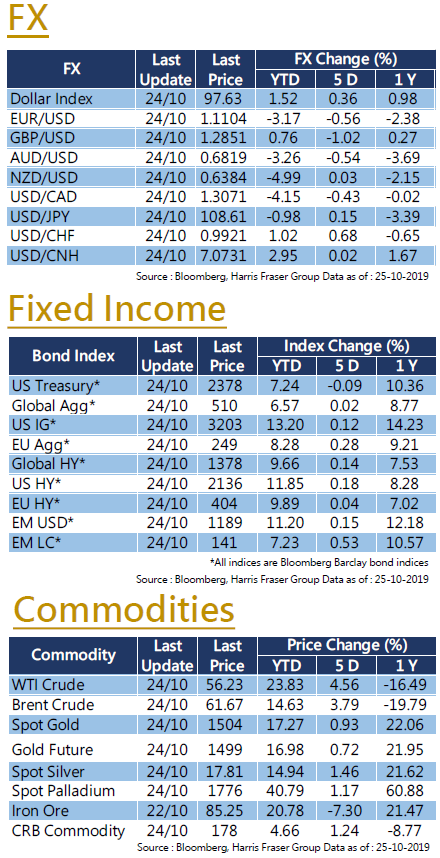

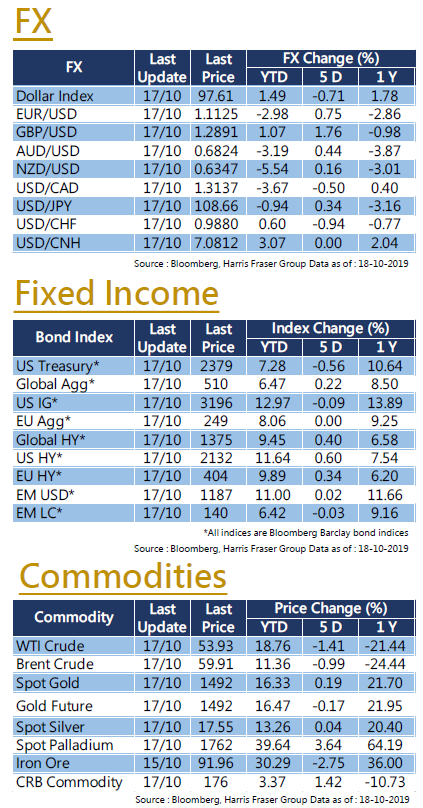

There were mixed results for fixed income products in September.

The Bloomberg Barclays Global Aggregate Bond Index and US Investment Grade fell 1.02% and 0.65% respectively, while Emerging Markets US dollar Bonds and US High-yield bonds rose 0.04% and 0.36%. As trade tensions somewhat eased over the month, risk capital moved out of the safer assets over September. That said, we do not think that the trade conflict is going to be truly resolved anytime soon due to fundamental differences, the economy would still face downward pressure, investors should continue to look into high quality bonds in the times of turbulence. With the drop in recent bond prices, this offers an opportunity to further increase the bond exposure in the investment portfolio

