Inflation is strong, but the economy was relatively solid, providing a strong backdrop despite the expected monetary tightening from Fed. US equities suffered early in the month, but bounced back late in the month. Over the month of March, the Dow, S&P 500, and the NASDAQ gained 2.32%, 3.58%, and 3.41% respectively.

There is still no de-escalation in the situation in Ukraine, and little have been agreed on a ceasefire. However, given that the unlikelihood of a full blown war between the West and Russia, we expect no further deterioration in the situation and think that most of the downside arising from the conflict are already priced in. Economic fundamentals are strong, but the issue of high and persistent inflation remains in place, due to the fallout impacts of both the Russo-Ukrainian conflicts, as well as sanctions and self-sanctions, which significantly reduced the supply.

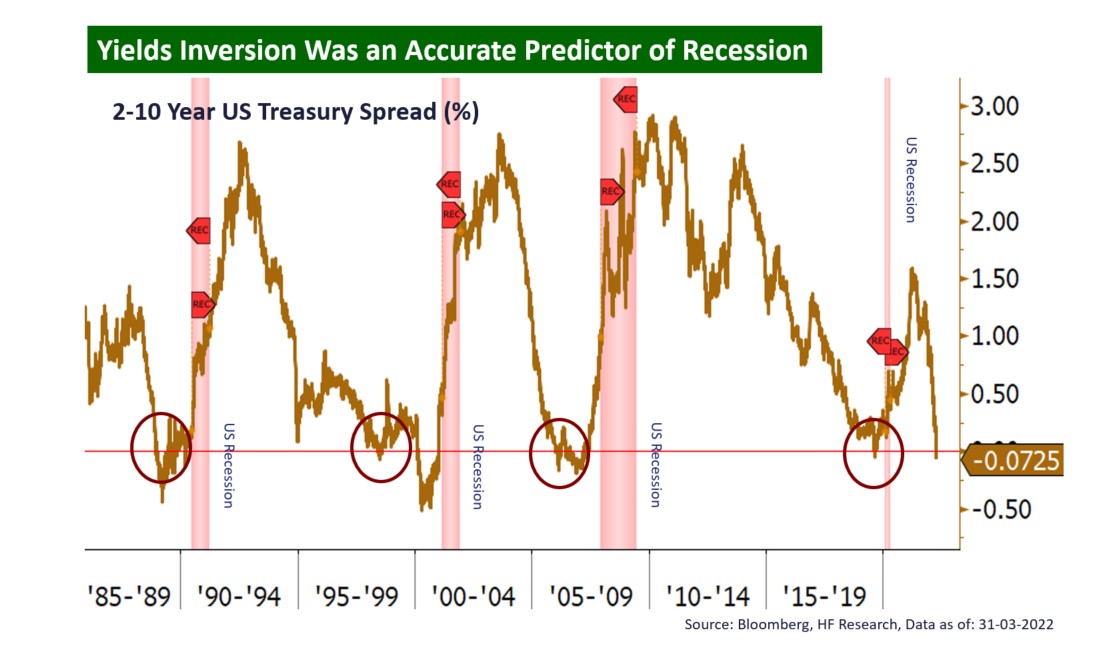

With inflation remaining at highs of recent decades, monetary policy is poised to tighten notably, which will continue to be headwinds against the equity market. Considering the recent rebound, there could be downside risks arising from rebasing valuations. Another intriguing observation is the inversion of the yield curve, which was a historic predictor of future recession. While the current economic fundamentals of US are strong, with the high lingering inflation, economic momentum could further slowdown, potential stagflation scenarios could not be completely ruled out. Henceforth, we remain relatively conservative over the US equity outlook, and would suggest holding defensive sectors and only increase equity exposure if market further corrects.