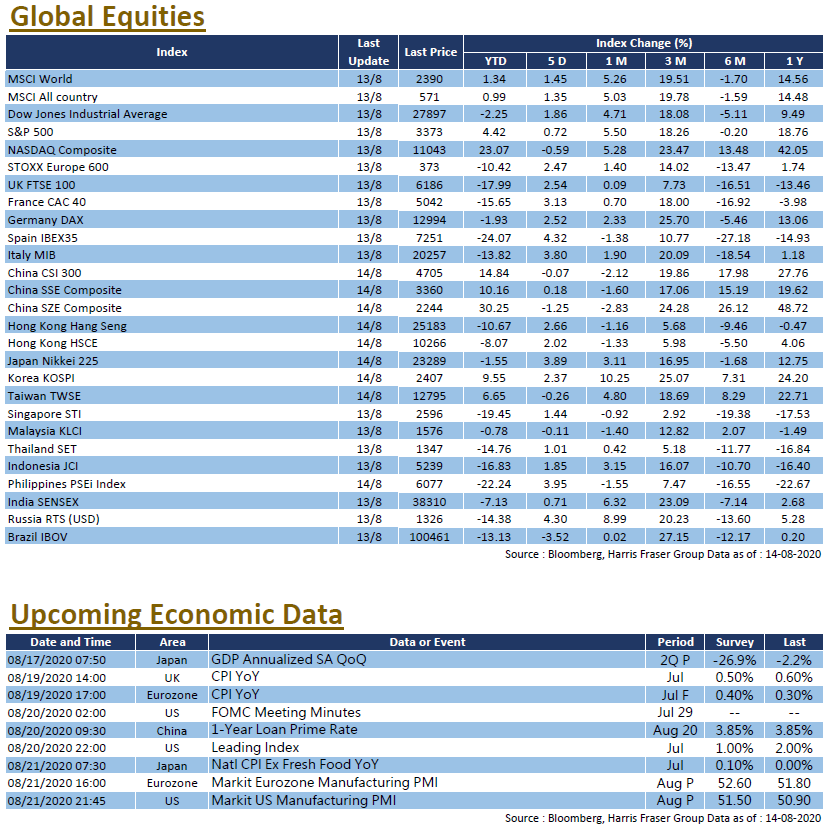

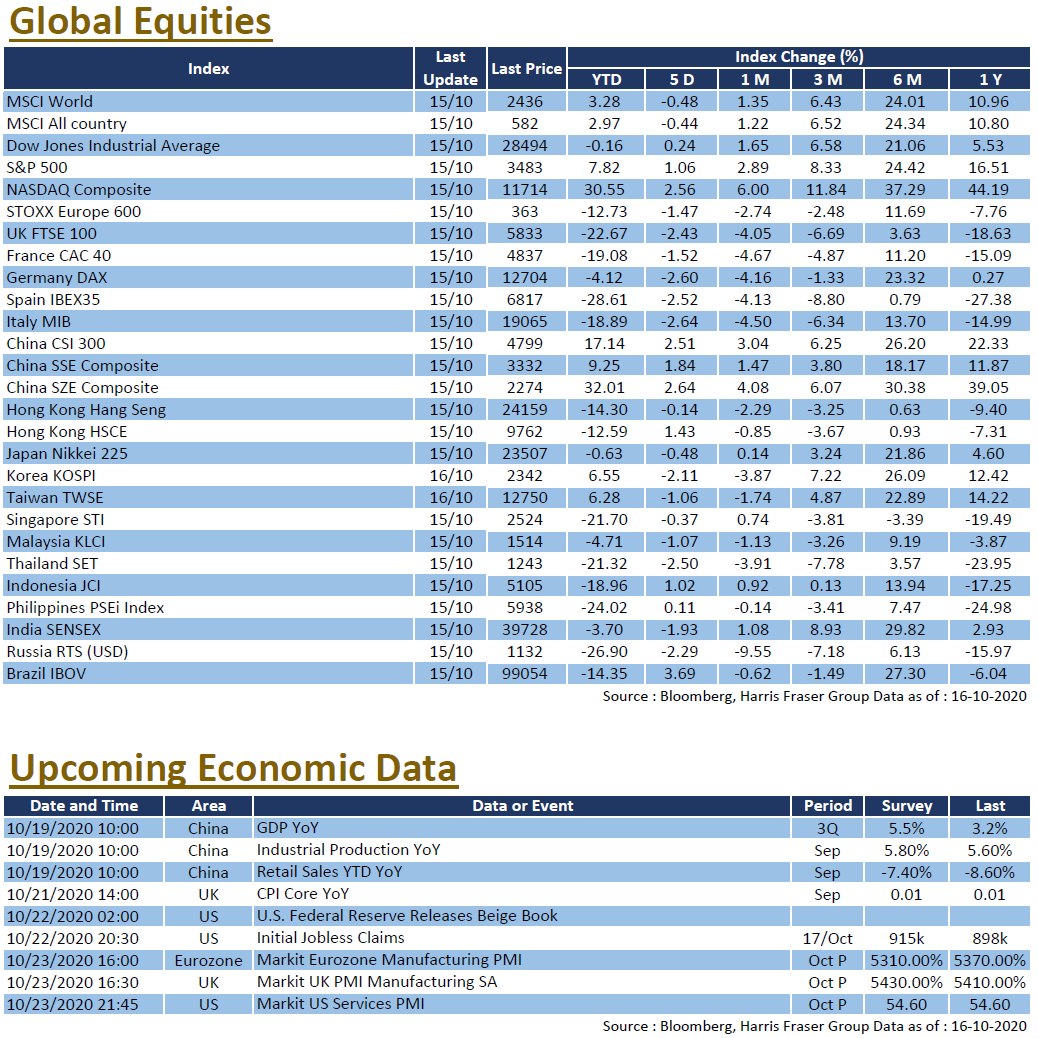

The virus continued its spread across emerging markets, the BRICS countries except China continue to rank just behind the US in total cases.

That said, markets have seemingly largely ignored the potential impacts of the epidemic, as countries are resuming normal activities with less restrictions and lockdowns. With economic indicators implying a recovery from the fallouts of the epidemic, the MSCI Emerging Markets Index surged and gained 8.42% in July.