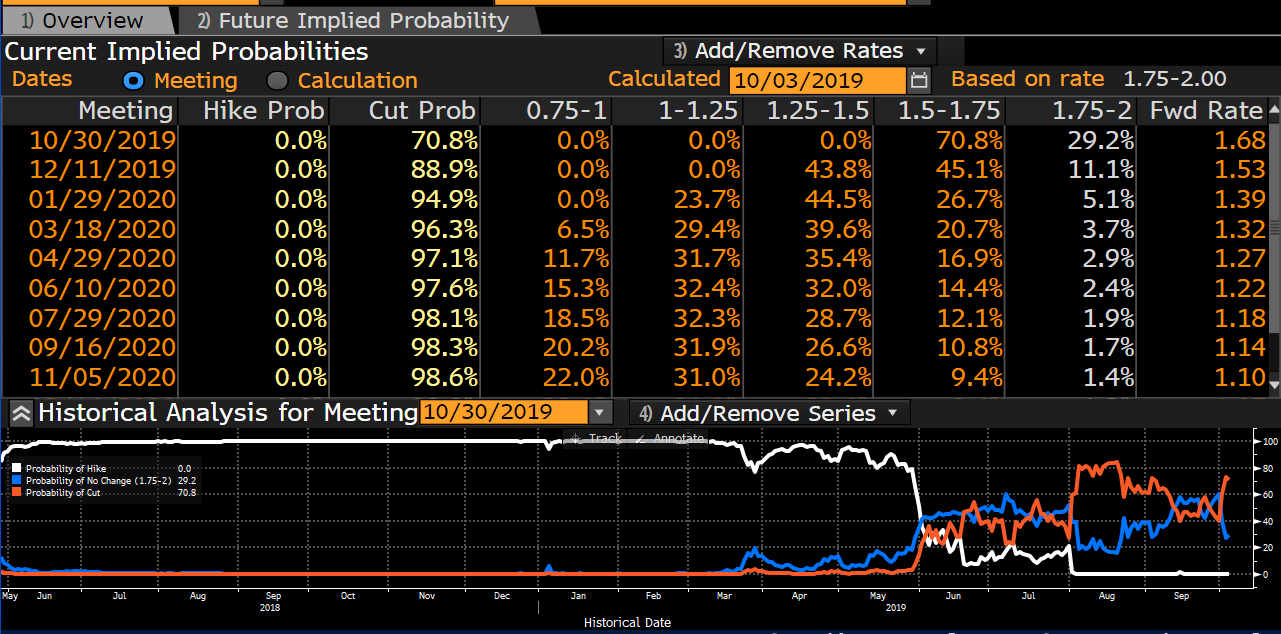

Even though the fed did cut interest rates in September, it is expected that there is more than 90% chance that Fed will take at least another cut before the end of the year to support the economy. Sources also suggested that the board is currently considering expanding the Fed balance sheet again soon. With the global central banks entering a possible rate cut cycle and adopting generally dovish policies in light of a possible economic downturn, increasing bond exposure can also capture the capital appreciation.

As we get into the last quarter of the year, we expect heightened volatility and greater downside risk in the equity markets. In light of the late cycle potentially ending, investors should prioritise quality over yield, with a larger portion of fixed income investments held in investment grade bonds, which can help limit volatility while still improving risk adjusted returns.

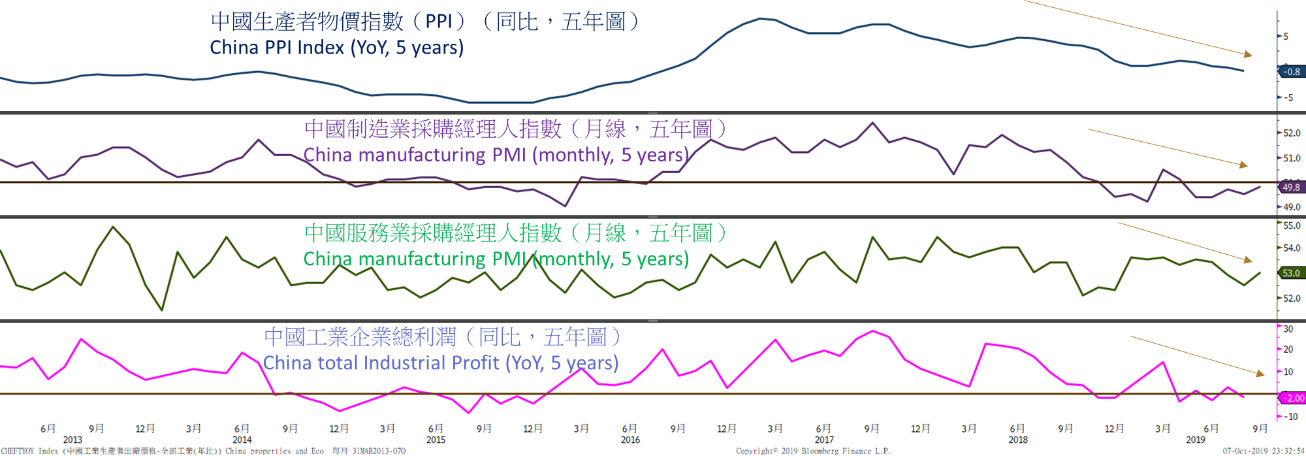

Source: Bloomberg, Harris Fraser, Data as of :7-10-2019