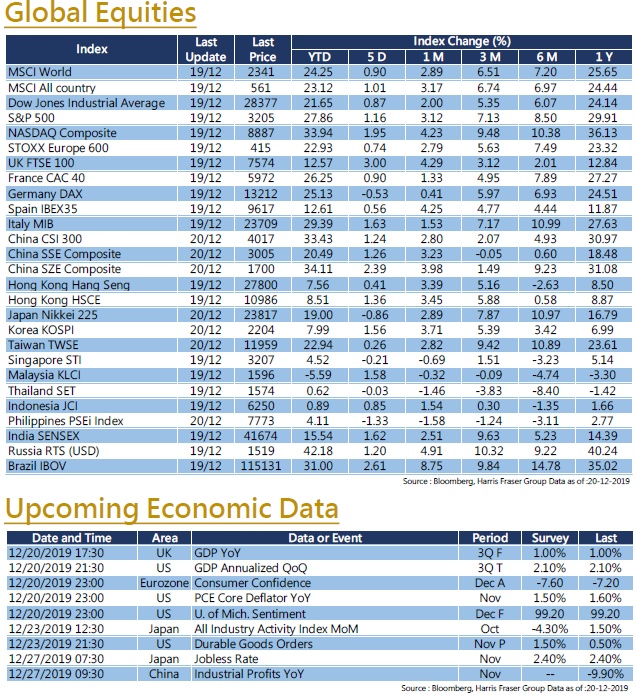

China and the United States earlier reached the first phase of a trade agreement, avoiding a new round of tariffs on China and Canada on December 15. The news is positive for market sentiment. The three major US stock indexes rose about 1% to 2% in the past 5 days as of this Thursday. In addition to the good news from China-US trade relations, the economic data released by the United States this week is generally satisfactory, including the numbers of industrial production and manufacturing production in November changed from negative to positive. On the other hand, U.S. President Trump's impeachment charge was approved by the House of Representatives. Trump became the third president to be impeached in history. The impeachment case will be heard in the Senate early next year. The US-Mexico-Canada agreement (USMCA) was implemented. The US Senate passed the Domestic Expenditure Act, which supports the government's funding needs throughout the fiscal year. Important data which will announce next week such as the core PCE and the University of Michigan market sentiment index.

Europe

Europe

In Europe, the UK Market rise the most. In the past 5 days as of this Thursday, the FTSE 100 index has risen more than 4%, the French CAC index has only increased by 1.5%, and the German DAX index has fallen slightly by 0.07%. After the British Conservative Party won a major victory in the general election, British Prime Minister Johnson also announced the government agenda, saying that legislation would allow Britain to leave the European Union on January 31, and set the implementation period until the end of 2020. The news supported the UK stock market. On the other hand, for the UK's unexpected extension of the Brexit transition period, the EU warned of risks, and the news affected the GBP to soften to about 1.30. In addition, the Bank of England kept the benchmark interest rate unchanged at 0.75%. Next week, the market may focus on the EU consumer confidence index.

