Although the economy was stable, Chinese equity markets still had dampened performance, partly as a result of the tight liquidity conditions. CSI 300 index lost 2.02% (3.34% in US$ terms), the Shanghai Composite was down 0.67% (2.01% in US$ terms), while the Hong Kong Hang Seng Index was also 1.11% lower (1.17% in US$ terms).

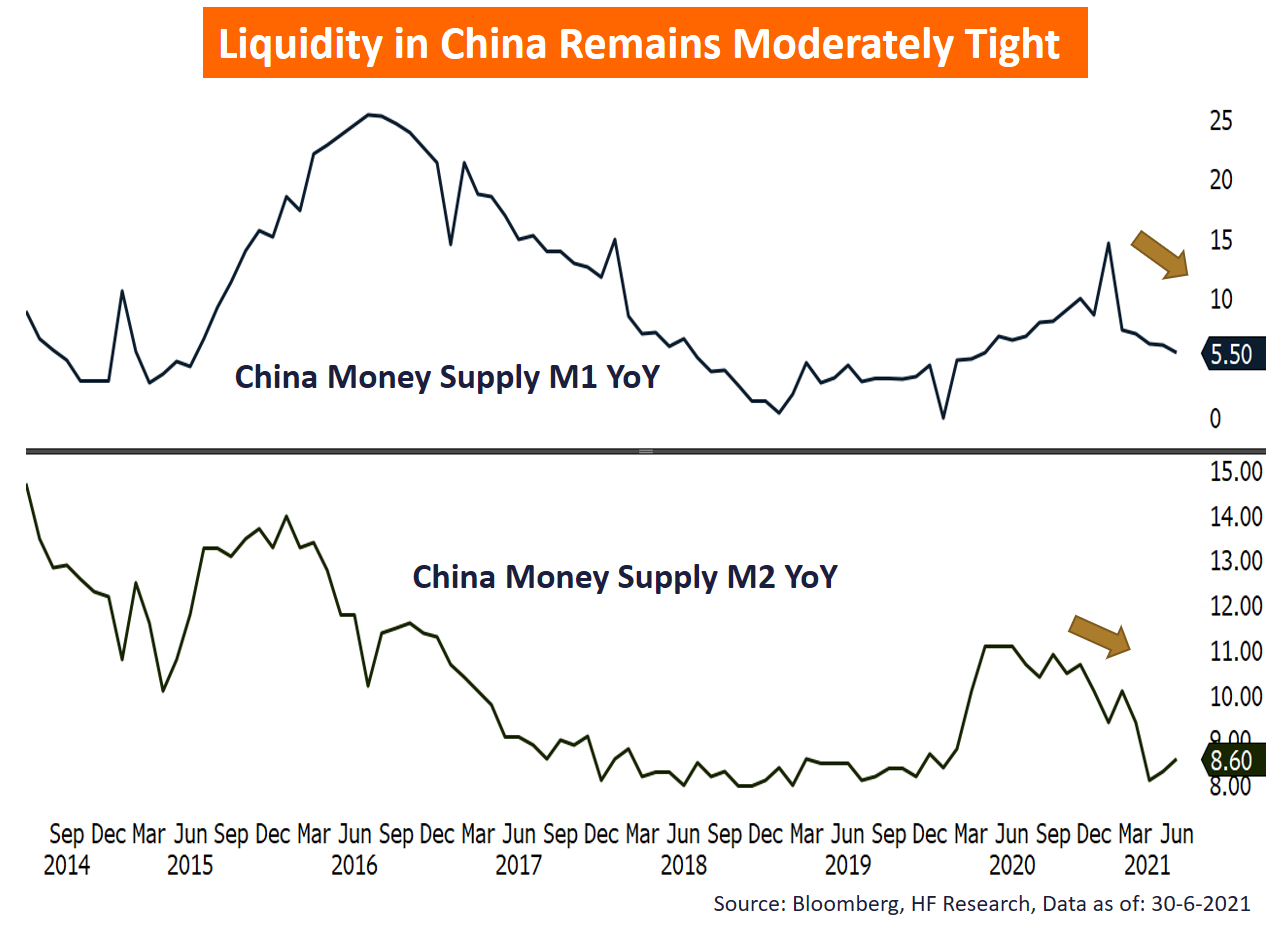

On the fundamental side, although the economy is still in the expansion zone, the momentum of the Chinese economy does seem to be slowing down. As the low base effect fades out, economic indicators continue to fall. This could have implications for the market, as it could imply that the economic recovery from the epidemic exit is fading, such that we are entering late cycle economic expansion. To top it off, liquidity shortage has been one of the main limitations on the market performance, despite the strong economy and corporate earnings.

For the remaining half of the year, we still expect monetary policy in China to remain modest, where further gain in the equity market would depend more on corporate earnings growth. As we enter the late cycle, the new economy sector will return as one of the segments in focus, as valuations of quality growth companies are attractive, partly due to a surprise ban on DiDi, which impacted market sentiments. Henceforth, for the remaining half of the year, we would prefer to pick individual quality companies in the Chinese equity market, as the overall market should remain under pressure.