US

US

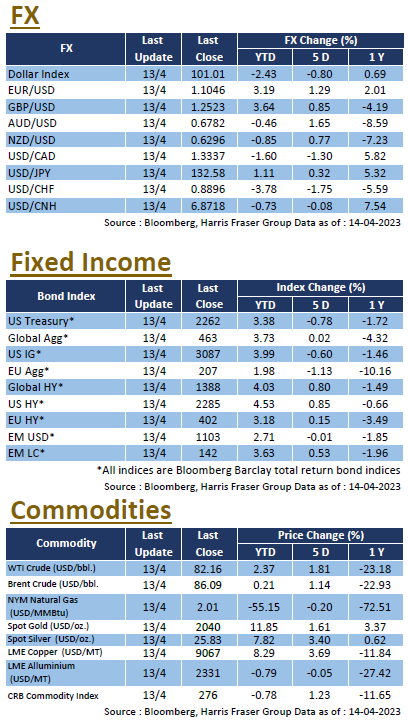

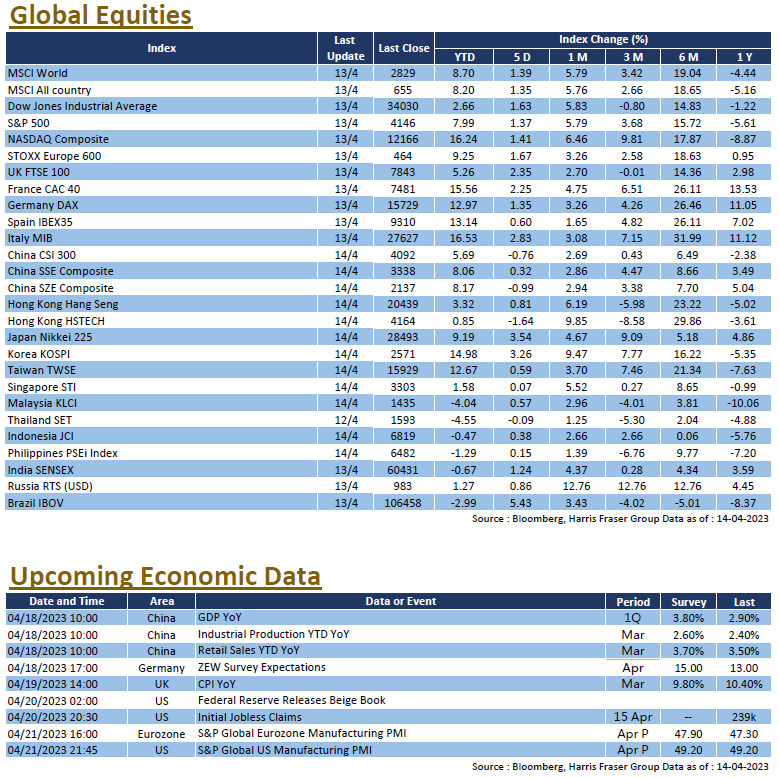

Worries over the banking system crisis continued to ease, markets returned their focus to economic fundamentals and the upcoming earnings season. Weaker than expected data lowered expectations on further rate hikes from the Fed, equities rebounded on Thursday, the 3 major equity indices gained 1.37-1.63% over the past 5 days ending Thursday. According to Fed data, banks further reduced their borrowed liquidity from Fed as liquidity pressures fall, suggesting that the impacts of the SVB collapse might be receding. The Fed published the FOMC meeting minutes for the March meeting, which showed that members expect the US to enter recession later in the year due to the banking crisis, but reiterated that the inflation remains too high and it remains a priority in Fed’s agenda, and would lean towards another rate hike in May. According to interest rate futures, markets are now pricing in around 70% chance for another rate hike in May, and around 2 rate cuts before the end of the year.

As for the economy, the inflation data came in lower than expected, the headline CPI was 5.0% YoY in March, lower than both the expected 5.2% and the 6.0% in February, largely fuelled by the fall in food prices. Core CPI on the other hand remained elevated, mainly driven by the higher rental and shelter costs, the March figure was 5.6% YoY, in line with expectations. The PPI contracted 0.5% MoM in March, translating to 2.7% higher YoY, both lower than expected. The labour market situation remains mixed, initial jobless claims of 239K was higher than expected and the previous figure, but continuing claims was lower than expected. The softer headline CPI and PPI data together with the mixed labour market data raised expectations of less rate hikes ahead. Next week, the US will be releasing the latest Markit PMI data for April, the leading index for March, as well as housing market data, including building permits, housing starts, and mortgage application data for March. The usual labour market data on initial and continuing jobless claims will also be released, while the US Fed will publish the latest Fed Beige Book.

Europe

Europe

European equities went higher as market sentiment continue to recover from the earlier banking crisis. Over the past 5 days ending Thursday, the UK, French, and German equity indices were 0.81-2.74% higher. Divergences continued to appear within the ranks of ECB officials, Austrian National Bank Governor Robert Holzmann suggests that a 50 bps hike is still on the table for the May meeting, the sentiment is echoed by Bank of Slovenia Governor Bostjan Vasle, who suggested that a bigger hike could still be needed due to the stickiness of the core inflation. However, Bank of France Governor Francois Villeroy De Galhau argued that the ECB has completed most of the rate hikes needed. Interest rate futures suggest that market expects no more than 3 rate hikes before the end of the year. As for the economy, industrial production in the Eurozone was 2.0% YoY in February, which was better than both market expectations and previous value. Retail sales contracted 3% YoY in February, which was also better than market expected. Next week, both Eurozone and the UK will release the Markit PMIs for April, the UK will release CPI data and retail sales figures for March, while Germany will publish the ZEW survey data for April.

China

China

Hong Kong and China equities had a mixed week, index heavyweights Tencent and Alibaba saw steep losses after their key shareholders announced plans to sell their existing holdings. Over the week, the CSI 300 index was 0.76% lower, the Hang Seng Index gained 0.81%, while the Hang Seng Tech Index lost 1.64%. More world leaders arrived at China for a State visit, including Brazil president Lula, trade and economy will likely be the focus at the meeting. As for the economy, Chinese data show conflicting signals, new loans and aggregate financing data show more growth in credit, and export data in March surprisingly grew at 14.8%, quite the opposite of the markt expected 7% contraction. However, inflation data were soft, CPI contracted 0.3% MoM in March, lower than market expected; PPI also contracted 2.5% YoY, suggesting that demand is likely weaker. Next week, China will be publishing their GDP data for Q1 2023, sectorial data on industrial production, retail sales, fixed assets, as well as property sales data for March.

홍콩 개요

홍콩 개요 홍콩의 지리적 위치

홍콩의 지리적 위치 홍콩의 주요 사용 언어

홍콩의 주요 사용 언어