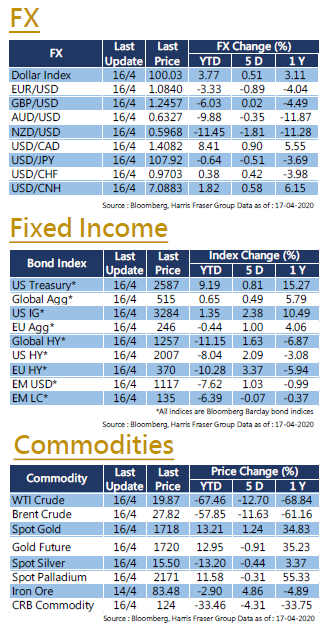

Fixed income products produced positive results in August. The Bloomberg Barclays Global Aggregate Bond Index rose 2.03%, US Investment Grade, Emerging Markets US dollar Bonds, and US High-yield bonds rose 3.14%, 0.25%, and 0.40% respectively. Global trade tensions intensified over the month with no apparent signs of slowing down, investors seek lower volatility amidst global uncertainty, increased demand for high quality instruments such as investment grade bonds continued to contribute to the indexes in August. Despite compressed yields, we remain optimistic about the prospects of the fixed income markets.

After Trump announced new tariffs on another 300 billion goods from China on August 1, China has finally retaliated and announced an additional 5-10% retaliatory tariffs on $75bn of US goods, and will resume 25% tariffs on US automobiles on 15 December. Later, Trump retaliated, increasing tariffs by 5% to 15%-30%, some of which will be implemented during the Chinese National Day, which has a strong political implication. With the end of the trade war nowhere in sight, our view of the economic outlook towards the end of the year is relatively negative. As shown by the worsening economic indicators around the globe, global corporate earnings is expected to be further pressured in the 2 remaining quarters and the equity market will likely face greater volatility. Holding fixed income as the core investment can allow investors to navigate the investment environment in such turbulent times and limit the downside risk of the investment portfolio.

After the Fed rate cuts in July, many central banks across the globe followed. Notable ones include Reserve Bank of New Zealand, which cut 50 points, exceeding market expectations; India by 35 points to a 9 year low; Thailand by 25 points, the first cut in 4 years, and Philippines by 25 points which was the second cut in 2019. Looking forward, we expect both the Fed and the ECB to slash the rates again in September, as the economic indicators showed more weakness in the past month. Deriving from the interest rate futures, we are looking at possibly around 2 cuts from Fed before the end of the year, while the ECB is expected to follow suit and cut at least 0.2% in total further into negative territory in 2019. With central banks potentially entering an interest rate cut cycle, increasing bond exposure in the portfolio can also better capture the capital appreciation.

Another pushing factor for bond prices is the high demand from various investors, especially European and Japanese investors. German bunds and Japanese government bonds are very safe investments which are considered risk free, but as money flow increased, quantitative easing policies deployed, investors becoming more risk adverse, and various central banks cutting interest rates to negative levels, it drove bond yields down to unreasonable levels. German bunds are all negative yielding, while Japanese government bond are almost all in the negative territory apart from the 20, 30 and 40Y bonds. As investors would still want to capture positive return, most of them turned their attention to the currently higher yielding US$ denominated bonds which are still relatively safe. Thus, the global yields are falling due to increasing demand driving prices up, and the situation is likely going to continue in the mid-term as there are no alternatives for the relevant parties to invest in. This could also partially explain the rally in global aggregate bonds, investment grade bonds and T-bills, which rose around 2-3.6% over the month despite the falling equity markets.

We also note that the EM bonds and high yield bonds performed much poorer than their investment grade partners, which was mainly driven by concerns over general economy, EM liquidity and debt situation. As Argentina’s elections ended with an unexpected result, Argentine stocks and currency crashed on the surprise, Argentine debt yield skyrocketed as concerns over possible sovereign default mounted. Global investors were concerned if there would be any ripple effects in the EM investing universe as there has been unhealthy levels of debt in several EM economies. As the global macroeconomic environment worsens, the outlook for the relatively risky high yield bonds and EM bonds are less positive.

As the markets expects the global central banks to potentially enter a rate cut cycle amidst trade woes and economic slowdown, the global investment landscape will likely be symbolized by a higher volatility and downside risk in the equity market. Investors should consider adjusting their portfolio and include more high quality debt to limit volatility while still getting positive returns. The balanced portfolio may improve the risk-adjusted return.

Written by Harris Fraser Investment Research Team

Harris Fraser Investment Research Team embraces a top-down analytical approach to deliver a satisfying risk-adjusted return to meet the objectives of our clients. We start with macro-level research on an individual country, region, or sector before doing technical analysis like cross-market money-flow and trends to identify investment opportunities.

US

US EU

EU China

China