Chinese markets had a horrible month with the market significantly underperforming global markets. Political uncertainties remain, pandemic continues to exist as a problem, and the economy has further weakened, Coupled with external geopolitical factors, the overall market sentiment was affected. Over the month of March, the CSI 300 index lost 7.84% (8.28% in US$ terms), while the Hang Seng Index shed 3.15% (3.39% in US$ terms).

The economy further tanked in March, PMIs in China have fallen into the contraction zone, as the country experienced a surge in the omicron wave. The government have decided to stick to the ‘dynamic zero’ policy, where social activities were severely limited to clamp down on infections. Henceforth, economic activities and demand have taken a hit, which inevitably impacts the economy itself. With the pandemic still ravaging different locations, it is expected that the economy will remain under pressure in the short term, which serves as headwinds for the market.

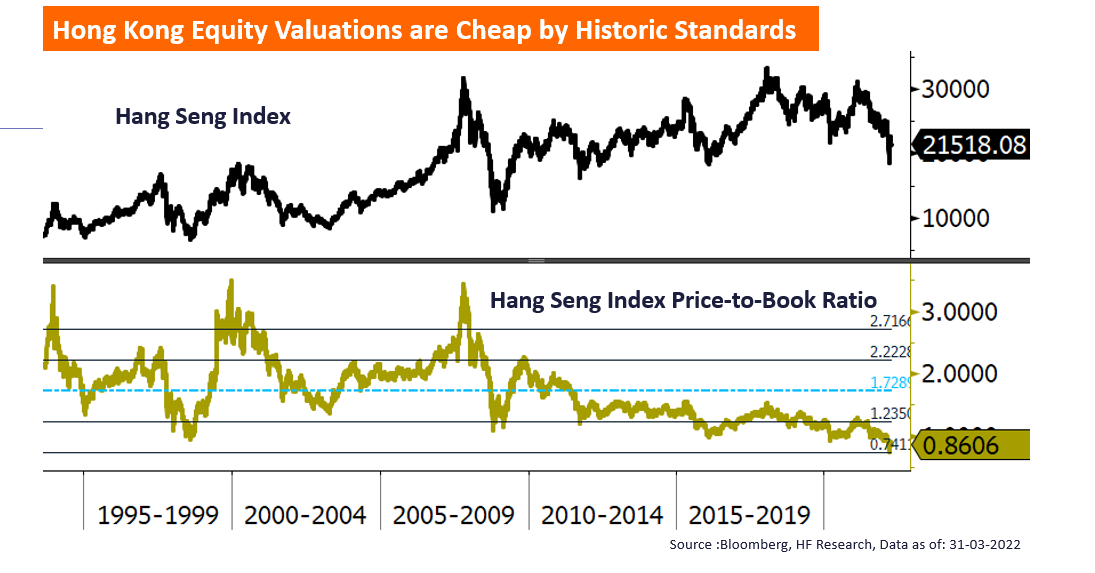

As a result, uncertainty in the Chinese equity outlook increases. Although there has been signals that the government would provide more support via monetary loosening and fiscal incentives, the overall business landscape remains rather tight in the short term, as the Chinese property sector suggests so. With no material changes, the Chinese economy will likely remain under pressure, short term equity market outlook is uncertain. However, in the long term perspective, we think that the current valuation levels are attractive, which might be an opportunity if one does not emphasis on the short term performance.