China

China

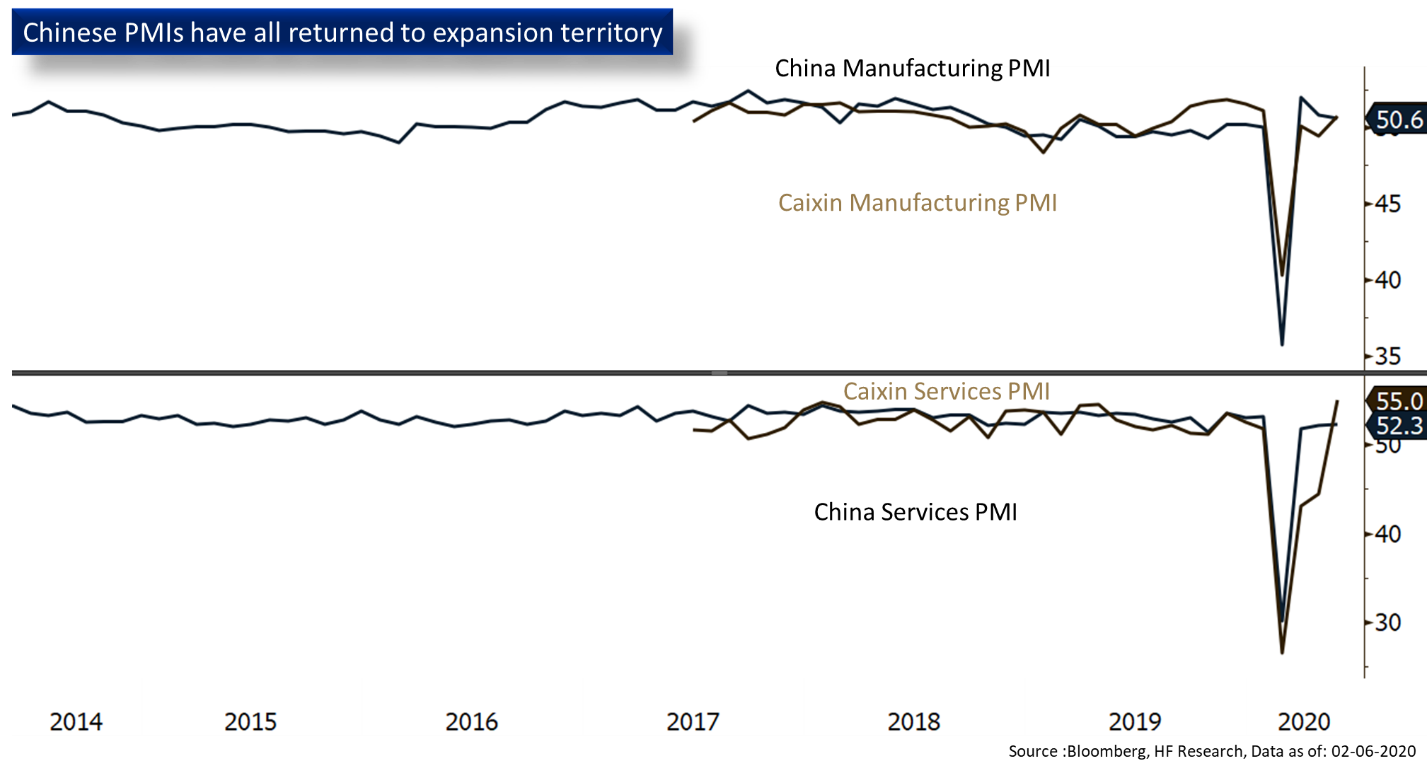

China and Hong Kong stock markets generally performed well this week, with indexes such as the HSI and the CSI 300 recorded rise. As for the China-US trade agreement, the US Treasury Secretary stated that the two sides will announce and sign it in early January next year. It is reported that China has re-purchased US soybeans this week, and plans to waive tariffs on agricultural products from the United States in the future. Mainland China's economic data improved this week, and the year-on-year growth rate of production and retail sales in November accelerated faster than last month. The market is concerned about whether the mainland will relax monetary policy before the Lunar New Year, such as lowering RRR or MLF rates.

- Recent activities include : Harris Fraser held a Press Conference on “2020 Global Investment Market Outlook”, Attended Bloomberg Businessweek/Chinese Edition Top Fund Awards 2019

- Columns, media interview and online channels : “TVB News”,“TVB Big Big VIP”, “Now FINTERVIEW”, “iCable Finance”, “iCable News”, “Capital”, “SingTao Newspaper”, “Sing Tao Investment Weekly”, “Headlines News” , “ET Net”, “OrangeNews”, “Quamnet” and online videos produced by Harris Fraser Group. (including but not limited to the above)