Weekly Insight October 29

US

US

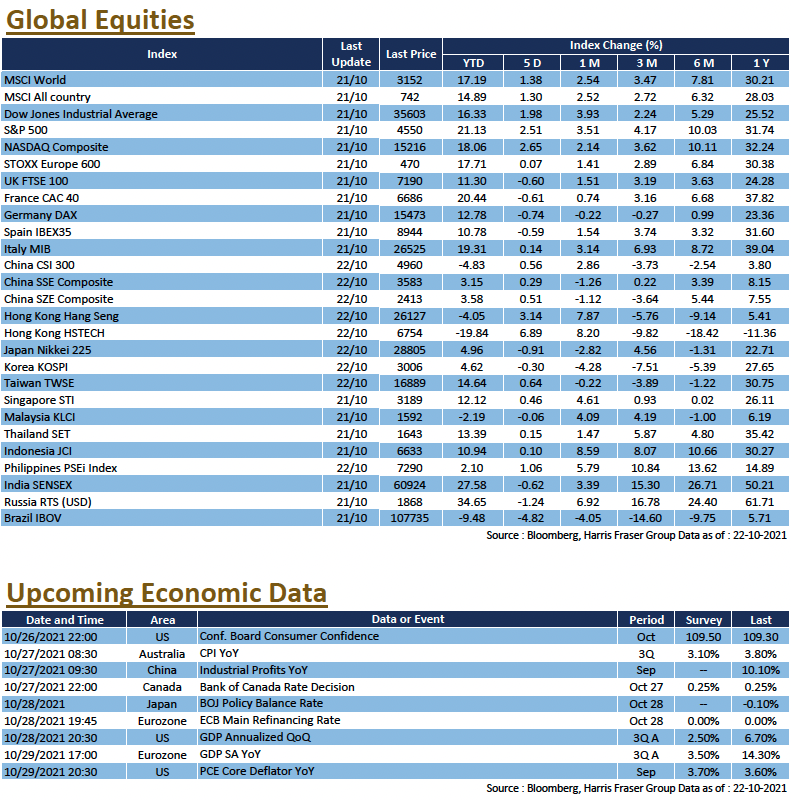

Strong Q3 earnings in the US boosted market confidence, as the S&P 500 hit a new all-time high. The three major US stock indices continued their strong form over the past five days ending Thursday, posting gains of 1.98% - 2.65%. Of the 109 reporting S&P 500 companies, more than 80% reported earnings beats; In particular, among the 31 reporting financial institutions, 87% beat earnings estimates, driving the S&P 500 Banks index up 6.7% MTD.

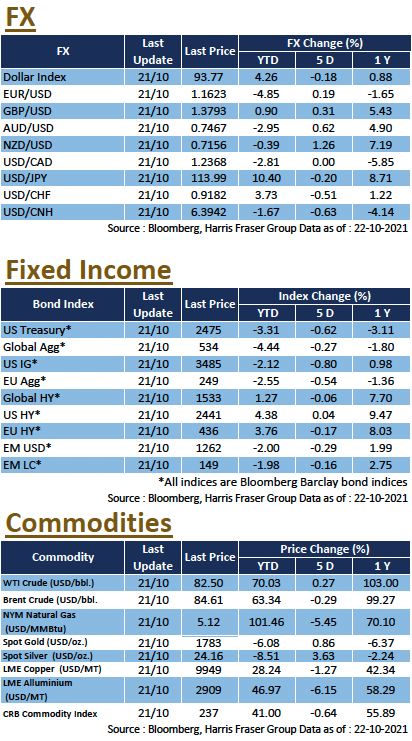

Global energy supply shortages persist, it was reported that OPEC+ missed output targets again last month, and Russia has not increased natural gas supply to Europe. Data showed that US Cushing crude inventory recorded the largest fall since February this year, while gasoline stockpiles also fell to a two-year low. The WTI crude futures price peaked at US$84.25 per barrel. The S&P 500 Energy index rose 10.0% month-to-date, driven by higher oil prices. In addition, copper prices surged as physical copper stocks on the LME fell to their lowest level in over 40 years.

High energy prices kept inflationary expectations elevated, increasing tapering pressure on the Fed. According to Bloomberg interest rate futures, market expects the Fed to raise interest rates twice by the end of 2022. US Fed governor Christopher Waller pointed out that the Fed may need to accelerate its monetary tightening if inflation remains too high. The US 10-year Treasury yield, which is an indicator of interest rate policy expectations, hit 1.7%. Next week, the US will release important data including the preliminary Q3 GDP and the core PCE for September.

Europe

Europe

The ECB's interest rate meeting on Thursday had little impact on the broader market, with European equities following external markets, the UK, French and German indices rose 0.62% - 1.05% over the past five days ending Thursday. The ECB left policy rates and the size of its PEPP unchanged after the meeting. Against the backdrop of higher inflation, the market is expecting the ECB to raise interest rates in the coming year. According to Bloomberg interest rate futures, the probability of a rate hike at the September 2022 ECB meeting has reached 100%. However, ECB President Christine Lagarde dismissed the market's expectations at the press conference, stating that this is not in line with the policy guidelines. Next week, Europe will announce the Eurozone unemployment rate for September.

China

China

The US Federal Communications Commission announced the revocation of China Telecom's license in the US. The news weighed on the performance of many China shares listed in the US, the Chinese technology sector was also affected. The Hang Seng Index lost 2.87% over the week, while the CSI 300 Index was also 1.03% lower. It was reported that some holders of the Evergrande US dollar bonds due in 2024 have received their late coupon payments. On the energy front, it was reported that Chinese authorities are planning to limit coal prices to alleviate power shortages, sending mainland coal futures prices sharply lower in recent days. Next week, China will release several important economic data, inclusding the Caixin Manufacturing and Services Purchasing Managers' Index for October.