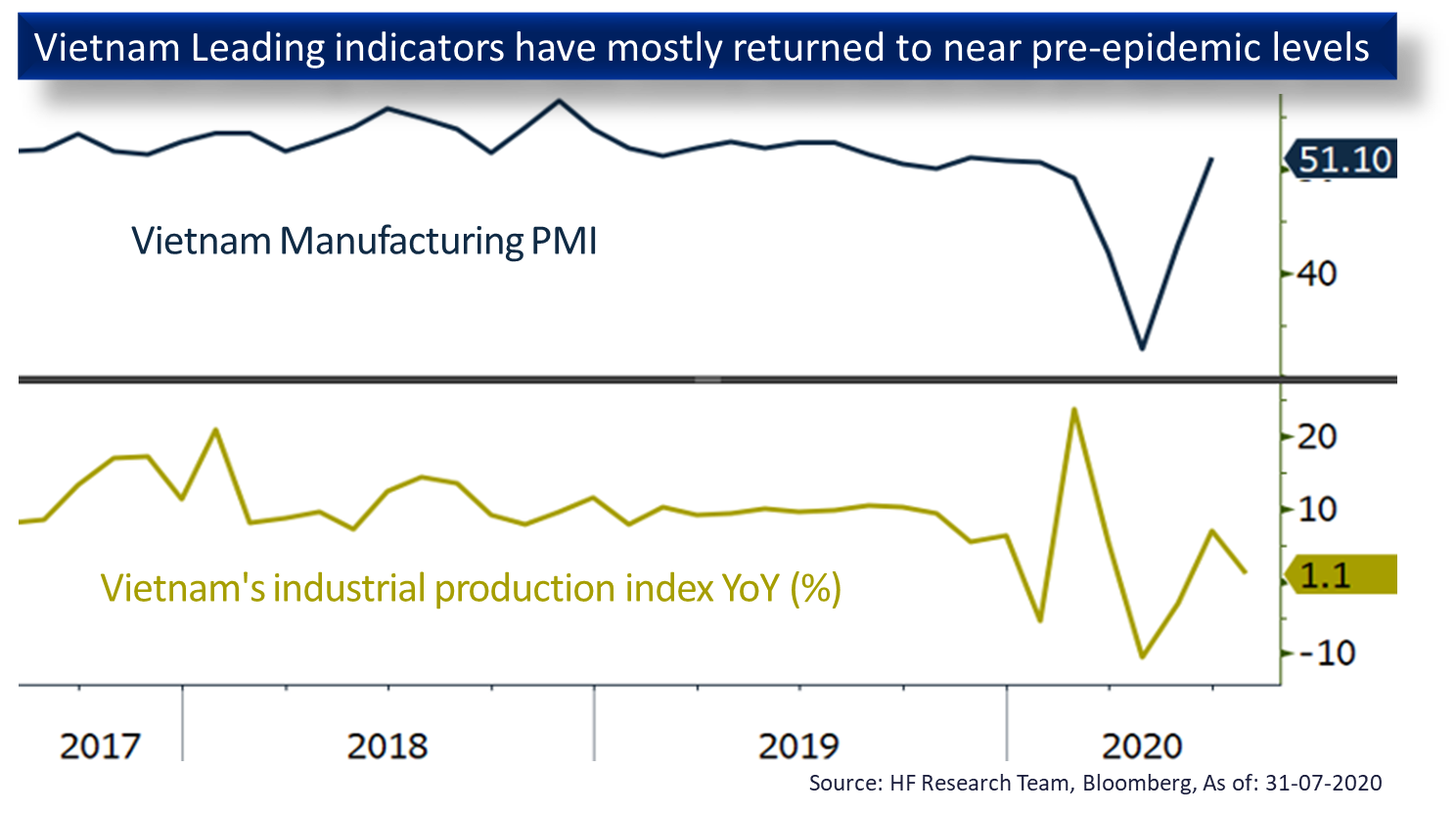

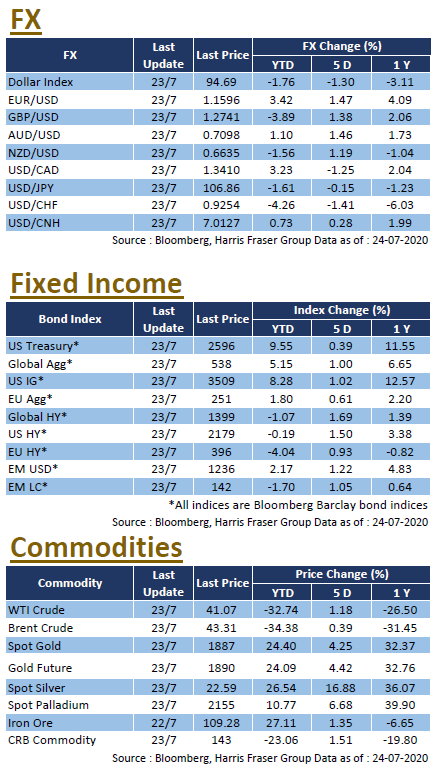

With the extended quantitative easing having no end in sight, we expect excess liquidity to further flow from USD assets to non-USD assets, which provides an upward driving force for emerging markets, in particular emerging Asian markets. Among them, we would focus on the Vietnam market. The frontier market recorded a hefty drop at the end of July, as markets were concerned over the spike in covid cases, after over hundred days without locally transmitted cases. However, we see the drop more like a market overreaction than anything.

With a timely reaction to the situation, we are relatively confident that Vietnam will not see the situation go out of control. In addition, despite the global economic slowdown, the economic indicators in the country recovered to pre-epidemic levels, we find Vietnam’s fundamentals rather solid. This is further bolstered by the Sino-US geopolitical tensions, which benefits the country as the production lines shuffle. IMF sees the country’s economy growing 2.7% this year and returning to 7% next, the sharp fall in Vietnam equities is likely an opportunity for a great upside potential.

US

US Europe

Europe China

China

United States

United States Europe

Europe China

China

US

US Europe

Europe China

China